[ad_1]

Scott Olson

Investment Thesis

Palantir’s (NYSE:PLTR) Q2 report was not what investors had hoped to see. Not only was its guidance notably weak, but crucially its bottom line profitability appears to have moved in the wrong direction.

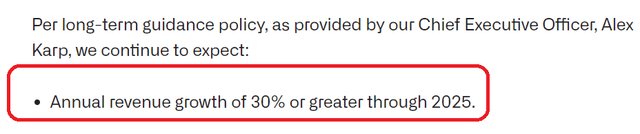

If you remember, Palantir noted last quarter that it could grow at 30% CAGR into 2025. However, Q2 2022 saw revenue growth rates of 26% which missed that guided CAGR. Also, Palantir’s guidance for the remainder of H2 2022 meaningfully misses that guidance.

Meanwhile, its added-back stock-based compensation adjusted free cash flow line was the real shocker. How can this business not be printing stronger free cash flows when it has such little consistent revenue growth to show for it?

I do not believe that paying 12x this year’s sales for Palantir is justified. That being said, I recognize that the stock is already down more than 50% over the previous year, hence it’s difficult to argue that the stock today is overpriced.

On balance, I remain on the fence and am neutral on this stock.

Palantir’s Revenue Growth Rates Fizzle Out

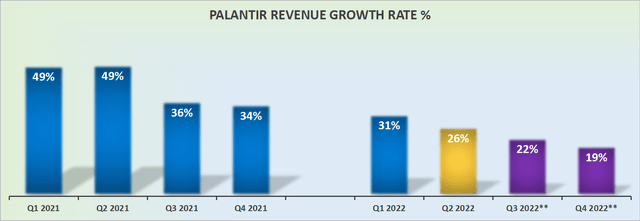

PLTR revenue growth rates

This time last year, Palantir was clocking nearly 50% y/y revenue growth rates. Today, Palantir reported nearly half the growth rate of the same period a year ago.

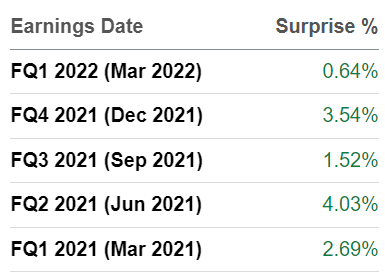

Furthermore, perhaps more importantly, Palantir’s revenue growth rate guidance leaves a lot to be desired. Even though I recognize that for Palantir bulls they’ll declare that Palantir is lowballing estimates to allow for easy beats later on, I counter that insight by showing evidence that that narrative isn’t supported by facts:

PLTR revenue beats

As you can see above, over the past several quarters, Palantir’s revenue beat has been consistently moving towards the low end of single digits.

While Q2 of last year saw Palantir’s topline beat revenue estimates by 4%, the size of the beat has been consistently moving lower over subsequent quarters. This has culminated with Palantir’s most recently reported revenue only beating consensus by less than 1% (figures not shown above).

Now, if you remember, Palantir has consistently noted that it has what it takes to grow over the longer term by 30% CAGR:

PLTR’s Q1 2022

However, just 90 days after Palantir made that announcement, it now appears that its guidance towards the back end of this year is looking to exit in the low 20s% CAGR!

Hence, this really forces the following question. If Palantir struggles to forecast 90 days out, despite signing multiple multi-year contracts, can investors really be justified in paying such a multiple for this stock?

Palantir’s Adjusted Free Cash Flow Margins Moves in the Wrong Way

What follows is Palantir’s adjusted free cash flow margin. Let’s see if we can discern a pattern:

- Q1 2021: 44%

- Q2 2021: 13%

- Q2 2021: 30%

- Q4 2021: 24%

- Q1 2022: 13%

- Q2 2022: 13%

Over time, Palantir’s free cash flow margins have moved from the mid-40s% back in Q1 2021 through the 30s% – mid20s% margins range and now have found a floor around 13%

On the other hand, on a positive note, Palantir guides that 2022 as a whole will come in at +$300 million of adjusted free cash flow margin, which means that the second half of the year should see Palantir’s free cash flow margins improving.

Nevertheless, this reinforces my whole argument that Palantir’s adjusted free cash flow margin will end 2022 at around 16%, a substantial drop from 28% of adjusted free cash flow margins reported in 2021.

PLTR Stock Valuation – Priced at 12x Sales

I contend that PLTR is overpriced at 12x sales. The business is not only unprofitable, but most critically for investors Palantir simply provides investors with no level of predictable revenue growth rates.

If management can’t forecast their own business out 90 days at a time, how can investors be so eager to run a discounted cash flow analysis of the business that estimates its future free cash flows many years into the future?

Meanwhile, its stock-based compensation continues to move higher over time, as does adjusted weighted-average shares outstanding.

The Bottom Line

Palantir continues to be a favorite stock of investors. This is of course a high-tech business that is shrouded in secrecy and mystery, something that investors always favor. But the only mystery to solve here is how can the business not be able to forecast its next 90 days?

In the short term, Palantir is likely to remain a meme stock, with passionate shareholders. But over a longer-term horizon, investors will start to question, why does the business struggle to report a clean profit?

Altogether, I am not enthused about paying 12x forward sales for Palantir. Hence, I’m neutral on the stock.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.