[ad_1]

Maskot

Investment Thesis: Hanover Insurance Group could see a rebound in upside on the basis of gross premium growth and a reduction in the combined ratio across the Core Commercial segment.

In a previous article, I made the argument that while Hanover Insurance (NYSE:THG) could see continued growth in premium demand across the US private auto segment – the company could face higher risks of catastrophic losses across its commercial lines.

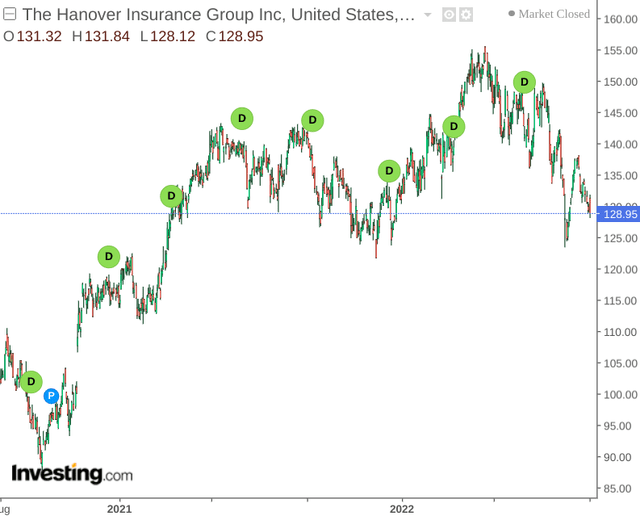

While the stock has had a strong run-up since 2021 – price has seen a decline in the last few months:

The purpose of this article is to investigate whether there is scope for Hanover Insurance Group to see a rebound from here, taking recent earnings performance into account.

Performance

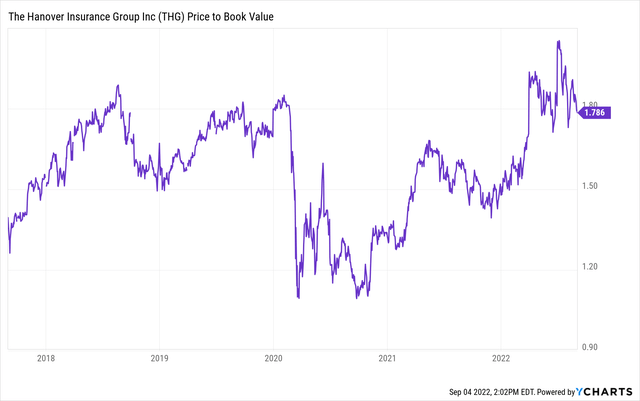

When looking at results for the six months ended June 2022 – we can see that both the catastrophe loss ratio and combined ratio across the Core Commercial segment has decreased from that of last year. This indicates that the share of claims from catastrophic events has decreased – and the lower combined ratio indicates that the ratio of losses and expenses relative to the earned premium has also decreased.

Hanover Insurance Group: Form 10-Q Q2 2022

With Core Commercial accounting for the largest segment in terms of gross premiums written – the drop in the combined ratio and catastrophe loss ratio has been quite encouraging.

While the combined ratio across the Personal Lines segment has increased – the catastrophe loss ratio has still decreased slightly.

Overall, we see that both the gross premiums written and net premiums earned are up on last year’s levels – which is encouraging.

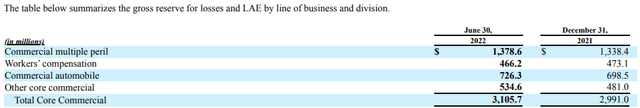

Additionally, Hanover Insurance Group has also increased its reserves for losses and loss-adjustment expenses across the commercial multiple peril, commercial automobile, and other core commercial segments – indicating that the company is in a better position to cover losses arising from these segments.

