[ad_1]

ShyLama Productions/iStock via Getty Images

Introduction

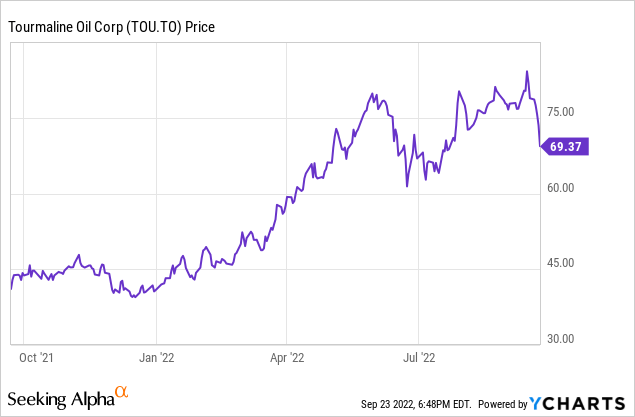

Tourmaline Oil (TSX:TOU:CA) (OTCPK:TRMLF) is one of Canada’s largest natural gas producers. Although the total output exceeds in excess of half a million barrels of oil-equivalent per day and despite having “oil” in its company name, almost 80% of its oil-equivalent output actually consists of natural gas so we should really look at Tourmaline from the natural gas angle.

Although its US listing is relatively liquid with an average volume of almost 50,000 shares per day (for a monetary value of US$2.5M per day), the Canadian listing is obviously the most liquid one as the average daily volume in Canada exceeds 2.3 million shares. As Tourmaline reports its financial results and has its most liquid listing in CAD, I will use the Canadian Dollar as base currency throughout this article. The current market capitalization is approximately C$23B.

