[ad_1]

Brastock Images/iStock via Getty Images

Thesis

We are of the belief that we have not yet seen a capitulation move in the current bear equity cycle. To that end, despite the recent rally we feel a retail investor should be prudently allocating a substantial portion of their portfolios to cash, with other instruments providing to be extremely poor hedges for volatility and equity market losses as we have highlighted here and here. We are always on the lookout for good vehicles that can provide a market hedge for a retail investor portfolio composition, but nothing has worked this year except cash. The larger the cash allocation, the better the performance in 2022.

The SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (NYSEARCA:BIL) seeks to provide investment results that correspond generally to the price and yield performance of the Bloomberg 1-3 Month U.S. Treasury Bill Index. The ETF is ultimately a vehicle that invests in the very short end of the treasury curve and thus benefits from a very shortened duration profile and a yield that is equivalent to the front end of the treasuries curve.

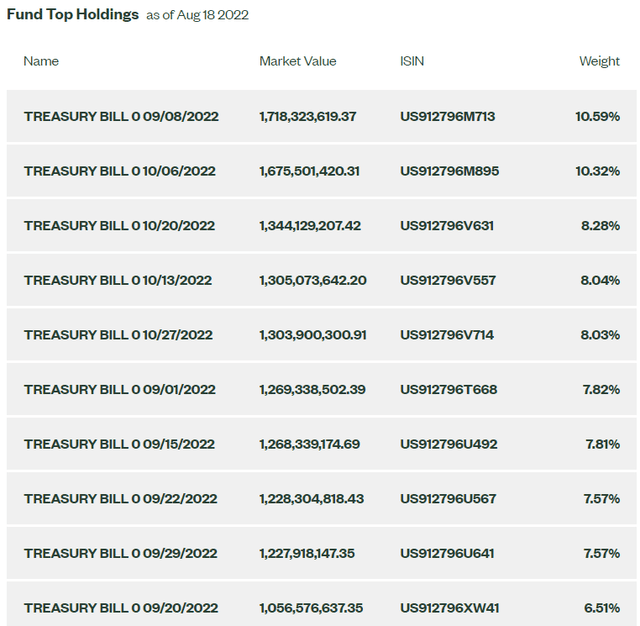

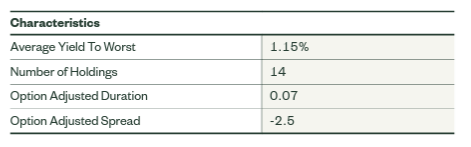

The fund has only 14 holdings and an ignorable duration profile:

Holdings (Fund)

An investor should think about this ETF in the context of just rolling T-bills outright themselves. Due to the small amount of holdings and short duration, the BIL portfolio represents a proxy for just doing that. The fund only charges 0.1363% in fees, and the 30-day SEC yield is going to climb as yields rise. Irrespective, a retail investor should not buy BIL for yield, but to park cash and get something in return. BIL is not going to make you rich or pay your monthly utilities. All underlying securities are AAA government guaranteed holdings, hence the fund does not expose an investor to any credit risk. Correlated with the very small duration, the fund also quasi eliminates market risk.

BIL is to be utilized for the cash allocation for an investor’s portfolio. In the current market we think the cash bucket should be extremely high since other traditional instruments have failed to provide a hedge in 2022 for the equity market decline. We feel the summer rally is just a classic bear market rally to be followed by more pain, and a savvy retail investor should increase their cash allocation. BIL serves as a wonderful risk-free tool to park your cash during volatile times and keep your portfolio earning a positive return in 2022.

Performance

The fund is up almost 0.3% year to date:

Rather than the net performance, which is ignorable, an investor should focus on the total return curve. It has a smooth upwards sloping curve. Exactly what a cash like vehicle should show. In comparison, its cousin from Goldman, namely GBIL is fairly flat year to date.

On a 3-year basis, we get a similar performance graph:

Please note that an investor is not to expect an outsized gain when purchasing BIL. You are getting a cash-like vehicle, not a high return investment. The concern should be preservation of capital with the transfer of a risk-free rate yield. BIL delivers on both those aspects.

Holdings

These are the fund top holdings as of August 2022:

In essence, they are short-dated T-Bills with yields that are reflective of the short end of the curve. From a credit risk standpoint, they are all AAA and are backed by the full faith and credit of the US Treasury, so they represent risk-free assets. The fund is going to re-balance at each month end to an equivalent maturity weighted portfolio.

Conclusion

Basic portfolio construction provides for a cash-like bucket. During equity up-markets, the respective allocation should never exceed 5% of the portfolio and generally should be somewhere around 3%. In today’s bear market we feel investors, depending on their risk appetites, should hold a much, much larger portion of their portfolios in cash. BIL is a U.S. T-Bills ETF that has a very short duration and no credit risk. The instrument has a stable NAV and captures the front end of the U.S. yield curve. We feel the summer rally in equities is almost over, and a savvy investor should proactively think about allocating more to funds like BIL in their portfolios.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.