Hanover Insurance Group: Form 10-Q Q2 2022

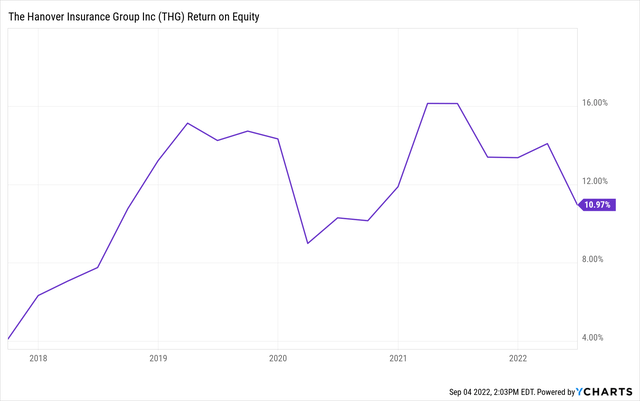

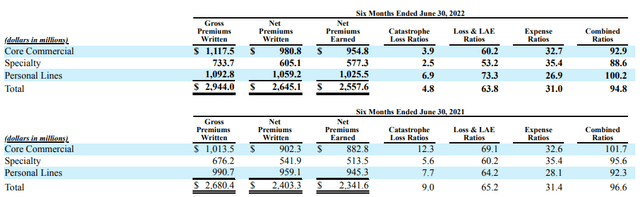

From a valuation standpoint, we can see that while the stock is trading at a higher price-to-book ratio over the past five years – return on equity has also risen:

Price to Book

Return on Equity

In this regard, I take the view that the stock could still see a significant rebound over the longer-term in spite of the higher P/B ratio.

Risks

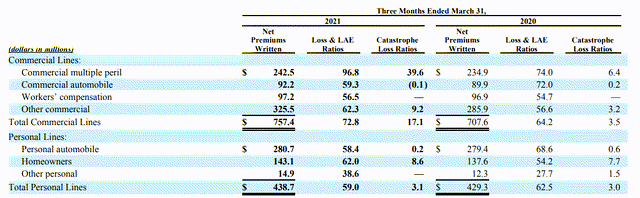

Previously, my main reason for arguing that losses across Core Commercial could be a risk for the company were due to the risks posed to commercial multiple peril in particular – with the winter storm of February 2021 in Texas having meant that many businesses needed to close at the time due to property damage, and we observed that the three-month catastrophe loss ratio for Q1 2021 had risen greatly:

Hanover Insurance Group: From 10-Q Q1 2021

Going forward – the strong exposure to commercial multiple peril could mean that adverse weather events could result in catastrophic losses of similar magnitude once again.

For instance, the United States has reportedly seen four “1 in 1,000” rainfall events this summer across the West and Midwest – it is quite probable that such events will have resulted in significant property damage and disruption to businesses.

As a result, we could expect that the catastrophe loss ratio across commercial multiple peril might see a significant rise over the next two quarters. Under such a scenario – Hanover Insurance Group may see lackluster growth over the short to medium-term and the case for upside might no longer stand.

In this regard, investors are likely to pay significant attention to the catastrophe loss and combined ratios over the next two quarters – as an increase in these ratios across commercial multiple peril would mean that the cost of insuring policies would be more expensive relative to what the company is collecting in premiums.

With that being said, the fact that Hanover Insurance Group has continued to bolster reserves for losses and LAE is encouraging, and given the continued growth in gross premiums written across commercial lines more generally – I take the view that the company should be able to withstand the effects of such losses and sustainably grow premiums over time.

For Personal Lines, the company notes that the current accident year combined ratio rose in Q2 2022 – which was explainable by the fact that Q2 2021 saw a lower than typical level of claims across auto. With loss frequency in auto having remained below pre-pandemic levels up until now, investors are likely to watch for a rise in the loss ratio across this segment.

Conclusion

To conclude, Hanover Insurance Group has seen downside over the past few months. However, I take the view that this has been driven more by broader market sentiment as opposed to business performance.

Should the company be able to continue growing premiums sustainably and continue to keep its combined ratio at current levels or lower, then there could be upside for the stock once market sentiment becomes less bearish.

However, the company could see a rise in catastrophic losses over the next two quarters and auto claims could also see a rise to pre-pandemic levels. For these reasons, I see Hanover Insurance Group as a hold for now – with the caveat that the stock could have longer-term upside once market sentiment becomes less bearish.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.