[ad_1]

LordRunar/E+ via Getty Images

I have been working my way through many of the net lease real estate investment trusts (“REITs”) in the last month, from STORE Capital (STOR) to Agree Realty (ADC). One of the smaller net lease REITs that I haven’t covered for a while is NETSTREIT Corp. (NYSE:NTST) (“Netstreit”). It is newer to public markets and not as widely followed, but I still think the long-term future is bright for this small cap REIT.

Investment Thesis

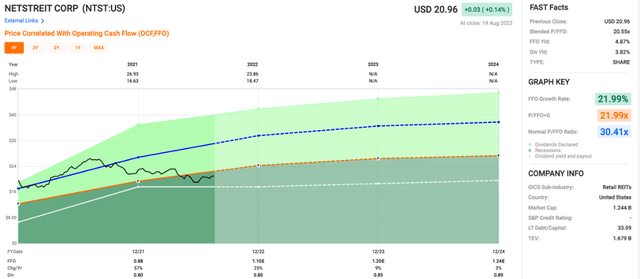

Netstreit is a lesser-known REIT, but it has several attributes that make it interesting. The first is a portfolio that is heavily weighted towards investment grade tenants. The second is a consistent history of growth that should continue for years to come. Shares currently trade just over 20x price/FFO, which I think is a good deal considering Netstreit’s portfolio and growth potential. Investors currently get a 3.8% yield, but we haven’t had any dividend growth since the IPO. I’m starting to get impatient, but I still think we will see some dividend growth sooner or later. Investors looking for a net lease REIT with a lot of long-term upside might want to take a closer look at Netstreit.

The Business

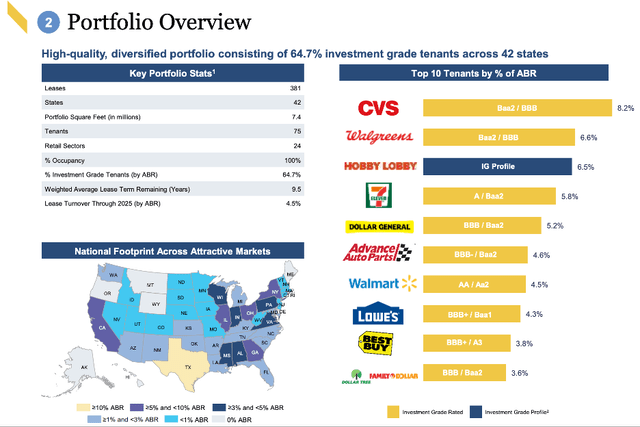

Netstreit has been solid all the way through the COVID lockdowns, maintaining a 100% occupancy rate. Most of their portfolio is dedicated to investment grade tenants, which make up approximately 65%. As you can see below, the company is still heavily weighted towards Texas and the rest of the southern U.S. I like the focus on the southern part of the U.S. as I think migration patterns will continue to be favorable for that part of the country.

NTST Portfolio (netstreit.com)

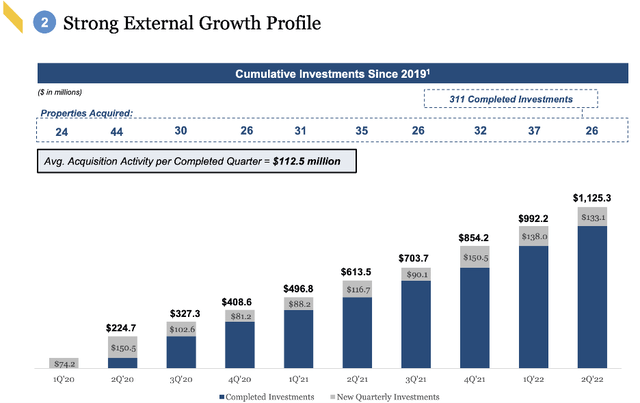

One of the other things I like is that the company has been growing at a consistent pace since going public. If they continue to invest wisely in defensive real estate sectors, I think they should be able to turn that growth into impressive returns for investors. Below is a graph of their investment activity over the last couple years.

NTST Investment Activity (netstreit.com)

Netstreit has a long growth runway, partially because they focus on smaller deals than some of the larger net lease REITs. I can see the REIT growing from a small cap into a large cap REIT over time, especially if they continue to increase the pace of their investments. While Netstreit hasn’t been public for long, I like the portfolio and growth strategy, along with the valuation.

Valuation

Netstreit currently trades at a 20.6x price/FFO, which is higher than most net lease REITs. While it is significantly below the normal 30.4x price/FFO since going public, that number isn’t that helpful due to Netstreit’s short history as a public company. I think that buying shares near a 20x price/FFO is going to turn into double-digit returns for long term investors, especially if we get a little multiple expansion to go with FFO/share growth.

While I think some multiple expansion is possible, I’m not counting on it. I’ll be more focused on the FFO/share growth, which is going to be more important for long term returns. It will also be a good predictor of dividend growth, another thing that will factor into returns. While Netstreit has grown FFO/share significantly since the IPO, I’m still waiting for that to translate into dividend growth.

Where’s My Dividend Growth?

One of the things that I look for in my REIT investments is a history of dividend growth. I made an exception to this rule for Netstreit as it was new to public markets, and I figured dividend growth would come sooner rather than later with the company’s solid portfolio and growth strategy. I have been long for a year and a half, and to be honest, I’m starting to get impatient.

The yield right now is 3.8%, so you are getting a decent starting income, but I thought we would start to see dividend growth at some point this year. I won’t be selling my shares just yet, but I’m starting to keep my eyes open to see if there might be another small cap net lease competitor that I like better. I’m still bullish on the company, but I won’t wait forever for dividend growth, especially when there are competitors out there that have hiked multiple times in the last couple years.

Conclusion

Some of you might think I’m being short-sighted on the lack of dividend growth for Netstreit. That is a possibility, but I want to see growing dividend payouts for companies I own, especially ones that have grown like Netstreit has since going public. I like the portfolio focus and investment grade tenants, and the geography is another reason to be bullish. The company has a long growth runway and continues to make more than $100M in acquisitions each quarter, a large amount for a REIT with a market cap of $1.1B. The valuation is attractive today at just over 20x price/FFO, and I still think double digit returns are likely from here. While I’m still at a buy on Netstreit, but I won’t be sticking around forever if the dividend growth stays stuck in neutral.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.