[ad_1]

sergeysan1

While a lot of companies discuss building urban air mobility (UAM) networks in the next few years, Blade Air Mobility (NASDAQ:BLDE) has already successfully built an air mobility platform. The company now has a network covering the US, Canada and Europe preparing the business for the eventual launch of eVTOLs. While competitors wait for their launches, Blade will immediately insert the new aircraft into existing helicopter networks. My investment thesis remains Bullish on the concept, especially with the stock now dipping below $5.

Building The Network

In reality, eVTOLs will open up more opportunities for air taxi services, but the business concept is just an expansion of existing helicopter services offered in places like New York City to transport Manhattan passengers to and from local airports. Blade is the company building a network and brand in order to set the company up for the market expansion with modern electric aircraft allowing for more efficient and safer trips.

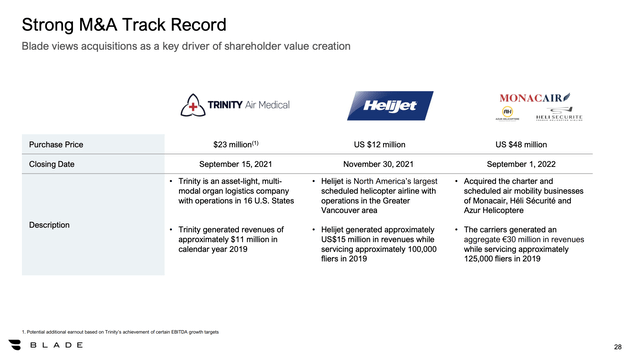

Blade recently completed the acquisition of three commercial helicopter activities in Europe to create the largest UAM service on the continent. The company paid $50 million for businesses that generated an aggregate of €30 million in revenues while servicing approximately 125,000 fliers in 2019 with service in 2022 topping those levels.

Source: Blade Q3’22 presentation

The company now offers service via branded passenger terminals at over 10 airports and heliports throughout Europe. Blade now offers service in Southern France, Monaco, Italy, and Switzerland.

The deals cost ~$50 million and closed on September 1. On top of businesses acquired in Canada and Trinity Air Medical, the company now has combined annual revenues topping $200 million.

The impressive part of achieving this milestone is that ~60% of the growth in Q3’22 is attributed to organic growth. The building of the Blade platform has led to additional customers in the Organ Transport segment along with additional helicopter passengers for Blade Airport in New York City and Blade Europe.

Improving Financials

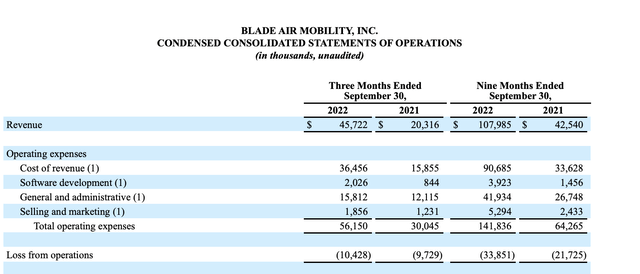

Now that Blade has built up a large network generating $45.7 million in quarterly revenues, investors can fully appreciate the financials now. In the beginning, the company was losing a substantial amount for the size of the business.

In Q3’22, Blade lost $10.4 million, but the EBITDA loss was cut in half. The UAM service generated 20.3% flight margins with a gross profit of $9.3 million.

Source: Blade Q3’22 earnings release

The quarter only includes one month of the new Blade Europe business. Blade forecast this division as already having positive cash flows in what should improve the Q4 numbers with another $5+ million in quarterly revenues.

Blade has a long-term goal of producing 50% flight margins and the Q3’22 results show a glimpse of how those margins will ultimately produce strong profits. The asset-light model is definitely appealing in the start-up phase with the company not having to incur large capital outlays to build a fleet of aircraft.

As mentioned above, the EBITDA loss was only $4.5 million due to stock-based compensation, amortization, transaction costs and others excluded from the loss. Considering Blade has 2+ years before electric aircraft start reaching the market and expanding UAM service options, the company appears ahead of schedule of achieving long-term targets with EBITDA margins reaching 35% to 40%.

The stock only has a $335 million market cap with a cash balance of over $200 million. Blade has over 24 million potentially dilutive securities, but the 14 million warrants and nearly 8 million stock options will provide more cash to fund the business, if exercised. The market cap will rise, but the enterprise value won’t rise significantly on their exercise.

Takeaway

The key investor takeaway is that Blade Air Mobility is incredibly cheap with an EV below $150 million. The company is forecast to approach $200 million in revenues next year highlighting the bargain basement price here.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.