[ad_1]

Wirestock/iStock Editorial via Getty Images

Introduction

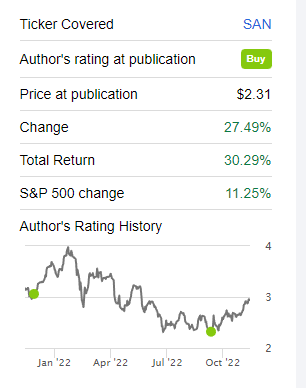

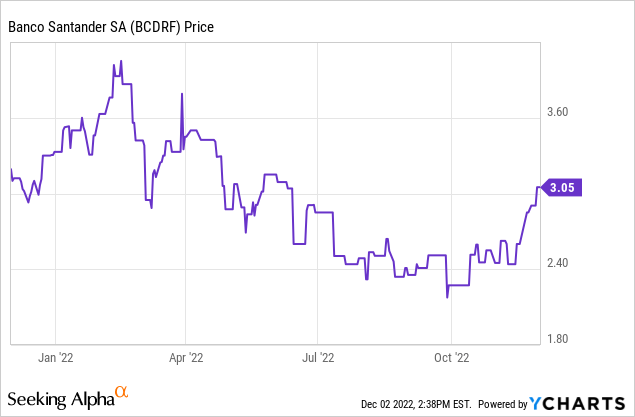

Banco Santander (NYSE:SAN) appears to be one of the eternal underperformers. Although the share price is now up by approximately 27.5% (and a total return of just over 30%) since my previous article was published in September, I feel like the bank has a lot more potential.

Seeking Alpha

The perception of European banks is improving and that’s important for Santander as well. Unfortunately (or perhaps fortunately) the bank generates the vast majority of its earnings outside of Europe and in the first nine months of the current year, about 68% of its underlying profit was generated outside of the European continent.

The increasing net interest income is a blessing

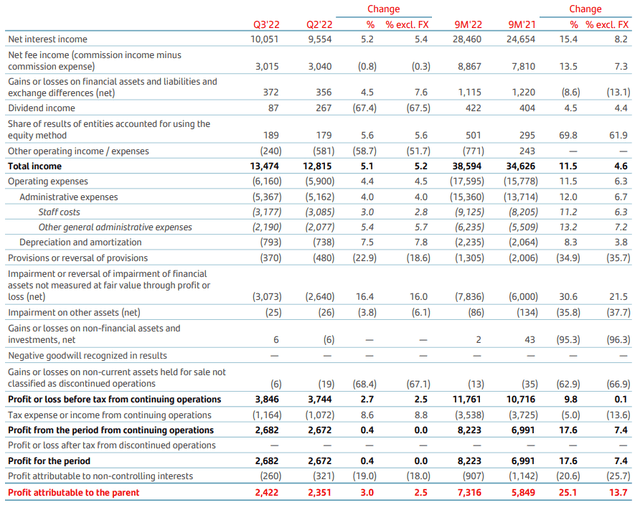

Santander is starting to see the positive impact from increasing interest rates and its net interest income increased by just over 5% on a QoQ basis, to 10.05B EUR. This was a big help to offset the small decrease in the net fee income and the much lower dividend income. The total ‘income’ as reported by Santander was 13.5B EUR, a 5.1% increase compared to the second quarter of this year.

Santander Investor Relations

The bank obviously also saw its operating expenses increase. The admin expenses increased by 4% while the depreciation and amortization expenses also increased by a few percent. That being said, the bank’s pre-tax and pre loan loss provision income increased to just over 6.9B EUR, but unfortunately the loan loss provisions increased by a pretty substantial amount as well. Whereas Santander had to record a 2.64B EUR provision in the second quarter of this year, the total amount of provisions jumped by in excess of 16% to 3.07B EUR in the third quarter. That’s a very noticeable increase.

Despite that, the pre-tax income still increased by 2.7% and that’s encouraging as it means Santander was easily able to absorb the higher loan loss provisions without seeing pressure on its net income. The bottom line shows a net income of 2.68B EUR of which 260M EUR was attributable to non-controlling interests which means the net income attributable to the shareholders of Santander came in at 2.42B EUR, a 3% increase compared to the 2.35B EUR in the second quarter.

