[ad_1]

nattrass/E+ via Getty Images

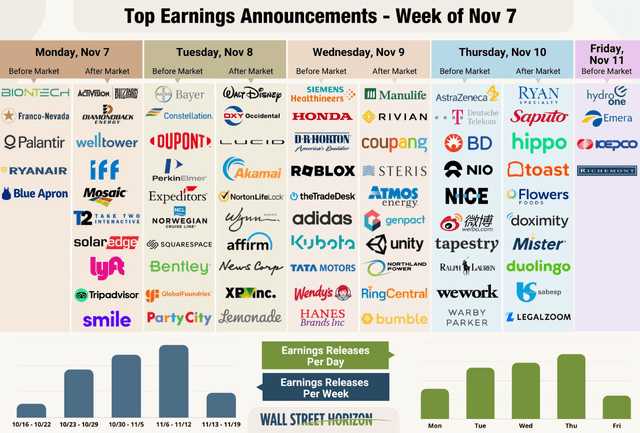

It’s the final peak week of earnings season. John Butters, Senior Earnings Analyst at FactSet, notes that 70% of S&P 500 companies have beaten bottom-line estimates, while 71% have topped sales expectations. More big names report this week. One foreign solar name, a 10% holding in the Invesco Solar ETF (TAN), has seen big share price volatility lately, but it has also underperformed its peers. Are more dark days ahead for SolarEdge?

The Last Big Week of S&P 500 Earnings

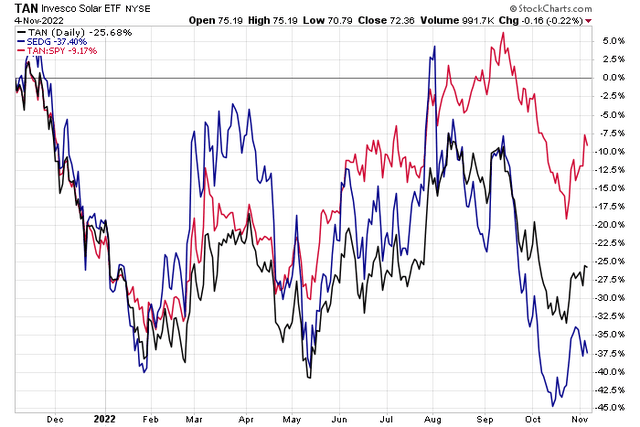

SEDG: Underperforming the TAN ETF YoY

According to Bank of America Global Research, SolarEdge Technologies (NASDAQ:SEDG) is a leading global power electronics company headquartered overseas. SEDG designs and sells semiconductor-based DC-optimized inverter and battery systems comprising DC optimizers to regulate output at the module level, a string inverter to convert DC electricity to AC, and a DC-coupled battery to store electricity. SEDG sells its products to solar installers, EPCs, and distributors globally with the largest focus on North America and Europe.

The Israel-based $12.5 billion market cap Semiconductors & Semiconductor Equipment industry company within the Information Technology sector trades at a high 85.8 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

The company has headwinds from a weakening housing market, significant negative currency exposure impacts, a somewhat weak execution history, and ongoing logistical challenges. Other downside risks include increasing competition which could bring down margins and policy uncertainty. Upside potential comes from improved execution, more legislative support, and lower market interest rates.

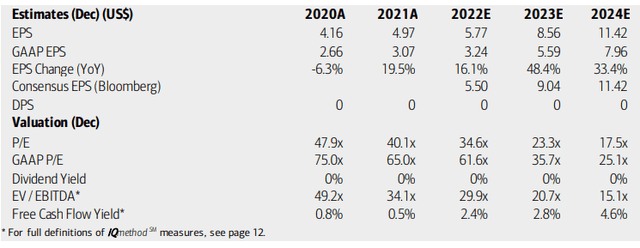

On valuation, analysts at BofA see earnings growing sharply next year after a solid 2022. EPS growth should then remain high through 2024. The Bloomberg consensus forecast is about on par with BofA’s outlook. Still, both the operating and GAAP P/Es are very high and SEDG’s EV/EBITDA multiple is extremely rich while free cash flow is low.

A high earnings multiple and strong per-share profit growth lead me to check the forward PEG ratio. Right now, it stands at just 1.34 – below its 5-year average, according to Seeking Alpha. So, the valuation looks fair to me here.

