[ad_1]

AUD/USD ANALYSIS & TALKING POINTS

- U.S. data in focus for AUD/USD.

- Commodity prices providing sustenance for Aussie.

- Technical analysis points to hesitancy ahead of economic releases.

Recommended by Warren Venketas

GET AHEAD OF THE CURVE AND READ OUR AUD Q1 GUIDE

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The pro-growth Australian dollar is enjoying some upbeat risk sentiment this morning after the U.S. ADP employment report yesterday showed an uptick in the labor market. The positivity for the AUD is quickly narrowing ahead of the European session open and may fall further should the upcoming Non-Farm Payrolls (NFP) print follow suit.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Unfortunately, the ADP release is an unreliable precursor to the NFP which allows for a miss later today. In addition to the NFP data, the ISM non-manufacturing report for December (see economic calendar below) will close out the data for the week and will carry much significance as the U.S. is primarily a services driven economy. Expectations are signaling a slight decline but the overall figure remains in expansionary territory at this point. Finally, several Fed officials are scheduled to speak with the likelihood of reiterating the fight against inflation extremely high.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

From an Australian perspective, there are no real drivers locally but markets continue to ebb and flow around China’s reopening optimism and mounting COVID cases. The commodity landscape today shows some encouraging signs for the Aussie dollar with key exports of iron ore and gold trading in the green.

TECHNICAL ANALYSIS

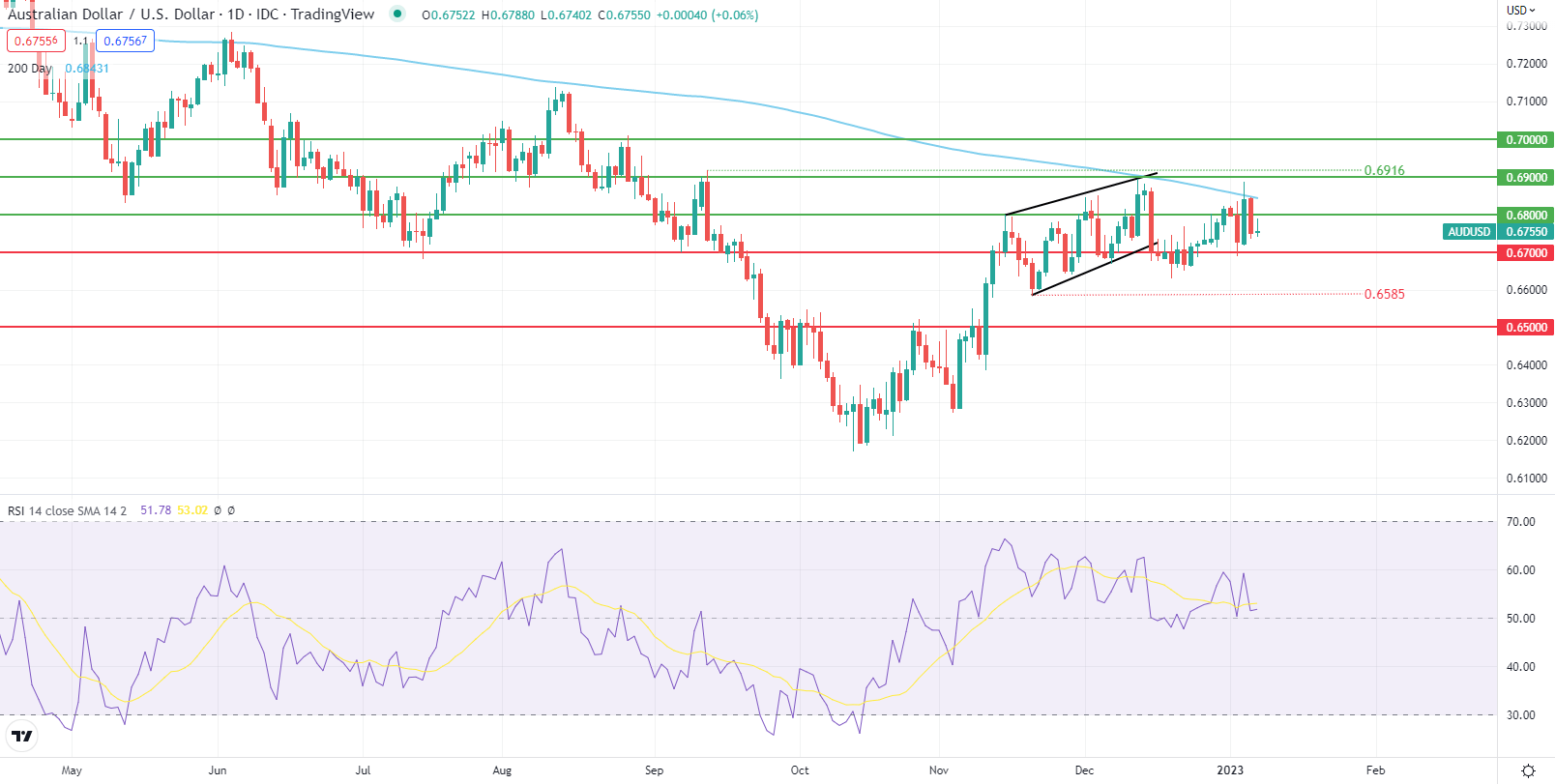

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action highlights market cautiousness on this particular currency pair with the Relative Strength Index (RSI) lingering near the midpoint 50 level. Todays daily candle currently reflects that of a long upper wick and traditionally leads to subsequent downside making today’s close key for short-term directional bias. As mentioned above, the NFP is the main driver for today and a estimate beat will likely give the USD added support exposing the 0.6700 psychological handle once more.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently LONG on AUD/USD, with 59% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.