[ad_1]

US RETAIL SALES KEY POINTS:

- October U.S. retail sales grow by 1.3%, three tenths of a percent above expectations

- Strong data suggests that the U.S. consumer remains resilient despite falling real incomes and that the Fed has more work to do to slow demand

- The U.S. dollar remains in negative territory after the retail sales report crosses the wire

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

Most read: Bitcoin and Ethereum Crashed and Recovered Before. Will They Do It Again Now?

U.S. retail sales increased at a strong pace last month, easing concerns that elevated inflation and falling real incomes are squeezing household finances and curtailing consumption, a sign that the American consumer staying power is not yet breaking.

According to the U.S. Census Bureau, Advance Monthly Sales for Retail and Food Services grew by a robust 1.3% in October versus 1.0% expected, after flatlining in September, with gains driven by a jump in motor vehicle dealers (+1.3%), food services & drinking places (+1.6%) and gasoline stations (+4.1%) receipts. Stripping away autos, the value of retail purchases also surprised to the upside, clocking in at 1.3% compared to a forecast of 0.4%.

RETAIL SALES DATA AT A GLANCE

Source: DailyFX Economic Calendar

Goods inflation advanced 0.5% in October, so today’s headline figure is softer in real terms, but still strong enough to suggest that spending is holding up very well heading into the holidays season, a situation that can bolster fourth-quarter gross domestic product.

While sturdy spending would normally be considered a blessing for the economy, it can be counterproductive in the current environment, insofar as it is indicative of resilient demand, the very thing the Federal Reserve is trying to rein in through tighter financial conditions in the fight to restore price stability.

Looking ahead, traders should continue to monitor incoming data to better assess the outlook and the path of monetary policy. Although the Federal Reserve has indicated that it may soon downshift the pace of interest rate hikes, policymakers would likely want to see weaker macroeconomic variables to press ahead with this strategy.

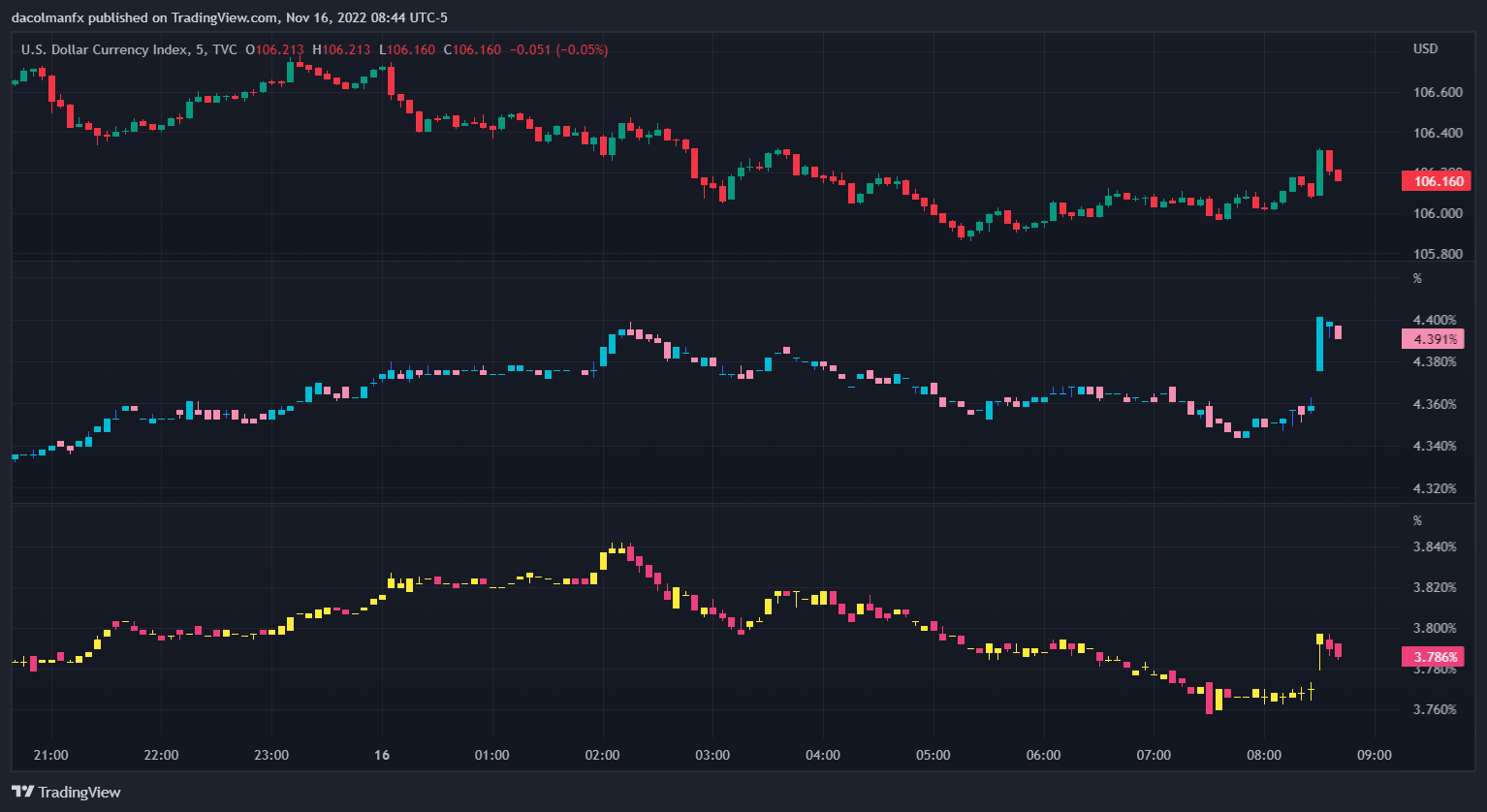

Immediately after the retail sales report was released, U.S. treasury yields edged slightly higher, but the move wasn’t enough to spark a full reversal in the U.S. dollar, which at the time of writing is sliding 0.35% (DXY) as traders remain convinced the Fed will soon adopt a less hawkish stance. In any case, the greenback could resume its recovery soon if macro data keeps surprising to the upside.

Click the link below to download the fourth-quarter U.S dollar forecast. It is free!

Recommended by Diego Colman

Get Your Free USD Forecast

Source: TradingView

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Diego Colman, Market Strategist for DailyFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.