[ad_1]

memoriesarecaptured/iStock Editorial via Getty Images

Last year in October 2021, Valvoline Inc. (NYSE:VVV) announced its plans to separate its two business units, Retail Services and Global Products, to better position the group for growth and a more deliberate capital allocation process. The Retail Services, being the larger contributor to the company revenues and EBITDA with a strong brand presence in the North America, seemed to be the more likely choice for the management to monetize the Global Products business and turn the group into a Retail Services pure play. According to the latest company brief, the expected use of proceeds is: majority for shareholder returns, remainder for debt reduction, including 2030 bonds, and reinvestment.

Valvoline – Investor Presentation – 2Q 2022 Valvoline – Investor Presentation – 2Q 2022

Aramco’s interest in the Global Products was reported in May ’22 by WSJ. It follows their entry into motor oil business through the Orizon brand that was launched in December last year catering to the domestic market. The acquisition of the Valvoline brand marks the entry of the oil giant into the global lubricants club, which has all the other major oil players competing for market share.

For Valvoline, it is a synthetic sale and leaseback of the lubricants business, as the company would continue to procure the products from its divested business to service its customers. However, it is exiting a business line which has a discomforting exposure to the volatility in gross margins and which cannot be mitigated easily without executing a successful and costly backward integration. As a result, the company does not have the luxury of competitive prices for the raw materials and is also exposed to the supply chain related challenges.

Through this sale, the risk is essentially being disposed of to Aramco, which can manage it relatively easily, given its presence across the entire value chain in downstream segment. This sale also ties up both parties through the long-term product supply agreement, which should mitigate the supply side risk for Valvoline and revenue risks for Aramco.

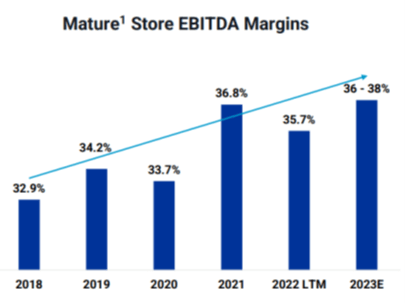

On the other hand, the Retail Services business is enjoying a very comfortable market position and is poised to grow even further. For the fiscal year 2021, the company recorded “a rate of more than 50 oil changes per day across the system, significantly outperforming the industry average, which is in the low 30s.” This would encourage any management to allocate more resources towards this side of the business, where they hold strong competitive advantage against other market participants.

Valvoline is largely comfortable with its debt position due to maturities having been extended to the years 2030-2031. The company was very prudent in managing the debt issuance, and currently 87% of the outstanding borrowings had fixed rates (Source: Fiscal 2021 – 10K Filing). The net sale proceeds of $2.25 billion are intended by the management to pay a good dividend (cash and/or share buyback), retire long-dated debt (2030). It also plans to increase market share in the retail services through opening new locations and expanding the existing facilities. After all, the company boasts of the fiscal 2021 as 15th consecutive year for system-wide same-store-sales having added another 132 stores.

For the buyer, Saudi Aramco (ARMCO), it allows them to get a better foothold in the lubricants industry, which already has the major global players competing through their strong brand names. According to the last 10K filing (Fiscal 2021), Valvoline currently ranks as the number three passenger car motor oil brand in the U.S. DIY market by volume. The long-term product supply agreement to be signed by both parties would also set a volumetric floor for the buyer. If Aramco could improve the product pricing, given its natural cost advantage, and inject enough capital to expand the footprint globally, it might be able to gain more market share. There’s a strong possibility of adding at least US$400-500m in annual sales through the EMEA region push that Aramco can easily manage for the next couple of years. With the tailwinds of cost advantage and location proximity, the margins should improve even further, expediting the payback period.

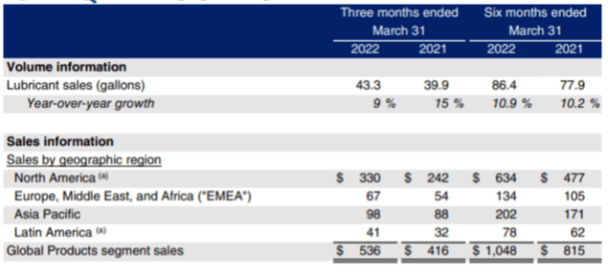

Valvoline – Investor Presentation 2Q 2022

The EBITDA generated by the Global Products segment last year was US$327m, which was achieved on the back of 160.9m gallons sold by the company in 2021 (Projection 2022 – 169m gallons). The business generated over US$200m in discretionary free cash flow, implying a reasonable valuation multiple, despite pressure on margins during the year 2021. The improvement in the key performance indicators should unlock the value even further for Aramco with strong monetary backing and relatively better distribution channels available to them.

The Valvoline shareholders are the most obvious beneficiaries on two fronts: 1) potential one-time high dividend; and 2) company focus reoriented towards a less volatile business segment. The higher dividend would certainly be a relief in the inflationary environment along with a continued shareholding in a business that is free to focus on the core competency with a key risk mitigated.

It is unusual to find such a transaction where the stakeholders are poised to benefit in their respective areas. The spanner that could wreck it for Valvoline and Aramco, though, is poor business performance with management being unable to take advantage of the strong hand both have been offered. However, the shareholders are able to at least front load their returns with the cream to be received as well, in case the Retail Services business continues on its current growth trajectory.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.