[ad_1]

SPmemory/iStock via Getty Images

Situation Update

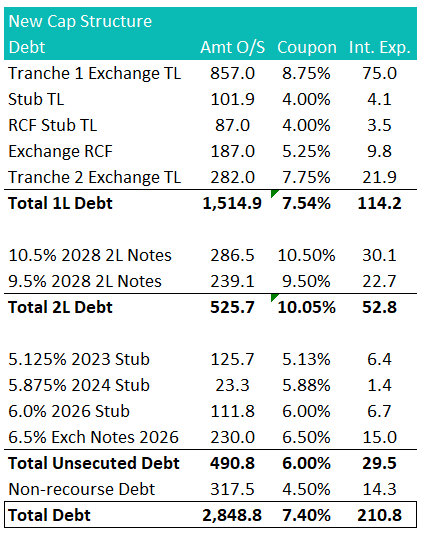

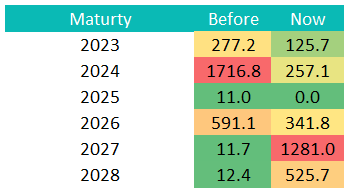

GEO Group (NYSE:GEO) successfully closed amend & extend transaction to smooth out its maturity wall. The previous $2.0 billion maturity in 2023 and 2024 is largely pushed out to 2026-2027. There are some stub pieces remaining in 2023 and 2024 but the sizes are small and the company will be able to deal with them using cash generated from operation. Below is the new capital structure:

Author’s Estimate & Company PR

Author’s Estimate & Company PR

Deleveraging Path

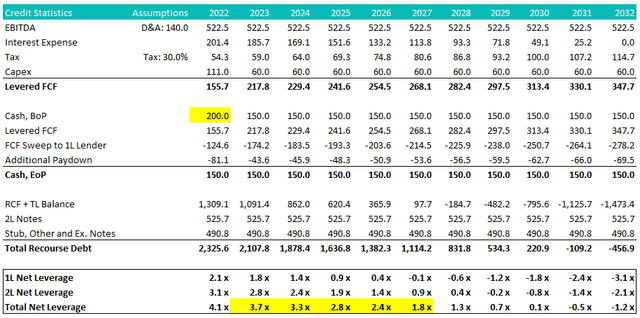

GEO is targeting 3.5x leverage by the end of 2023 and below 3.0x by the end of 2024. This deleveraging goal seems to be achievable on my cash flow model using the most recent guidance and assuming status quo. As a reminder, GEO is required to use 80% of excess cash flow to pay down various parts of its first-lien capital structure (i.e. term loan and RCF), in addition to any mandatory amortization and voluntary paydown.

Author’s Estimate

GEO 10.5% 2028 2L Notes

Within GEO’s capital structure, I like the new 10.5% 2L notes the most. You can probably source some bonds in the $96-97 context. At $96.5 this bond has 11.3% YTW and 11% current yield. The starting leverage through the 2L tranche is 3.1x and quickly dropping to ~2.5x by the end of 2024. I also believe GEO will try to take this expensive piece of debt out as soon as possible. GEO should apply some excess cash flow to purchase the bond in the market if it continues to trade below par. Alternatively, GEO will try to do a global refi for its entire capital structure once the net leverage drops to ~3.0x in 2024. A much more digestible leverage profile and a more favourable political landscape should lower the cost of debt for GEO in a few years.

GEO 5.875% 2024 Stub

After the amend and extend transaction, there are only ~$23 million of these notes outstanding. The company already revealed its plan by stating in the press release that:

Following the closing of the Transactions, GEO will have approximately $200 million in domestic unrestricted cash and cash equivalents and total liquidity of approximately $375 million. With its available liquidity, the expected future proceeds from the sale of certain non-core assets, and its current free cash flow run rate, GEO expects to be able to fully repay the outstanding debt amounts that will be due in 2023 and 2024, after giving effect to the Transactions, prior to their stated maturities.

The 2024s is callable at par on October 15, 2022. I believe the 2023 and 2024 stubs will be taken out together before the end of year. At $96, the bond is yielding 19.5% to the end of 2022. Holding this one to maturity is also not a terrible investment at ~8.0% YTM for a 2-year paper.

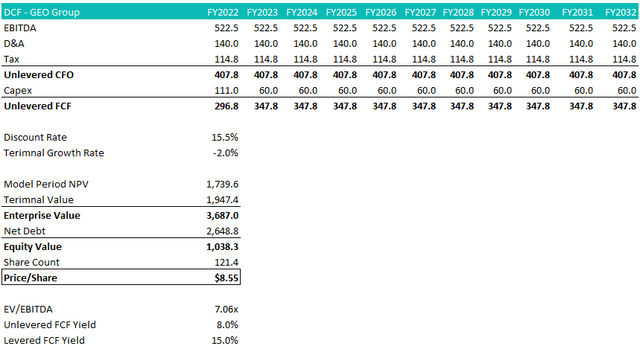

GEO Equity

GEO equity is up 15% since I last upgraded it to a buy. The equity is still very cheap on any metrics you look at (EV/EBITDA, P/AFFO, FCF Yield). At ~$8.50 the market is implying a -2.0% terminal growth and a 15.5% discount rate, which seems too punitive. I believe the midterm election should provide some political pressure relief if the Republicans can gain some ground. However, share buyback and/or restatement of dividends will probably happen in the 2024-2025 timeframe, but equity value should build starting now as GEO continues to delever.

Author’s Estimate

Conclusion

As expected, the parties were able to find common ground on how to deal with GEO’s tight maturity schedule. GEO’s deleveraging target seems to be on track thanks to its well-contracted cash flow and the essential nature of its service. GEO’s capital structure offers a menu of decent investment opportunities: the newly minted 10.5% 2L notes is one of the safest ways to earn a +10% yield that I can think of; the 2024s stub can be viewed as a high-interest GIC at this point; GEO’s equity continue to be undervalued despite the recent rally with a near-term catalyst in sight.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.