[ad_1]

Bartolome Ozonas

The following 2 histograms and table provide perspectives on stock and bond performance in 2022.

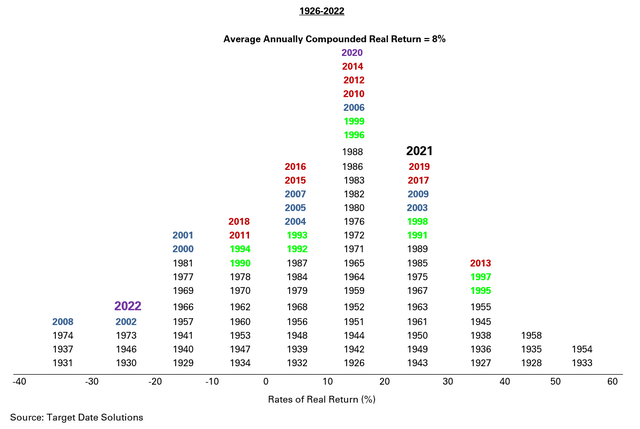

Stocks, as measured by the S&P 500, lost 18.6% which is a 25% real (inflation adjusted) loss, placing 2022 in the bottom decile of stock returns over the past 97 years

Dow Jones S&P and Target Date Solutions

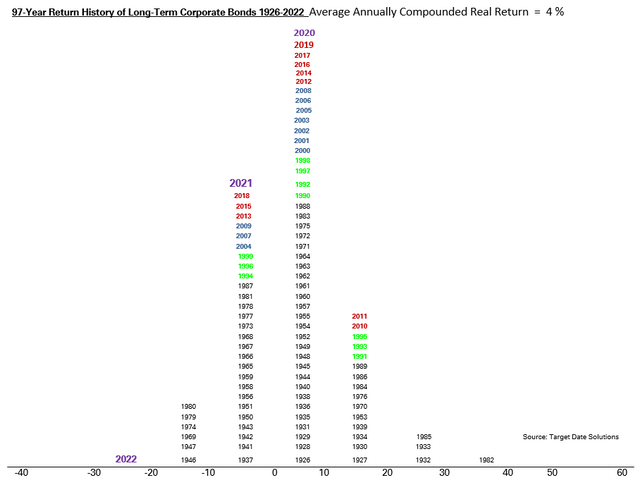

Bonds, as measured by the Vanguard Total Bond Index, lost 13.7%. this is -20.3% inflation adjusted, making it the worst annual bond return in the past 97 years.

Vanguard and Target Date Solutions

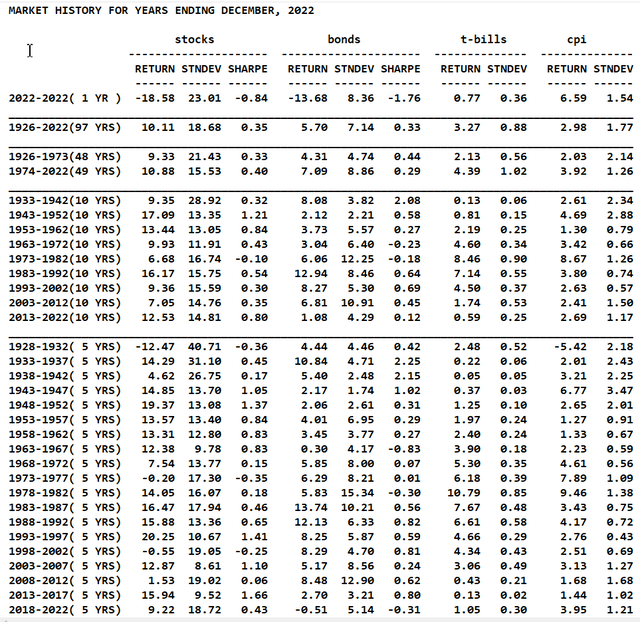

The following table shows stock, bond, T-bill and inflation for the full 97 years and broken out by quinquennial and decade. The current quinquennial and decade have been the worst for bonds, losing 0.5% per year over the past 5 years and earning only 1% per year over the past decade. Bond losses in 2022 were the worst over the past 97 years.

Conclusion

It’s official. Bond losses in 2022 are the worst in our 97-year history. Yet the 10-year government bond yield is only 4%. Historically bonds have yielded 3% above inflation, which is 10% in a 7% inflationary environment.

Bond losses could conceivably continue into 2023. The worst might not be over.

Similarly, stock losses reflect a gradual relief in the superbubble that has built up over the past 13 years. Rising interest rates will generate further stock price declines.

We are in a regression toward the mean, but the mean has not yet been reached.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.