[ad_1]

Persistent inflation remains a thorn in the market and for the Fed. According to the CME Group’s FedWatch Tool there is a 84.0% probability of a 0.75% increase and a 16.0% chance of a 1% hike tomorrow (as of approximately 4:45 pm est). Treasury bond yields, the U.S. dollar and mortgage rates have all risen briskly in anticipation of the Fed’s next rate increase while the stock market has languished.

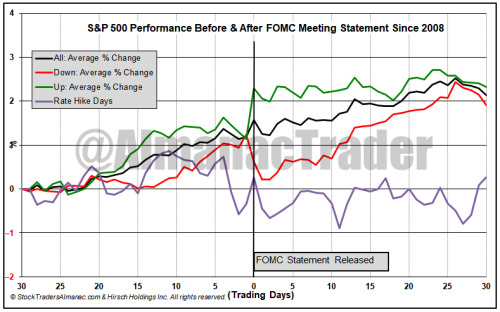

In the chart above the 30 trading days before and after the last 115 Fed meetings (back to March 2008) are graphed. There are four lines, “All,” “Up,” “Down,” and “Rate Hike Days.” Up means the S&P 500 finished announcement day with a gain, down it finished with a loss or unchanged. In 115 Fed meetings, there have been just 13 rate increases. Four have occurred this year. These 13 increases are represented by Rate Hike Days. Of the 13 hike days, S&P 500 was down 7 times and up 6 times with an average gain of 0.63% on all 13. This year’s rate hikes were well received by S&P 500 with gains over 2% in March, May and July and a near 1.5% gain in June. On the day after the last 13 rate hike announcements, S&P 500 has declined 0.74% on average.

[ad_2]

Image and article originally from jeffhirsch.tumblr.com. Read the original article here.