The first half of the year was strong thanks to the high natural gas price

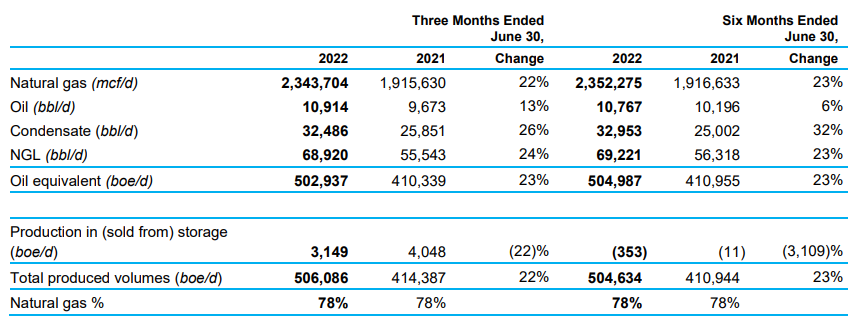

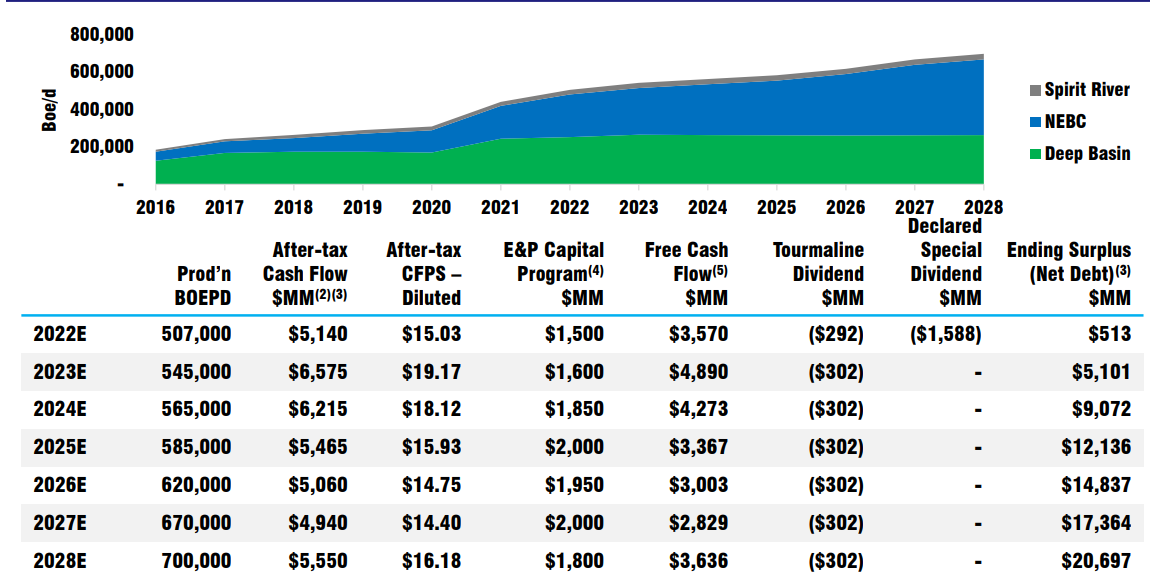

During the second quarter of this year, Tourmaline produced just over 500,000 barrels of oil-equivalent per day. That’s a small decrease compared to the production rate in the first quarter of the year, but a substantial 23% increase vs. the production rate in the same quarter last year as newly acquired assets and properties started to contribute.

Tourmaline Oil Investor Relations

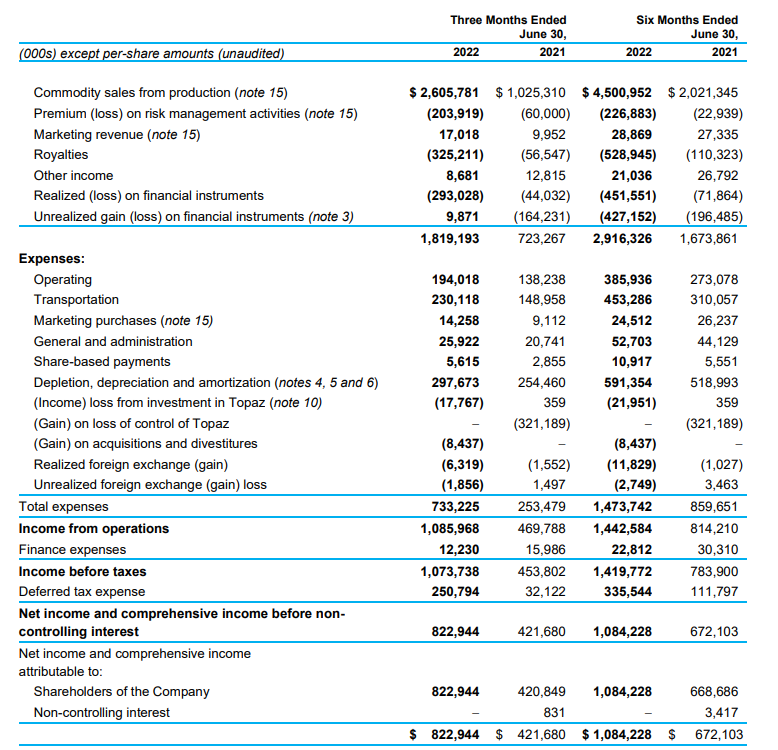

The total revenue in the second quarter came in at C$2.6B, and after taking care of the royalty payments and the hedging losses, the net revenue was C$1.82B. Tourmaline has a very low operating cost as the total amount spent on actually operating the assets was just over C$730M. Approximately 40% of the operating expenses consisted of depletion and depreciation expenses.

Tourmaline Oil Investor Relations

Despite the almost C$300M in hedging losses, Tourmaline was still able to report a pre-tax income of C$1.07B and a net income of C$823M which resulted in an EPS of C$2.46.

