[ad_1]

Leestat

Thesis

In our previous article on EQT Corporation (NYSE:EQT), we urged investors to sell and rotate their exposure, as we believe the price action suggested more pain was in store for investors who refuse to cut exposure.

Accordingly, EQT went on to stage another high in August 2022, as the market leveraged the energy crisis in Europe to draw in more dip buyers before digesting those gains. Notably, EQT has fallen more than 20% from its August highs through September.

Therefore, we believe providing a timely technical analysis update is necessary for investors looking to buy the recent pullback in EQT as it nears near-term oversold conditions.

Our analysis suggests that investors need to focus on the rejection of EQT’s August and September highs, which corresponded to similar rejection levels in June. Therefore, we believe it’s clear that EQT would likely continue to face significant resistance at those levels as we head closer to a global recession.

Investors buying into the structural growth drivers of EQT underpinning the world’s energy transition amid the current energy crisis need to consider whether the market has changed its focus.

Hence, we discuss why we urge investors considering adding positions to be extremely cautious about buying this dip.

Given the near-term oversold conditions for EQT, we revise our rating from Sell to Hold and urge investors looking to rotate exposure to wait for the potential relief rally.

EQT: From One Rejection To Three Denials

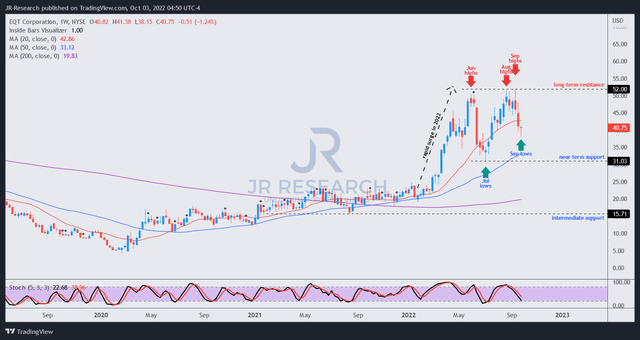

EQT price chart (weekly) (TradingView)

As seen above, EQT staged its first major top in June after the significant run-up in 2022 at its long-term resistance ($52). However, the subsequent steep collapse (down nearly 40% in three to four weeks) to form its June lows was expected to find support, given the extent and speed of decline.

Accordingly, EQT buyers went on the buying offensive through August, lifted by the worsening energy crisis in Europe. However, it reached peak optimism in August even as Russian President Vladimir Putin turned off Nord Stream’s gas flows entirely. Notably, EQT topped out at the same levels in June, increasing our conviction that a further rally from its August highs is increasingly unlikely.

Subsequently, EQT mounted another (its third and likely final) attempt to re-test July/August highs in September, but buyers were resolutely rejected (again) at the $52 resistance zone.

Therefore, we are confident that EQT’s buying momentum has already been decisively exhausted, with sellers waiting gleefully for buyers to revisit its long-term resistance before unleashing their sell orders.

So, where do we go from here?

EQT is likely at a near-term bottom, which could lead to a consolidation zone at the current levels, or even a relief rally, as the market looks to draw in dip buyers.

However, we urge investors to be extremely wary of buying the dip as a triple rejection at its long-term resistance indicates that the market is “unwilling” to push EQT further higher than $52.

So, unless you are a very nimble trader with highly robust risk management systems in executing a speculative long entry to capitalize on the current consolidation, we urge investors to stay on the sidelines.

EQT Is Being Configured For A Bigger Pullback

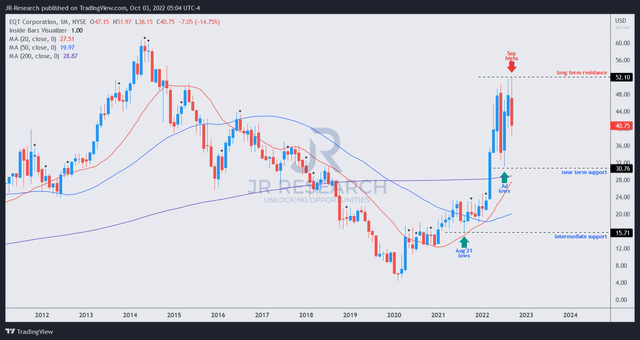

EQT price chart (monthly) (TradingView)

By zooming out to its long-term chart, we believe investors can glean why EQT remains precariously perched at its current levels.

The market has used the last three to four months to consolidate its gains in 2022, stanching further buying upside from June’s highs.

While we are increasingly confident that its long-term resistance would continue to reject further buying momentum, we aren’t ready to commit to a bottom yet.

Investors are urged to consider a potential re-test of its July lows if the market continues to digest EQT’s gains further. A decisive break of that low could inflict more pain on investors who chased its August momentum, with EQT potentially falling to a level between its intermediate support ($16) and near-term support ($31).

Hence, we believe the reward-to-risk profile is increasingly skewed to the downside at these levels and urge investors to be extremely cautious in adding exposure.

Given its near-term bottom, investors can consider using a potential short-term rally to cut more exposure moving ahead.

We revise our rating on EQT from Sell to Hold for now.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.