The S&P 500 crossed its 200-day SMA for the 173rd time since 2000 and the performance for this “signal” is not that great. Buying and selling the 200-day cross produced a lower return than buy and hold. This cross, however, did manage to curtail the drawdowns. Chartists can improve performance by taking it a little slower and adding a signal filter. We will look at some chart signals first and then quantify performance for these signals.

The chart below shows the S&P 500 with crosses of the 200-day SMA highlighted in blue. The indicator window shows the percentage difference between the close and the 200-day SMA. The indicator turns green with a close above the 200-day and red with a close below. So far this year the S&P 500 crossed the 200-day SMA twelve times. And there were 22 crosses since 2020. Talk about whiplash.

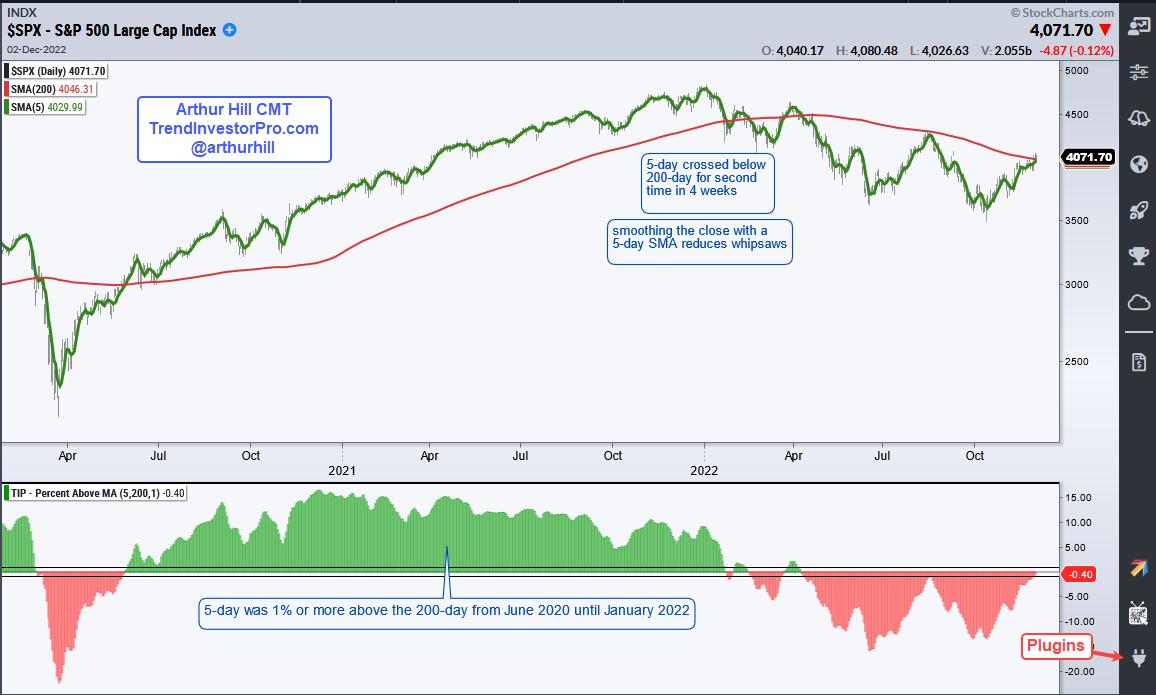

Chartists, and cowboys, can improve performance by slowing down a little and smoothing the close with a 5-day SMA. The next chart shows the 5-day SMA in green and the 200-day in red. Note that the 5-day SMA crossed the 200-day SMA just seven times since 2020. Five crosses occurred this year, which shows just how noisy it’s been in 2022.

The indicator window shows the percentage difference between the 5 and 200 day SMAs, and the crosses. Notice that I added lines at +1% and -1% as a signal filter. A bull signal triggers when the 5-day is at least 1% above the 200-day and a bear signal triggers when the 5-day is at least 1% below the 200-day. This filter further reduced whipsaws and improved performance. This indicator is part of the TIP Indicator Edge Plugin for StockCharts ACP.

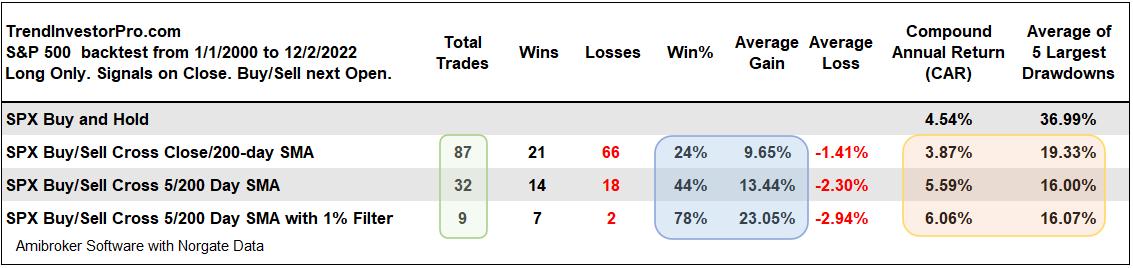

Now let’s quantify these signals. The table below shows backtest results for buy-and-hold, the 200-day cross, 5/200 day cross and the 5/200 day cross with a 1% filter. Buy-and-hold produced a Compound Annual Return (CAR) of 4.54% since 2000 and the average drawdown was 37%. The drawdown is the decline from peak to trough in portfolio equity.

Notice that the number of trades decreased as I smoothed the close with a 5-day SMA and then added a 1% signal filter (blue shading). Each step increased the Win% and Average Gain. The Compound Annual Return for the 200-day cross (3.87%) was lower than buy-and-hold because of all the whipsaws. The 5/200 cross outperformed buy-and-hold with a lower average drawdown and the 1% filter increased the return with a small increase in the drawdown (orang shading).

The takeaway here: not so fast with crosses of the 200-day SMA. Take a step back by smoothing the close with a 5-day SMA and adding a 1% filter for signals. This will not eliminate whispaws, but it will reduce them and help with broad market timing. The S&P 500 provides an important clue to the overall health of the stock market and we should pay attention.

TrendInvestorPro tracks Trend Composite signals for the 274 ETFs in our MasterList and ranks these ETFs according to price performance. Our reports and videos highlight chart setups with dozens of ETFs featured each week. Click here for immediate access.

The Trend Composite, Momentum Composite, ATR Trailing Stop and eight other indicators are part of the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Click here to learn more and take your analysis process to the next level.

—————————————