[ad_1]

MicroStockHub/iStock via Getty Images

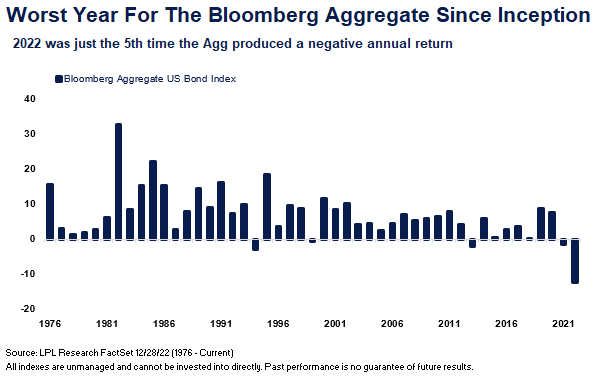

With one trading day left in 2022, the US bond market is set to record a deep loss for the year.

LPL Research notes that a broad measure of US fixed income is suffering an unusually stark year of red ink – the worst on record for calendar-year results, based on market history since the mid-1970s.

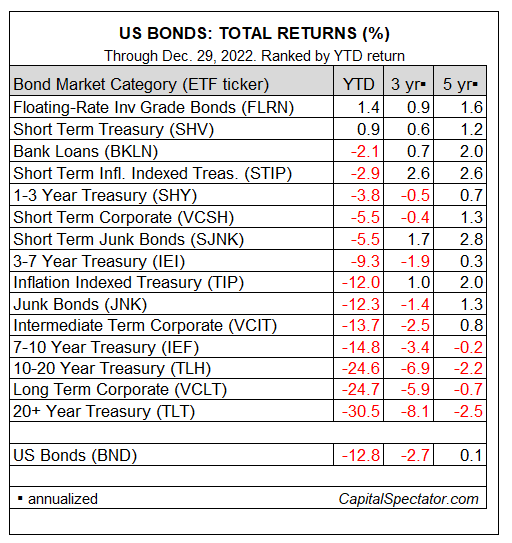

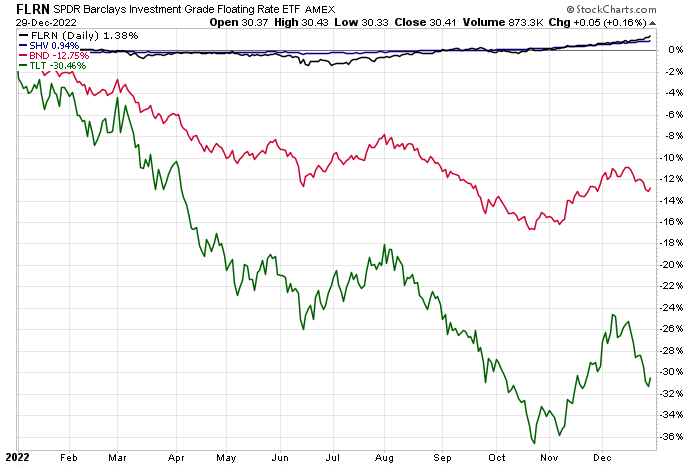

Looking at bonds through a more granular lens, based on ETFs through Dec. 29, isn’t pretty either. The hardest hit slice of fixed income in 2022: long-term Treasuries (TLT), a market that’s down 30%-plus this year, or more than double the broad market’s loss via Vanguard Total Bond Market Index Fund (BND).

Two market niches stand out as havens from the storm this year: floating-rate bonds (FLRN) and cash (SHV). These two subsets of fixed income delivered sharply divergent upside results on a relative basis compared with the broad market (BND) and long-term Treasuries (TLT).

By some accounts, the worst for the bond market may be over. After a horrific year for bonds overall, the decline in prices is accompanied by a commensurate rise in yields, which looks relatively attractive, says a wealth manager.

“Bond yields are giving you a real return now, above inflation,” says Patrick Armstrong, chief investment officer at Plurimi Wealth LLP. “So it’s a reasonable place to put capital now, whereas at the start of this year it didn’t make much sense. It was hard to expect a return above inflation where yields were.”

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.