[ad_1]

Eurozone PMI Key Points:

- Final Eurozone Composite Output Index at 49.3 (Nov: 47.8). 5-month high.

- Final Eurozone Services Business Activity Index at 49.8 (Nov: 48.5). 4-month high.

Recommended by Zain Vawda

Get Your Free EUR Forecast

The seasonally adjusted S&P Global Eurozone PMI Composite Output Index remains sub-50 and in contraction territory for a sixth consecutive month with a print of 49.3, which was up from 47.8 in November. The data signalled the slowest decline since last July, when activity levels first started shrinking. The decrease has now softened in each of the past two survey periods. Eurozone Services PMI Business Activity Index rose to 49.8 in December, up from 48.5 in November with signs of a marginal decline in service sector output across the euro area. Overall, this was the softest decrease in activity since last August.

Customize and filter live economic data via our DailyFX economic calendar

Outstanding business volumes fell for a second successive month as reduced new business enabled companies to focus on orders pending completion. A further expansion in employment also boosted resource availability. The rate of job creation was only fractionally stronger than the 20-month low seen previously, however. Business confidence showed signs of improvement but remains subdued while input and output price increases were somewhat offset as inflation eased to 11 and 4-month lows respectively.

Recommended by Zain Vawda

How to Trade EUR/USD

The Euro Area showed resilience toward the end of 2022 with a host of positive data releases which so far seems to be continuing into 2023. Yesterday delivered some more positives as German inflation data came in at -0.8% Vs -0.3% forecast with the unemployment rate beating estimates as well. French preliminary inflation data was released earlier today further strengthening the narrative by beating estimates of 0.4% MoM with a print of -0.1%. Given the improvement in recent data releases coupled with a slightly more positive tone to start the year the Euro could remain supported in the near term.

Market reaction

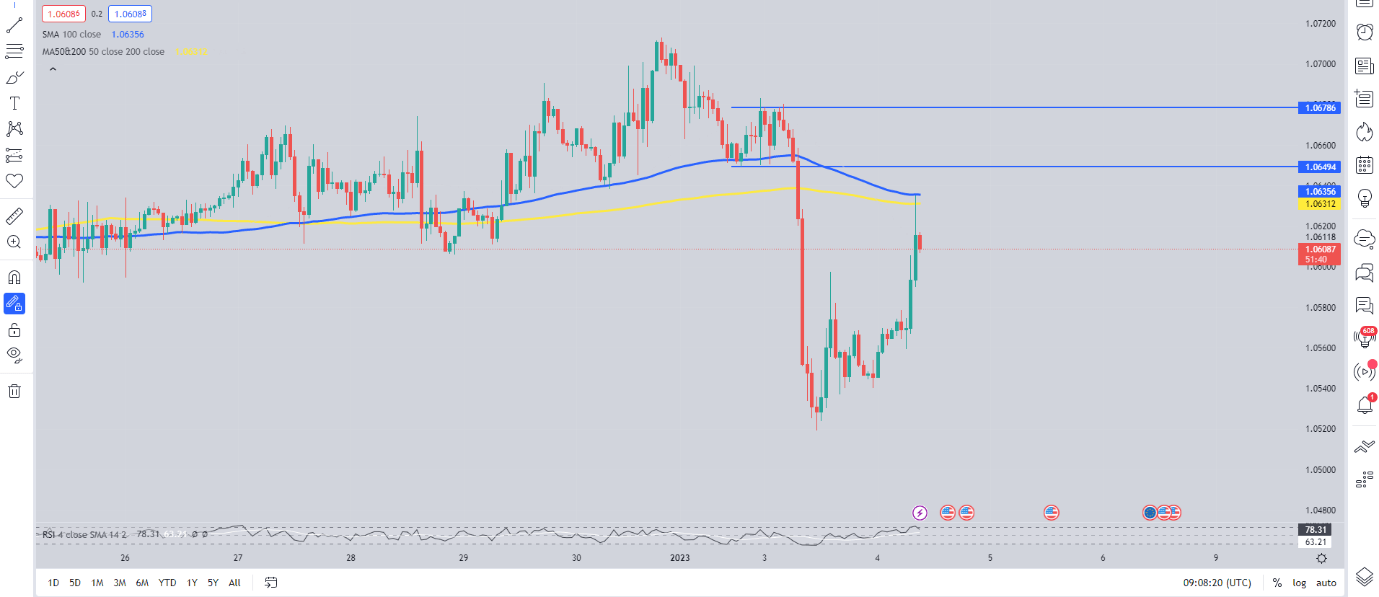

EUR/USD 1H Chart

Source: TradingView, prepared by Zain Vawda

The Initial reaction to the data saw EURUSD decline 10 pips before moving higher once more.

On the daily timeframe we remain within the rising wedge pattern with yesterday’s decline failing to break lower. We have since bounced higher this morning with EURUSD up some 60-odd pips for the day.

IG CLIENT SENTIMENT: BEARISH

IG Client Sentiment Data (IGCS) shows that retail traders are currently SHORT on EUR/USD with 58% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are SHORT suggests EUR/USD prices may continue to rise.

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.