[ad_1]

Richard Drury

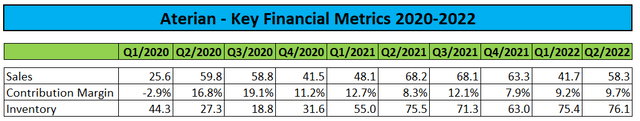

Last week, e-commerce brand consolidator Aterian (NASDAQ:ATER) reported preliminary third quarter sales well ahead of expectations as the company focused on selling through excess inventory and maintaining its product rankings in order to protect market share:

While this strategy is at the expense of our expected Adjusted EBITDA loss, we are optimistic that these moves have helped to strengthen our product portfolio and will allow us to restock at a lower cost basis due to declining shipping costs, hopefully leading to future margin expansion as we enter 2023.

The move doesn’t come as a surprise as management had outlined its approach on the company’s second quarter conference call in August.

While the clearance sales will hurt margins, cash flows should actually benefit.

Aterian’s third quarter results will also include an estimated $24 to $29 million goodwill impairment charge due to the ongoing decrease in the company’s market capitalization.

The company also announced the resumption of its roll-up strategy:

The Company intends to purchase the assets of a brand in the health and wellness category. The Company believes that the acquisition will be accretive; expanding and securing market share in an existing portfolio brand’s category. The specific terms of the acquisition will not be disclosed.

The proposed acquisition likely required Friday’s capital raise:

Aterian, Inc. today announced the pricing of a registered direct offering of 10,526,368 shares of its common stock (…) and accompanying warrants to purchase 10,526,368 shares of its common stock. Each share of common stock and accompanying warrant will be sold at a combined offering price of $1.90 (…). The accompanying warrants are exercisable six months from closing for a period of 5 years at an exercise price of $2.00 per share.

The offering is being led by existing shareholder Armistice Capital Master Fund Ltd.

In addition, the Company’s Co-Founder and Chief Executive Officer, Yaniv Sarig; Chief Financial Officer, Arturo Rodriguez; Chief Legal Officer and Global Head of M&A, Joe Risico; and Chief Technology Officer, Roi Zahut are purchasing an aggregate of 116,666 shares of the Company’s common stock and accompanying warrants to purchase 116,666 shares of its common stock. Each share of common stock and accompanying warrant purchased by insiders will be sold at a combined offering price of $2.10.

The gross proceeds to the Company from this offering are expected to be approximately $20.2 million before deducting offering expenses payable by the Company.

While the offering increased outstanding shares by a moderate 15%, the issuance of warrant sweeteners likely caused the stock price to drop by more than 35% on Friday as some investors in the offering apparently sold the shares while only keeping the warrants.

That said, in contrast to the private placement in March, both the company’s existing shareholder Armistice Capital Master Fund and senior management participated in the offering, thus showing some level of confidence in Aterian’s prospects.

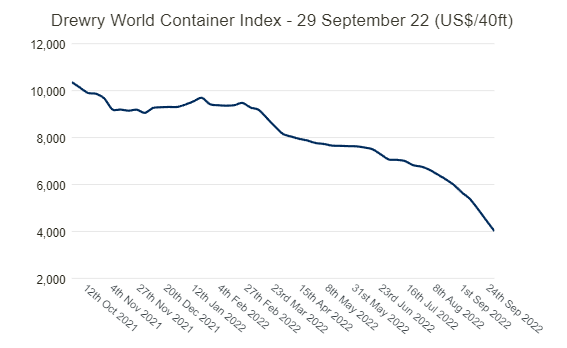

As laid out in great detail by fellow contributor Penny Stocks Today six weeks ago, weakening consumer demand might actually help Aterian more than it hurts the company as container freight rates have been dropping like a rock in recent weeks:

Drewry Supply Chain Advisors

With rates widely anticipated to fall even further, Aterian should be able to replenish inventories at a much lower cost base, thus paving the way for a substantial recovery in profitability going into next year.

That said, the company still needs to work through its remaining high-cost inventory which is likely to result in another EBITDA loss in Q4.

In fact, there might be an opportunity for additional, near-term clearance sales with Amazon launching a new 48-hour “Prime Early Access Sale” on October 11.

Bottom Line

With tailwinds from the ongoing drop in container freight rates likely to be much stronger than headwinds experienced from weakening consumer demand, I am upgrading Aterian to “Speculative Buy” from “Hold“.

Admittedly, I remain unimpressed by the company’s business model and the repeated requirement to dilute common shareholders near all-time lows but at this point, Aterian appears to be one of the very few e-commerce companies with a chance to report improved results next year.

Speculative investors should consider initiating a trading position in the common shares following Friday’s 35%+ drop while keeping a close eye on the outlook provided by management in the company’s upcoming Q3 report in November.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.