[ad_1]

malerapaso

Yesterday was relatively quiet in advance of what should be a market moving speech today from the Chairman of the Federal Reserve. Performance for the month of November hangs in the balance with the S&P 500 up 2.2%, as one word from Chairman Powell could erase those gains in a flash. He is scheduled to speak at 1:30pm today. The job openings report (JOLTS) for October at 10:00am could also be market moving and impact what Powell has to say.

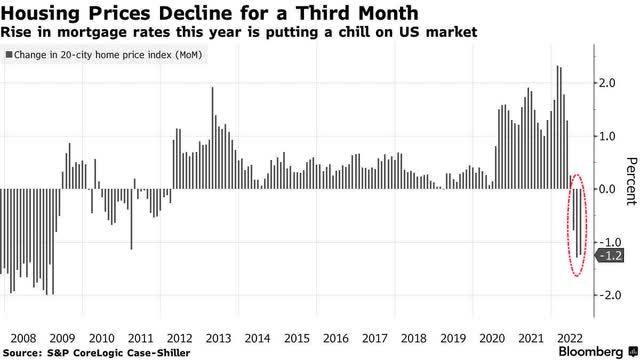

As Fed officials like James Bullard continue to discuss future monetary policy actions as though driving in the rear view mirror, the most influential component of the inflation gauge is finally rolling over. According to the S&P CoreLogic Chase-Shiller index, home prices fell 1.2% in September for a third consecutive monthly decline. This is due primarily to soaring mortgage rates, which have doubled over the past year. It will weigh heavily on owners’ equivalent rent (OER), which is a survey asking how much consumers would pay to rent instead of own their home. The OER accounts for approximately 25% of the Consumer Price Index and 12% of the personal consumption expenditures price index.

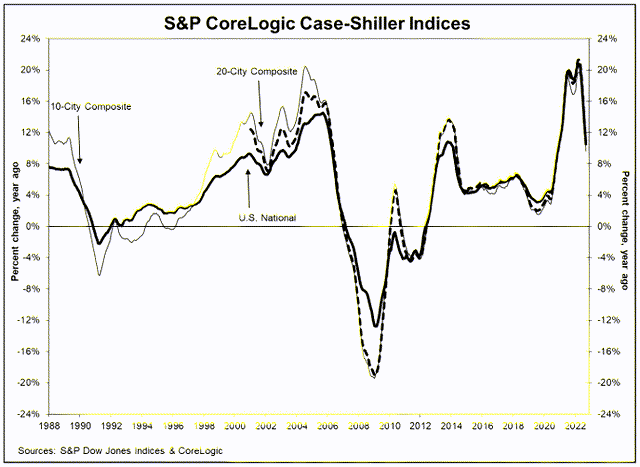

In the view below, we have already halved the year-over-year percentage increase in homes prices nationwide from more than 20% to 10%, and I expect to see a modest decline at some point next year. This is one example of deflation that should bring the inflation gauges very close to the Fed’s target in 2023, which will be well ahead of the schedules offered by the Fed and Wall Street.

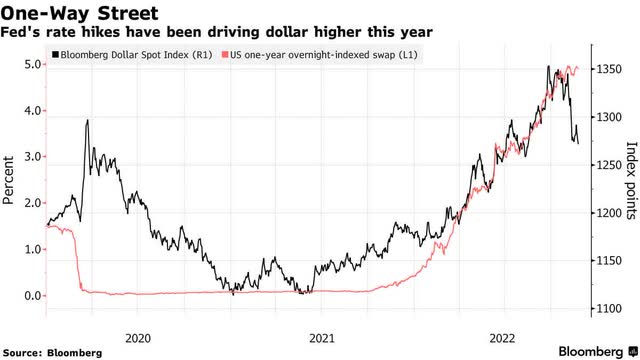

One tailwind likely to result from the peak in short-term rates that is followed by a slowing rate of economic growth in 2023 is a weaker dollar. I have discussed this over the past couple of months, but it is starting to happen now, and Wall Street is taking notice.

A weaker dollar will ease the inflation imported by Europe and emerging markets around the world, as well as reduce the debt burden for those governments borrowing in US dollars. There has been a very high inverse correlation between the dollar and emerging market equities, which implies outperformance moving forward. This is why bond king Jeff Gundlach recently asserted that emerging markets should be bought once the dollar falls below its 200-day moving average, which it is close to achieving.

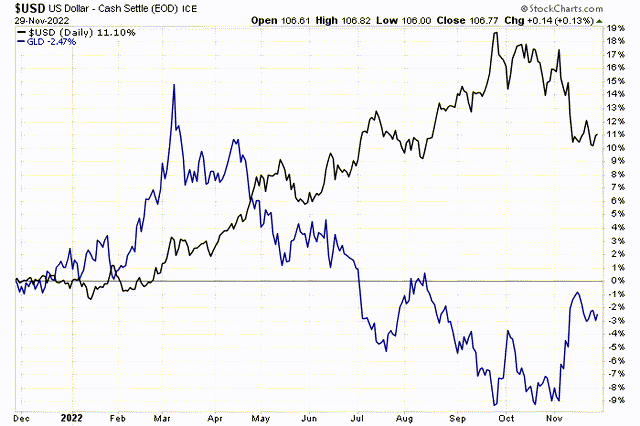

Precious metals like gold (GLD) have also had a very high inverse correlation with the dollar, as can be seen in the chart below. As such, now that cryptocurrencies have lost a lot of their luster, I expect to see gold and gold miners (GDX) perform well in 2023. While liquidity continues to be drained from the financial markets, as the Fed reduces the size of its bond portfolio, investors must be more selective and tactical. Instead of a rising tide lifting all boats, as we have experienced for more than a decade, many will sink in this new era.

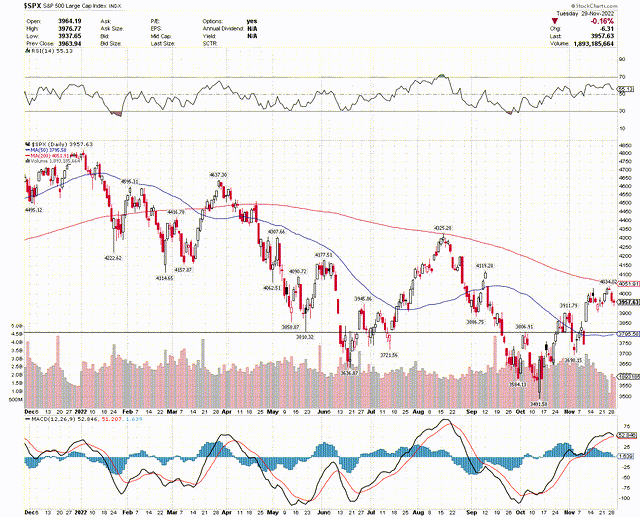

The Technical Picture

I wish the S&P 500 was not so extended on a short-term basis as we begin the final month of the year. Perhaps Chairman Powell will send shock waves through risk assets again today, quickly resolving this condition. I think it is highly likely, and I would look for support around the 50-day moving average at approximately 3,800.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.