The EPS came in at 0.137 EUR per share based on the 16.8B shares outstanding, and this brings the earnings per share at 0.409 EUR in the first nine months of this financial year, a 30.5% increase compared to the first nine months of last year.

The total amount of loan loss provisions in the first nine months of this year increased by in excess of 30% to almost 8B EUR. While some of the provisions increased, let’s also not forget the loan loss provisions in the first nine months of last year were relatively low as the bank was able to record some releases in 2021 as the fallout from the COVID pandemic was not as bad as initially feared. Additionally, there are some macro related provisions due to a slowdown and a 300M EUR additional provision related to the new mortgage payment holiday regulations in Poland.

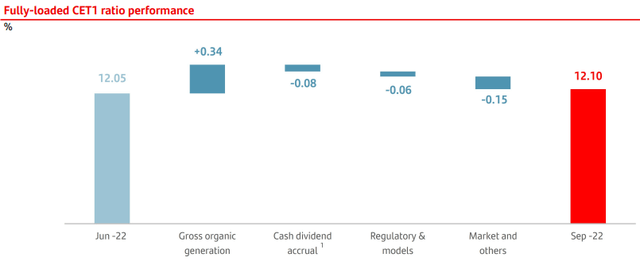

Santander saw its regulatory capital ratio increase as well. As of the end of September, the bank had a total of 617B EUR in risk-weighted assets and just under 75B EUR in CET1 capital on a fully-loaded basis. This means the CET1 capital ratio was 12.10% while the Tier 1 capital ratio was 13.56%. On a phased-in basis, the CET 1 ratio was 12.24%.

Santander Investor Relations

income still increased by 2.7% and that’s encouraging as it means Santander was easily able to absorb the higher loan loss provisions without seeing pressure on its net income. The bottom line shows a net income of 2.68B EUR of which 260M EUR was attributable to non-controlling interests which means the net income attributable to the shareholders of Santander came in at 2.42B EUR, a 3% increase compared to the 2.35B EUR in the second quarter.

Santander Investor Relations

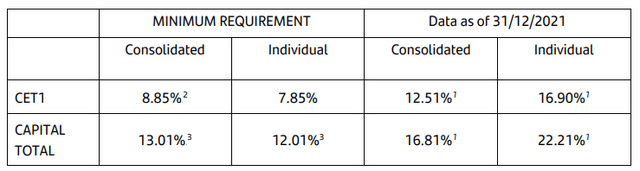

This means Santander still comfortably meets all minimum capital ratios. As disclosed earlier this year, the Supervisory Review and Evaluation Process has indicated Santander needs to maintain a minimum CET1 capital ratio of 8.85%.

Santander Investor Relations

This means Santander has a capital position surplus of approximately 325 basis points which works out to be approximately 20B EUR. This obviously doesn’t mean Santander will boost its shareholder rewards, but it means that the bank should be in a pretty comfortable position to mitigate the impact of a tightening economy thanks to the 20B EUR in ‘excess’ regulatory capital and its pre-tax and pre-loan loss provision income of in excess of 25B EUR per year.

Investment thesis

As Santander is currently trading at a discount of approximately 35% to its tangible book value of 4.31 EUR per share, the planned share repurchase program should increase the TBV per share further while providing an easy path forward to boost dividends as there will be fewer shares outstanding. Santander is planning to spend 979M EUR on buying back stock which should result in a 2% decrease of the total share count. This buyback program started last week and it is very interesting to see there is a hard ceiling on the maximum price Santander wants to pay as the document indicates the bank is not allowed to pay more than the TBV per share. Not that it really matters when the stock is trading at a big discount to the TBV but it does indicate the bank’s repurchase program is aiming to maximize its impact and Santander isn’t planning on buying back stock at any price.

I have a long position in Santander as I like its exposure to Mexico and South America, and I wouldn’t mind adding to this position.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.