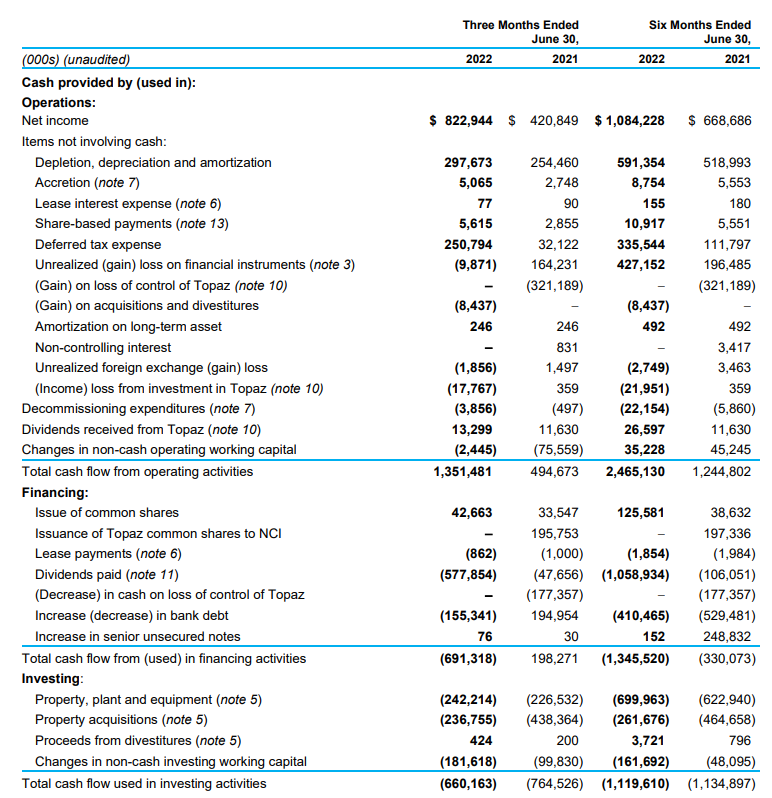

Looking at the cash flow statements, Tourmaline added about C$10M in unrealized gains on the hedge book back to the operating cash flow. Additionally, the company won’t have to pay any taxes in the near-term future as it is using the tax pools available to Tourmaline. This caused the reported operating cash flow to jump to C$1.35B.

Tourmaline Oil Investor Relations

The total capex during the quarter was just C$242M, which means Tourmaline generated about C$1.1B in free cash flow. The total free cash flow in the entire first semester was approximately C$1.7B thanks to the ability to defer taxes. If Tourmaline would have to pay taxes, the adjusted free cash flow would have been approximately C$1.35B. The cash flow statement clearly shows Tourmaline is generating more than enough cash flow to cover its anticipated annual capex which should push the production rate to 700,000 barrels of oil-equivalent per day by 2028.

Tourmaline Oil Investor Relations

While we still have an entire quarter to go in 2022, Tourmaline already provided a 2023 guidance

Earlier this month, Tourmaline already provided an update for 2023. The company expects to end 2023 with a total export of 925 mmcf per day including 140 mmcf per day expose to the JKM pricing (LNG prices in Asia) starting on Jan. 1, 2023. For the entire financial year, Tourmaline expects to produce 545,000 barrels of oil-equivalent per day which would be an increase of approximately 7% compared to the guidance of 507,000 barrels of oil-equivalent per day Tourmaline expects to produce this year.

The company also started hedging its output for 2023 and although I know a lot of oil and gas investors don’t like hedges, I think it’s a smart move to hedge a portion of the expected production to protect the cash flows. Tourmaline already hedged about 26% of its anticipated natural gas production at a fixed price of C$5.26 per mcf. A solid move as this will help the company to increase the visibility on its cash flows for 2023. Additionally, a portion of the production that will be correlated to the JKM price was hedged as well, at a price of US$50.46 per mmbtu.

Based on all these elements, in combination with strip pricing for the remaining output, Tourmaline now expects to generate about C$6.6B in operating cash flow in 2023. That’s a 28% increase compared to the previous guidance of C$5.14B. Considering the company plans to spend about C$1.6B in capex next year, Tourmaline is implicitly guiding for a C$5B free cash flow result.

Investment thesis

The third quarter may be a slightly disappointing for Tourmaline as the production will be lower than expected as the company voluntarily reduced its output while the Alberta/BC pipeline was down for maintenance. This shutdown had an immediate and substantial impact on the natural gas price in Canada as the AECO natural gas price was actually negative for several days in August. The lower production rate and lower spot prices likely means we shouldn’t expect too much from Tourmaline in Q3 but the cash flow will obviously remain very strong.

2023 already is shaping up to be very strong as the company is making the wise decision to hedge a portion of its production. Add the 7% production increase and Tourmaline remains one of the more important names on the North American natural gas sector.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.