[ad_1]

Agus Prianto/iStock via Getty Images

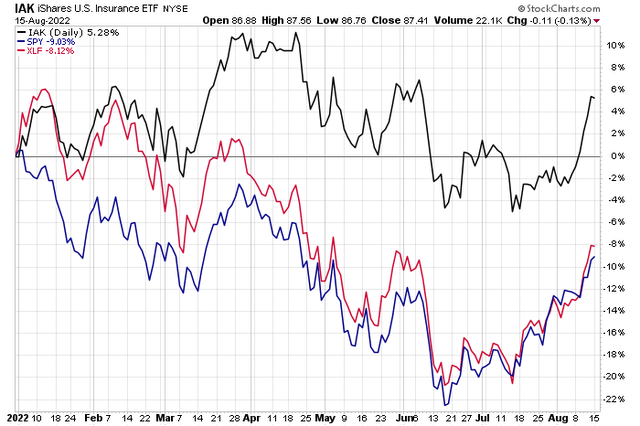

Amid a year of volatility and losses in most sectors, there’s one industry that has been a place of relative calm along with positive returns. Insurance stocks, within the financial sector, have been a standout group. The iShares U.S. Insurance ETF (IAK) is higher by more than 5% year-to-date, easily outpacing both the Financial Select Sector SPDR ETF (XLF) and the S&P 500 SPDR ETF (SPY). One stock, a more than 4% weight in IAK, has a positive earnings track record, solid valuation, and bullish technicals.

Insurance Stocks Beating Financials and the S&P 500

Stockcharts.com

According to Bank of America Global Research, Aflac Inc. (NYSE:AFL) is a life and health insurance company that markets supplemental insurance for individuals in Japan and the U.S. The company’s insurance policies include cancer insurance, hospital intensive care, home healthcare, accident, and disability insurance. Products are marketed mainly at the worksite on a payroll-deduction basis, but also through other channels.

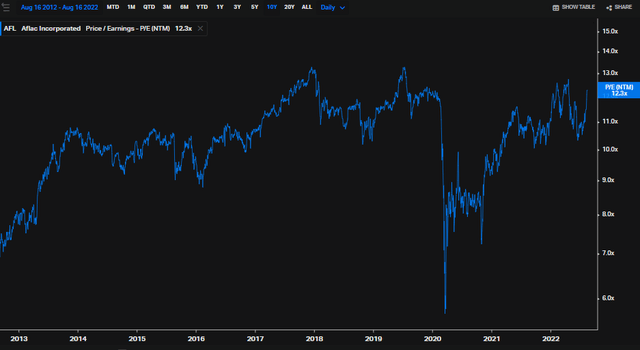

The $40 billion market cap Georgia-based insurance industry company within the financial sector trades at just 9.7 times last year’s earnings and pays a 2.5% dividend yield, according to The Wall Street Journal. While the trailing P/E ratio appears cheap compared to the market’s earnings multiple above 19, Aflac’s next 12-month P/E is toward the upper-end of its 10-year range, though still relatively low vs most equities.

Aflac Forward P/E: Above The Long-Term Average, Still Low

Koyfin Charts

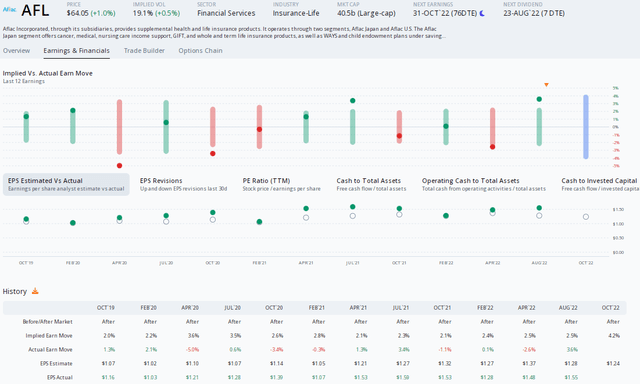

Aflac has a strong history of beating earnings estimates. Its August 1 Q2 report featured an adjusted profit figure of $1.55 per share, above the $1.28 consensus forecast. Data from Option Research and Technology Services (ORATS) show Aflac earnings verifying stronger-than-expectations for a whopping 12 consecutive quarters. The beat on the afternoon of August 1 helped spark a protracted share price rally.

Aflac: A Dozen Straight EPS Beats

ORATS

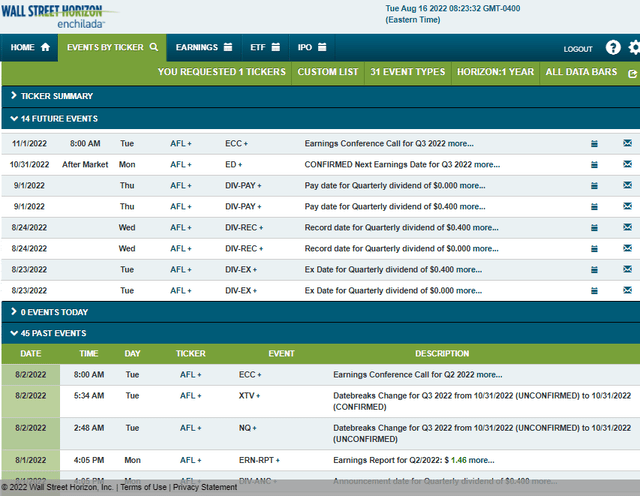

Looking ahead, AFL’s Q3 earnings report is confirmed by Wall Street Horizon on Halloween with an earnings call to follow on the morning of November 1. There’s also a dividend date on September 1 before then.

Aflac: Corporate Event Calendar

Wall Street Horizon

The Technical Take

Aflac shares have been up 10 straight days. That is the longest streak since September 2019 as investors digest impressive earnings. The stock has rallied big off support in the low $50s. I see AFL making a third attempt at climbing above $67. Technicians quip that there are no such things as triple tops, so the implication is that the stock would breakout on this attempt.

I think being long here works well with a stop under the key $58 level. Long-term investors should accumulate shares in the low $50s where there’s solid support.

AFL: Shares Eye New 2022 Highs

Stockcharts.com

The Bottom Line

Aflac’s strong earnings record and good valuation picture complement a bullish chart. Being long here with a stop under the July-range highs appears to be a good play on this insurance stock.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.