[ad_1]

JHVEPhoto/iStock Editorial via Getty Images

After the bell on Thursday, Intel Corporation (NASDAQ:INTC) released its Q2 earnings that were largely a disappointment across the board. Expectations were low going in, but in true Intel fashion, they managed to perform even worse.

Last month, management tried to set the table for these results by commenting on the tough macro environment the company has been facing along with the rise in competition from the likes of Advanced Micro Devices (AMD) and NVIDIA (NVDA), to name a few.

All the negativity and yet INTC still managed to outdo itself to the downside.

For Q2, the company reported total revenues of $15.32 billion compared to analysts’ average estimate of $17.92 billion, missing the street by nearly 15% or $2.6 billion. The revenue figure was a 17% decline year over year in that quarter on an adjusted basis.

In terms of EPS, Intel reported adjusted EPS of $0.29 vs Wall Street’s estimate of $0.70, another huge miss.

Looking at gross margins, those fell from 50.4% just a quarter ago to 36.5% in Q2 ’22.

Management has failed to live up to expectations and really meet any of its stated goals. In my opinion, CEO Pat Gelsinger is running out of time. In the press release, we got the typical response from Gelsinger:

This quarter’s results were below the standards we have set for the company and our shareholders. We must and will do better. The sudden and rapid decline in economic activity was the largest driver, but the shortfall also reflects our own execution issues.

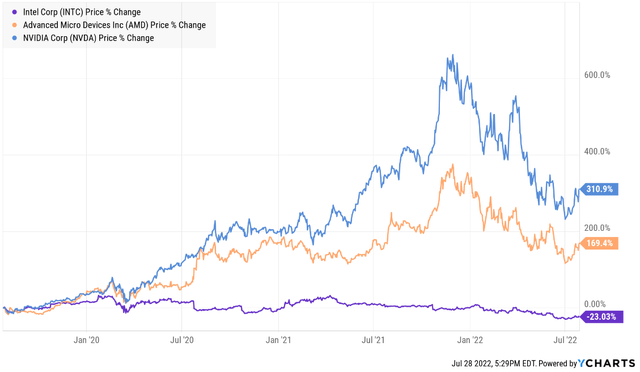

Over the past few years, we saw a boom from chip stocks, yet Intel has been unable to capitalize. Here is a look at the performance of AMD, NVDA, and INTC over the past three years:

Now the company finds itself in a supply chain mess and a slowing economy. Sales are falling, market share is reducing, and profitability is dropping like a rock.

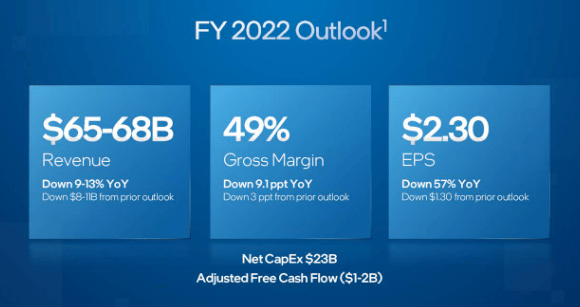

This comes from a once dominant chip player that had gross margins above 60%. Those have largely been cut in half this quarter, and the company had initially guided for the full year to be close to 51%. In the recent press release, management still believes they will hit gross margins between 51% and 53%.

After a dismal Q2, the company was left with no choice but to cut full-year guidance. The company now sees full-year adjusted earnings of $2.30 per share and revenue of $65 billion to $68 billion. This guidance is a move lower from a quarter ago in which management was expecting adjusted EPS of $3.60 per share on $76.0 billion in revenue. Analysts have lowered their full-year expectations to $3.42 per share in earnings and $74.3 billion in revenue.

INTC Q2 Investor Presentation

Where Do We Go From Here

It is clear as day that the company needs to get its act together, from the top down. This starts with execution on its investments. The company has been investing heavily in capex, which investors are banking on that coming through sooner rather than later.

These investments in capex do negatively impact cash burn, but so far through the first half of the year, the company is cash flow negative by “only” $437 million, which is not all that bad given the investments being made.

At the end of Q2 ’22, the company had $27.0 billion of cash on hand compared to $35.4 billion of debt on hand, moving the company into a net debt position.

Could this be the “Kitchen Sink” quarter for Intel? That could be possible meaning we could be near a bottom. When it comes to CFO David Zinsner, he believes we are near that point:

We do think we’re on the bottom.

AMD, NVIDIA, and even Apple (AAPL) appear to not only have passed INTC, but they are breaking away from it. All new Macs are being supported by Apple’s own proprietary chip M1/M2 that have been gaining rave reviews.

During the earnings call, management did note that they would be “cutting back” on spending due to the slowing economy and the slowing PC market.

Investor Takeaway

This was an extremely poor quarter for Intel and shares are being punished. However, the company has the ability to right the ship if this is in fact that “Kitchen Sink” quarter investors are hoping for. Get all the bad news out of the way, bring expectations down (again) and let’s start executing again.

After the cut in full year EPS guidance and with the stock price falling after hours, shares of INTC still look overvalued at over 13x current year earnings.

The stock appears to have more room to move lower before I consider taking a bite.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.