SolarEdge: Earnings, Valuation, Free Cash Flow Forecasts

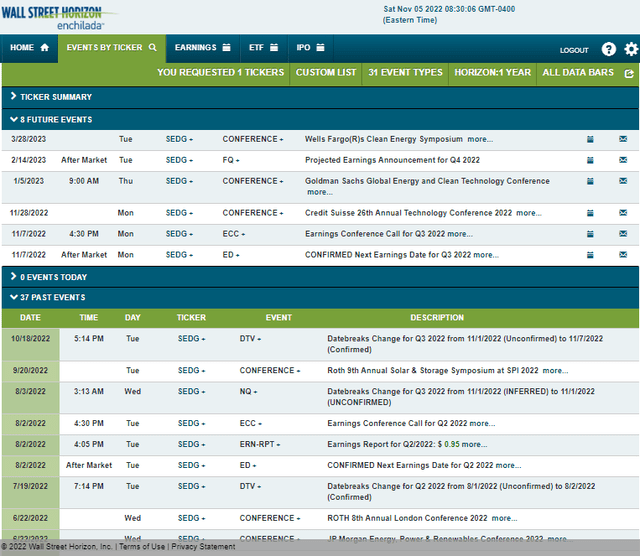

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2022 earnings date of Monday, November 7 AMC with a conference call immediately after results hit the tape. You can listen live here.

Volatility catalysts do not end there, though. SolarEdge’s management team is expected to present at the Credit Suisse 26th Annual Technology Conference from November 28 through December 1. There are two other upcoming speaking engagements as well. Those events sometimes include new company and industry-moving information.

Corporate Event Calendar

The Options Angle

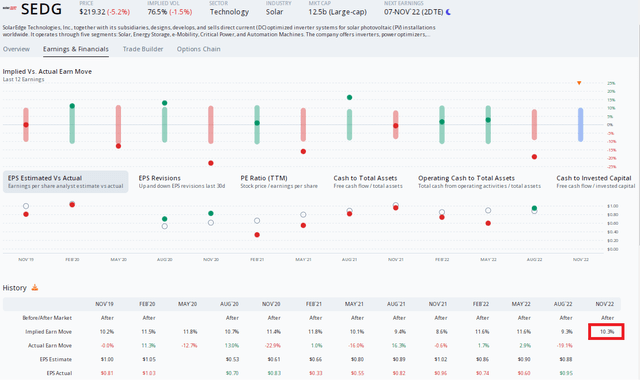

Digging into the earnings report, data from Option Research & Technology Services (ORATS) show an implied stock price move post-earnings of 10.3% using the nearest-expiring at-the-money straddle. That’s much lower than the massive 19% chance in SEDG shares after its August report.

Also, notice how its EPS beat rate history is poor – SEDG has missed on its bottom-line estimates in 6 of the past 7 reports. Overall, given large swings after some recent earnings reports, the more than 10% implied move looks about right in terms of premium pricing.

SEDG: A 10% Earnings-Related Stock Price Swing Priced In

The Technical Take

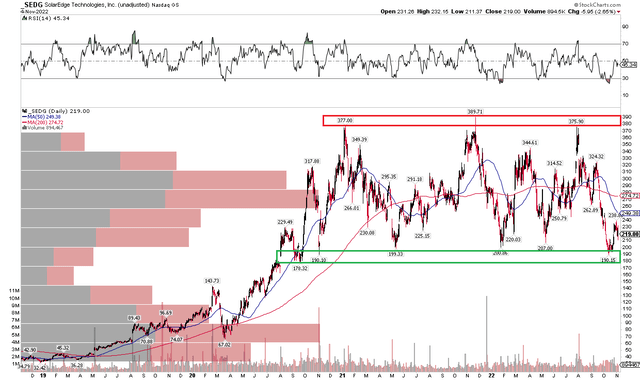

Revisiting the SEDG chart, the same general trading range persists. Back in July, I recommended monitoring $200 for support and the $375 to $390 range for resistance. That has generally held, although the stock did dip to $190 – marginally below its 2021 and 2022 lows last month. We should continue to wait for definitive signs that the trading range, now aged two years, has broken. I would buy shares near $200 and sell them near $350.

This time, however, there could be resistance starting near $265. Notice how the volume-by-price indicator on the left shows a large number of shares traded there up to $315.

Overall, if we see an earnings dip to near $200, I’d buy shares with a stop under $190. But the stock remains just a ‘hold’ technically.

SEDG: Clear Support & Resistance Zones

The Bottom Line

SolarEdge is expected to see volatility after earnings results are posted Monday night. Its valuation looks fair, but significant macro and company-specific risks remain. Moreover, the technical picture displays just a trendless choppy range with no momentum. I continue to have a hold on this company.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.