[ad_1]

Tesla, Nasdaq 100, Fed, Illiquidity – Asia Pacific Market Open

- Tesla’s market capitalization no longer towers over its competition

- Nasdaq 100 sank as Tesla plunged 11.41%, Treasury yields soared

- Be wary of volatility as holidays make for thin trading conditions

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

Asia-Pacific Market Briefing – Nasdaq 100 Sinks With Tesla as Treasury Yields Soar

Volatility roared back to life as risk aversion struck Wall Street in the first trading session after the Christmas holiday break. This is in line with historical performance in the days leading into and after the holiday since 1990. The tech-heavy Nasdaq 100 sank about 1.4 percent, with the S&P 500 falling about 0.4%. Meanwhile, the blue-chip-oriented Dow Jones was left mostly unchanged.

Clearly, tech stocks were disproportionately impacted on Tuesday. A look at the market pricing of where the Federal Reserve might take interest rates ahead can explain this dynamic. Traders boosted rate hike projections across tenors since Thursday, with the most coming from the 2-year outlook. Treasury yields gained across the board, pushing the 10-year rate to its highest since the middle of November.

Meanwhile, Tesla’s stock was caught in the crossfire. While tech stocks were sinking, traders also had to deal with an announcement that Tesla is planning on reducing production at its Shanghai plant. That sparked concerns about demand despite China increasingly reversing its Covid-zero policy. The country announced that it will end quarantine for incoming travelers.

Tesla’s share price sank 11.41% on Tuesday in the worst drop since April 2022. This means that since the November 2021 peak, the stock has lost about 73% in value. No longer does its market capitalization tower over the combined total of its top 5 competitors like it used to – see chart below. While Tesla’s market cap sank 72%, its top 5 competitors declined about 31% since last year.

Tesla No Longer Towers Over Competition Like Before

Wednesday’s Asia Pacific Trading Session – Eyes on Risk Aversion

Wednesday’s Asia-Pacific trading session is lacking notable economic event risk. With the holidays still producing thin trading conditions, be mindful of volatility risk. Wall Street’s disappointing session is opening the door to further losses for APAC bourses. This is placing indices like the ASX 200, Nikkei 225 and Hang Seng Index at risk.

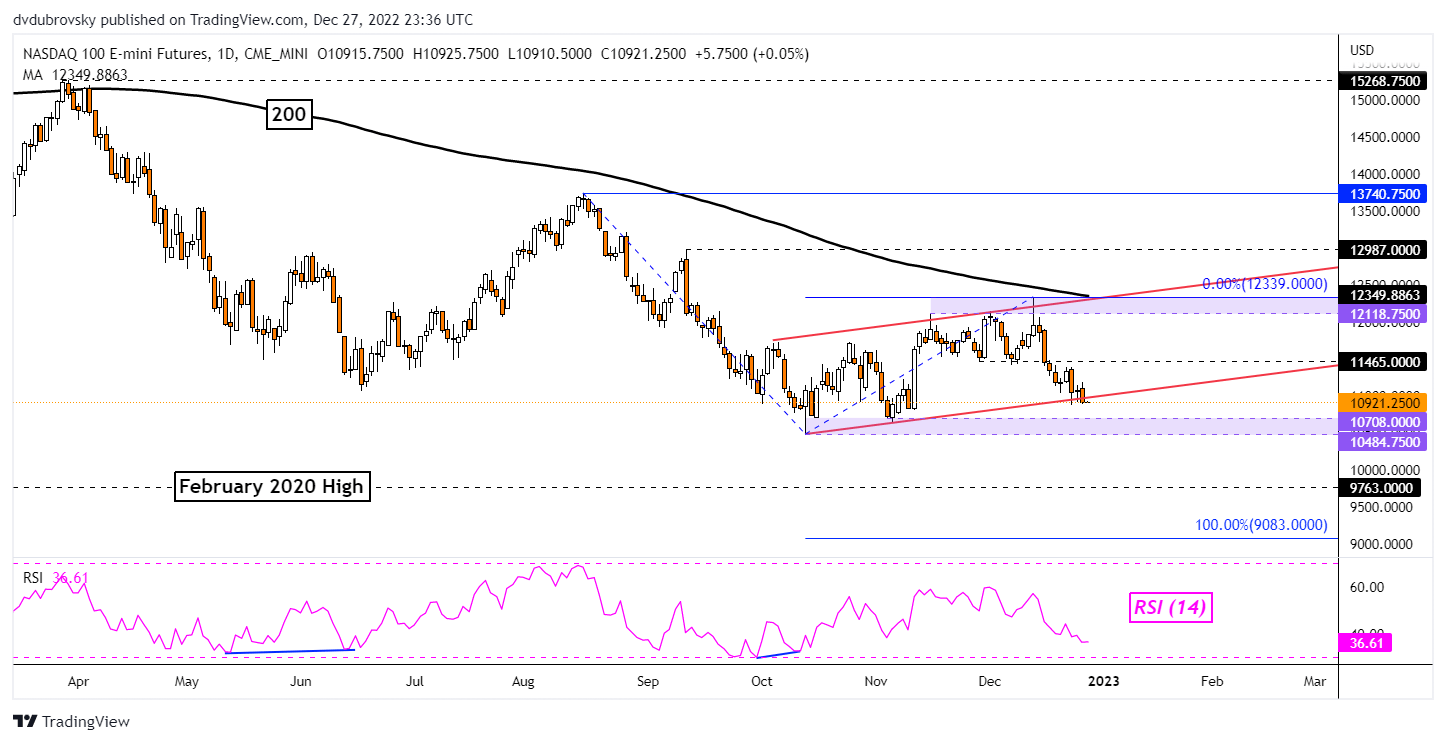

Nasdaq 100 Technical Analysis

On the daily chart, the Nasdaq 100 appears to have broken under a Bearish Flag chart formation. Confirmation is lacking at the time of publishing. Further downside progress risks opening the door to extending the dominant downtrend. That would place the focus on the 10484 – 10708 support zone. Meanwhile, the 200-day Simple Moving Average continues to maintain a downside bias.

Recommended by Daniel Dubrovsky

Get Your Free Top Trading Opportunities Forecast

Nasdaq 100 Daily Chart

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.