SPX Monitoring Purposes: Long SPX on 12/20/22 at 3821.62.

Long Term SPX Monitor Purposes: Neutral.

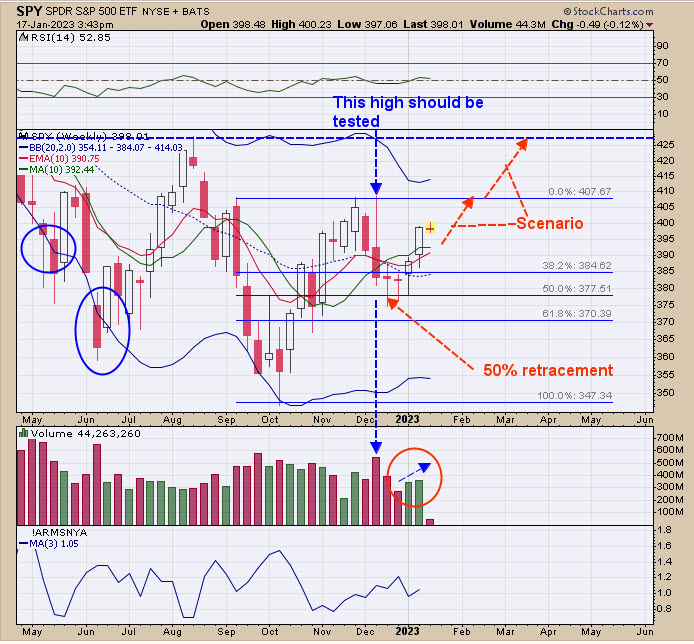

The week of the December 12 high had high volume (noted with blue arrow), and most high volume highs are tested. If the December 12 high is tested on 10% less volume, that will suggest resistance; if tested on higher volume, that will imply the market will move past the December 12 high. The SPY has only retraced 50% of the move up from the October low, which suggests the week of December 12 may be exceeded and go to the next higher high, the August high. The QQQ is now up seven days in a row as of today; not a lot of past examples of this, but the QQQ was higher 100% of the time within 5 days, with a 1% average move higher. If the QQQ moves higher, so will the SPY.

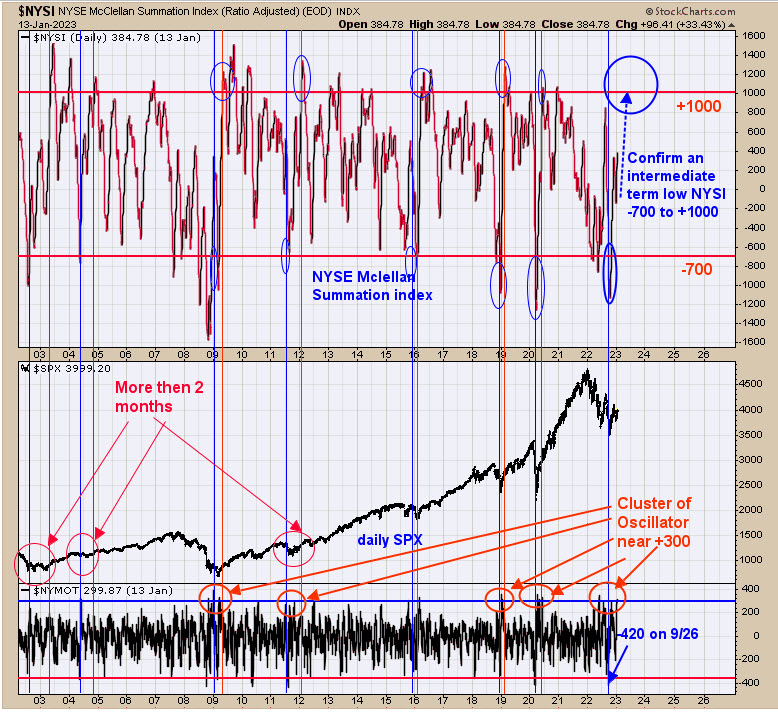

Bullish intermediate term rallies form when the NYSE McClellan Summation index falls below -700 and then rallies to +1000. The Summation index reached below -1000 in early October, and now we are looking for a +1000 to confirm an intermediate-term low. The NYSE Summation index closed Friday at +385 and now is only +615 points shy of the +1000 level; it looks promising that that level may be reached soon. The bottom window is the NYSE McClellan Oscillator. We circled in red the times when the Oscillator reached a cluster of +300. The current cluster of +300 readings is the largest bunch, circled in red, which suggests a high degree of accumulation.

Tim Ord,

Editor

www.ord-oracle.com. Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable; there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned above.