[ad_1]

BRENT CRUDE OIL (LCOc1) TALKING POINTS

- Supply troubles bolster brent crude.

- Will the EIA weekly data add to upside pressure?

- Brent crude approaching key area of confluence.

BRENT CRUDE OIL FUNDAMENTAL BACKDROP

Brent crude oil gained further traction today after last night’s weekly API data showed U.S. inventories on the decline (a second consecutive decline) coupled with a terminal log jam in the Black Sea preventing Kazakh oil exports from being shipped. The disruption to supply will add further upside pressure on crude oil prices despite a rampant U.S. dollar. Lingering at the back of everyone’s minds persists the potential for OPEC+ to implement supply cuts adding to the plethora of tailwinds for crude.

Learn more about Crude Oil Trading Strategies and Tips in our newly revamped Commodities Module!

From a European perspective, winter months are looming thus increasing the demand for energy to the region leaving minimal downside risk for crude oil. This week’s CoT report (see graphic below) highlights market positioning to the long side as open interest increases once more and echoes the fundamental backdrop outlined above.

BRENT CRUDE FUTURES COMMITMENT OF TRADERS OPEN INTEREST

Source: Refinitiv

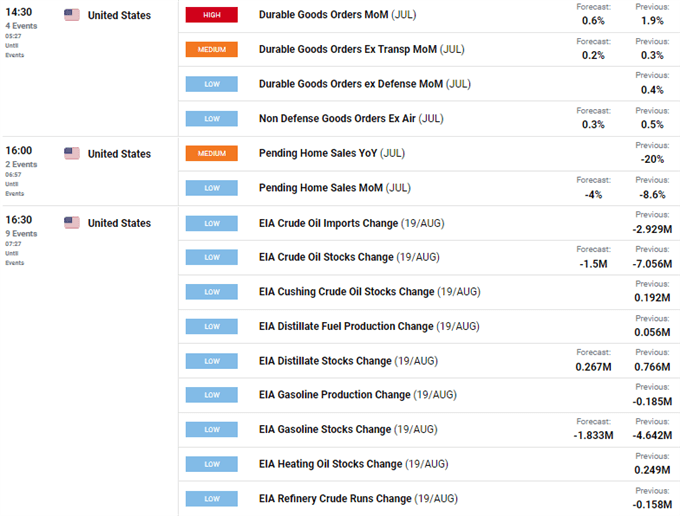

The economic calendar is fairly light today with U.S. durable goods orders the only high impact event for the day while the EIA weekly report will be in focus for oil markets. Should the release mirror the API data from last night, we could see an extension of the short-term upside rally.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

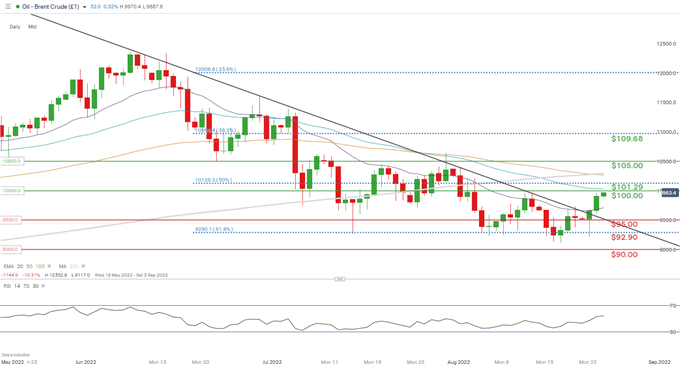

BRENT CRUDE (LCOc1) DAILY CHART -UNDATED

Chart prepared by Warren Venketas, IG

The daily brent crude chart (undated) above shows bulls preparing for a run at the 100.00 psychological resistance zone which was last seen in early August. Yesterday’s candle close above the medium-term trendline resistance (black) may have confirmed this breakout and could see 95.00 as the new floor for brent crude.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are NET LONG on Crude Oil, with 60% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning we settle on a short-term upside bias.

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.