[ad_1]

Sundry Photography

Thesis

QUALCOMM Incorporated (NASDAQ:QCOM) stock has recovered its post-earnings losses after weak holders bailed out as management proffered languid guidance to start its FQ1’23 (quarter ending December 2022).

We aren’t surprised by the market’s reaction, as it took out bearish holders/investors at its recent November lows. We highlighted in our pre-earnings update that significant damage had already been reflected in its valuation, as the market is forward-looking.

Therefore, the market brushed aside the initial post-earnings pessimism as investors focused on Qualcomm’s growth story post-FY23. Coupled with slashed estimates from Wall Street analysts after Qualcomm de-risked its FY23 guidance, we believe it sets up San Diego-based company well for outperformance moving forward.

Notably, QCOM has surged nearly 26% from its November lows to its recent highs. Therefore, we parse that a pullback is appropriate to help digest some of its recent gains.

However, we are confident that a medium-term re-rating is in store, with QCOM’s reward/risk profile skewed to the upside despite the recent sharp recovery.

Maintain Buy. However, investors can also consider layering in, taking advantage of potential near-term downside volatility.

Management De-risked Its FY23 Outlook Astutely

Given the transitory inventory digestion at its downstream handsets customers, we believe management provided a conservative outlook to reflect near-term macro risks. Furthermore, China’s recent refinement of zero COVID restrictions has come under further pressure, as its daily COVID cases exceeded the 30K ceiling “for the first time ever.”

Consequently, China state authorities have tightened their approach to combat the recent outbreak as investors parse the resilience of its recent refinement. As a result, economists have also revised their forecasts for China’s GDP growth in 2023, expecting an uneven cadence to its reopening measures. Bloomberg Intelligence also projected that a full reopening will likely stretch beyond 2023. China’s intensive care capacity is not configured to cope with the surge in infections associated with a full reopening. It accentuated:

The euphoric reaction to China’s softening of its zero-Covid-19 stance looks misplaced, given full reopening may lead to 5.8 million ICU admissions. To avoid this, continued caution across many regions in China will be needed, but this will prolong the time to full reopening beyond 2023. – Bloomberg Intelligence

Therefore, we believe CEO Cristiano Amon & team did the right thing in de-risking its execution markedly for FY23, reflecting the macro uncertainties and the COVID challenges in China. CFO Akash Palkhiwala articulated:

We were very clear that the OEM inventory drawdown, we see that as a couple of quarter issue. And it’s not something that’s a long-term challenge for us. It’s a short-term cyclical issue. And then on the market side, given the uncertainty at this point, our planning assumption is that the weakness in the market lasts through the fiscal year. Clearly, if the market improves, we’ll see that as upside. But at this point, we’re going to plan based on current scale of the market. (Qualcomm FQ4’22 earnings call)

Therefore, we think it’s clear that management has likely reflected significant risks on its outlook for FY23, contemplated in its initial guidance for FQ1. Notably, management doesn’t expect the inventory challenges to be structural.

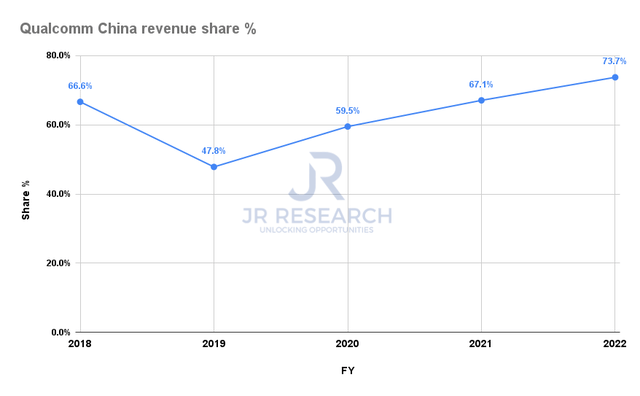

Qualcomm China revenue share % (Company filings)

Hence, Qualcomm’s under-shipping to demand should correct itself subsequently from H2’23. However, the main challenge is still predicated on the “China issue,” which is out of management’s control. However, the company remains confident about its long-term roadmap in China, which can also be gleaned from its revenue exposure of nearly 74% in FY22 (up from FY21’s 67%).

Hence, China’s outlook is instrumental in recovering its most critical handsets and RFFE segment while diversifying in IoT and automotive.

Moreover, we believe China is committed to hitting at least 5% in GDP growth in 2023, as China’s central bank highlighted in a recent address. However, it’s predicated on China “largely or completely [getting] rid of the impact of the pandemic in the first half of [2023].”

Hence, we assess there is upside potential to the slashed consensus estimates if China’s COVID situation could be brought under control earlier than anticipated.

Is QCOM Stock A Buy, Sell, Or Hold?

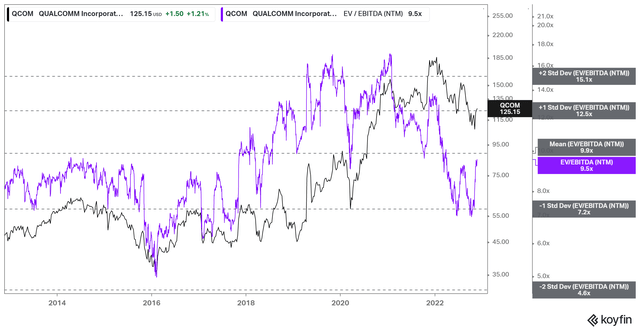

QCOM NTM EBITDA multiples valuation trend (koyfin)

With the significant cuts in Qualcomm’s forward estimates, its NTM EBITDA multiple surged to 9.5x, slightly below its 10Y average of 9.9x. Notwithstanding, it was also lifted by the remarkable recovery from its November lows, as highlighted earlier.

However, we are not perturbed by the normalization in its earnings multiple. Instead, we view it constructively, as Qualcomm’s de-risked guidance could have upside potential if the inventory digestion or China’s COVID situation gets resolved earlier than expected. Hence, we view the reward/risk constructively at these levels, as we postulate that further significant estimates cuts seem unlikely.

Therefore, we are confident that QCOM investors can continue to add exposure. Notwithstanding, a pullback should also be considered, given the rapid recovery from its recent lows.

Maintain Buy.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.