[ad_1]

Pgiam/iStock via Getty Images

We have traded Zoom Video Communications (NASDAQ:ZM) stock several times, both long and short. It is one of the tickers that is phenomenal for traders like us but has been a nightmare for investors. The thing is, when trading, you have to play on your belly. You set your stops, your targets, and stick to them. That is that. Disciplined trading. That is why we create winners. Then there is investing, and frankly, this is what your trading should help with. Your gains should feed your long-term investments. That is what we teach. So how can we trade Zoom here? Well we had a long bias on the name the last few weeks, but the just reported earnings left something to be desired. We think the stock struggles for a bit, then starts to get some bids after Labor Day. That is our read here. The markets are giving some of the bear market rally back, and this rally saw the tech names rally hard. Zoom was not alone. So we think zoom has some downside ahead the next few weeks, then catches some bids. We are buyers in the low $80s, and we do think the stock can get there. We see Zoom as a wonderful trading stock, both long and short just due to the swings. As shares fall again, it was a disaster reaction but it was actually a record quarter. We think that the weakness can be bought for a swing higher, but let it fall.

Discussion

Look, everyone knows what the company does. Telecommuting during the pandemic was made possible by Zoom and a few other companies. There is a lot of competition now, and sentiment has been subpar for months. With what we are seeing in public schools and more companies pushing back full returns to the office, Zoom is still winning, though guidance may be spooking the Street:

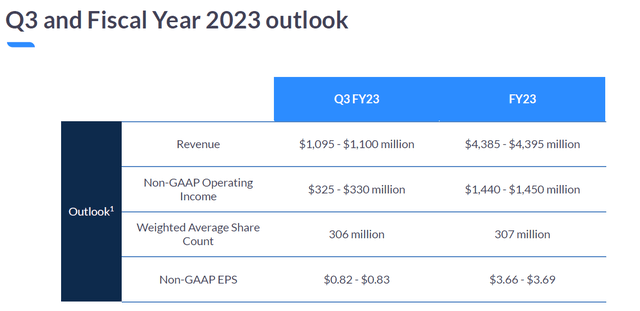

Zoom Q2 slides

The most important reason the stock is falling we think, is that guidance, while about what is expected, is, well, about what was expected. At this valuation, despite the stock being down tremendously, it is still priced for some really good beat and raises. Revenue growth has come down tremendously as the pandemic has normalized. The company ‘only’ managed 8% growth in revenue. Folks, the world is open again. This is growth, but not that great, and missed consensus slightly. The guidance was also weak. Q3 revenue is expected to be between $1.095 billion and $1.100 billion vs. consensus of $1.15B and adjusted income from operations is expected to be between $325.0 million and $330.0 million. Adjusted EPS is expected to be between $0.82 and $0.83 vs. consensus of $0.92. Not good at all.

But there is still some growth. With EPS of $3.675 expected for the year, there is some value if you can buy this in the mid $80s. At $85 this is 23X FWD EPS. That is not that bad for a massive growth tech. Remember this once was only a revenue growth company. Things have changed. As we move forward you need to be aware that Zoom Communications is continuing major adds and upsells and have secured big deals from major corporations which will translate to recurring revenue.

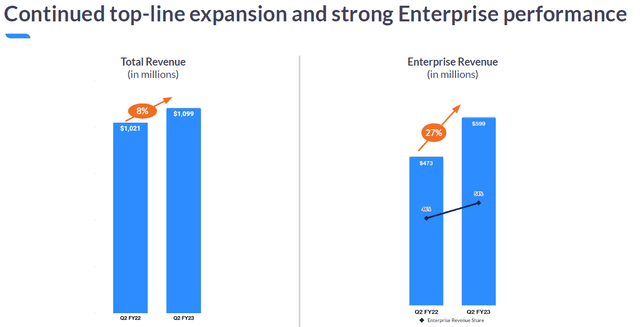

The company has a good mix of small and large customers. So, total revenue for the Q2 was $1.1 billion, up 8% year over year, as mentioned, and is a record:

Zoom Q2 slides

GAAP income from operations was a strong $121.7 million, down Q2 last year from $294.6 million in Q2. After making some adjustments for stock compensation and other special expenses, adjusted income from operations was $393.7 million, still down from $424.7 million last year. This is a problem and a reason the stock is so much different now than it was in 2020 and even 2021.

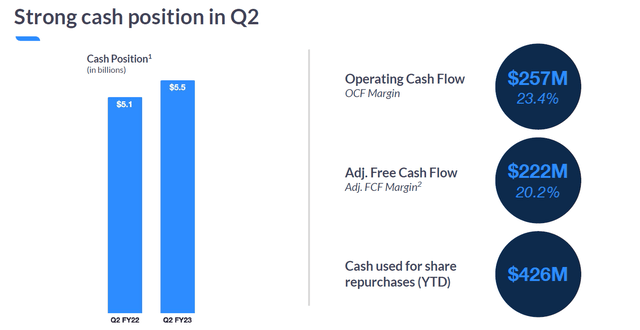

Making matters worse, cash flows are also down:

Zoom Q2 slides

So as you can see, this is not just a revenue growth company anymore, they are earnings positive and cash flow positive, but the cash flows are down big. It does not matter “why”, facts are facts and if you want this stock rallying they need to do better. No sugar coating it. They are generating real and meaningful cash flows, but they were down more than 50% from a year ago.

The fact is growth is normalizing and the market has continued to walk this stock lower and lower. There was a nice rebound in recent weeks, but not nearly enough to offset pain. Of course, the stock is still pricey, but we are getting a bit ridiculous here now just 23X FWD EPS. It is earnings positive. Net income was $323.5 million, or $1.05 per share. This was well down from Q2 2021. A year ago, net income was $415.1 million, or $1.36 per share. Despite the fall from last year the earnings of $1.05 were an upside surprise, beating estimates by $0.12.

But what we are looking at here is not just top and bottom line, which yes that is what investors want, obviously, a share in the company’s fiscal growth, but we are bullish because of the customer trends. This tells us revenue will be more resilient. We are talking 3,116 customers contributing more than $100,000 in trailing 12 months revenue, which is up approximately 37% from the same quarter last fiscal year.

Take home

Make no mistake, the extreme growth may be done but the company is emerging as one that is here to stay in our lives, and in the lives of businesses. But this is a trader’s stock. This bad report and tough guidance will knock the stock back. We like a buy in the low- to mid-$80s. Let the stock fall then do some buying.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.