[ad_1]

Japanese Yen Talking Points

USD/JPY trades to a fresh monthly low (145.31) as it fails to retain the advance following the Federal Reserve interest rate decision, and the exchange rate may face a further decline over the coming days as it fails to defend the opening range for November.

Recommended by David Song

Get Your Free JPY Forecast

USD/JPY Outlook Mired by Failure to Defend Monthly Opening Range

USD/JPY extends the series of lower highs and lows from last week amid the recent weakness in Treasury yields, and the exchange rate may face a larger correction over the coming days as the 261K rise in US Non-Farm Payrolls (NFP) does little to boost speculation for another 75bp Federal Reserve rate hike.

Source: CME

According to the CME FedWatch Tool, market participants are pricing a greater than 50% chance for a 50bp rate hike in December, and it remains to be seen if the Federal Open Market Committee (FOMC) will shift its approach at its last meeting for 2022 as Chairman Jerome Powell reiterates that at some point, “it will become appropriate to slow the pace of increases, as we approach the level of interest rates that will be sufficiently restrictive to bring inflation down to our 2 percent goal.”

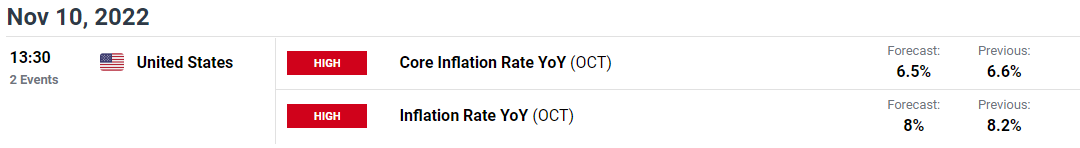

Until then, USD/JPY may face a larger correction as it appears to be reversing course following the failed attempt to test the July 1990 high (152.25), and fresh data prints coming out of the US may keep the exchange rate under pressure as the Consumer Price Index (CPI) is anticipated to show slowing inflation.

The update from the Bureau of Labor Statistics (BLS) is anticipated to show both the headline and core US CPI narrowing in October, and signs of easing price pressures may drag on USD/JPY as it puts pressure on the Federal Open Market Committee (FOMC) to winddown the hiking-cycle.

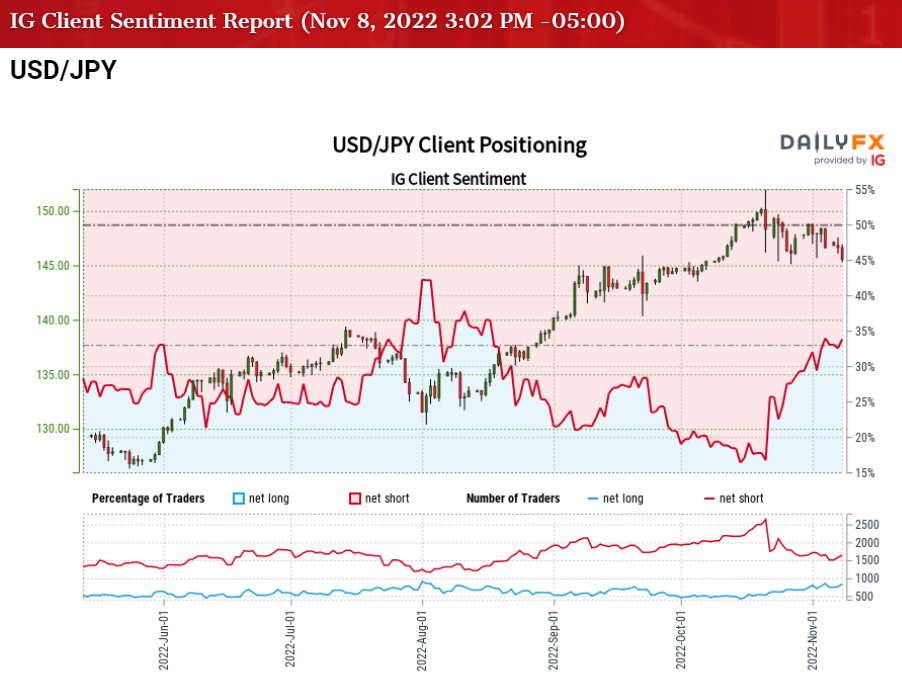

In turn, USD/JPY may no longer respond to the positive slope in the 50-Day SMA (145.24) if it pushes below the moving average for the first time since August, while the tilt in retail sentiment looks poised to persist as traders have been net-short the pair for most of the year.

The IG Client Sentiment (IGCS) report shows 35.12% of traders are currently net-long USD/JPY, with the ratio of traders short to long standing at 1.85 to 1.

The number of traders net-long is 3.90% higher than yesterday and 18.66% higher from last week, while the number of traders net-short is 3.49% lower than yesterday and 6.86% lower from last week. The jump in net-long interest has helped to alleviate the crowding behavior as 31.89% of traders were net-long USD/JPY last week, while the decline in net-short position comes as the exchange rate trades to a fresh monthly low (145.31).

With that said, a slowdown in the US CPI may lead to a further decline in USD/JPY should the update boost bets for a smaller Fed rate hike, but lack of momentum to push below the moving average may keep the exchange rate within the October range as the indicator continues to reflect a positive slope.

Introduction to Technical Analysis

Market Sentiment

Recommended by David Song

USD/JPY Rate Daily Chart

Source: Trading View

- USD/JPY trades to a fresh monthly low (145.31) as it extends the series of lower highs and lows from last week, and the exchange rate may no longer respond to the positive slope in the 50-Day SMA (145.24) if it pushes below the moving average for the first time since August.

- A break/close below 144.10 (100% expansion) may push USD/JPY towards the October low (143.53), with a move below the 143.00 (423.6% expansion) handle bringing the 141.70 (161.8% expansion) area back on the radar.

- However, USD/JPY may continue to track the October range if it manages to hold above the moving average, with a move above the August 1998 high (147.67) bringing the monthly high (148.83) on the radar.

Trading Strategies and Risk Management

Becoming a Better Trader

Recommended by David Song

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.