[ad_1]

Andrii Yalanskyi/iStock via Getty Images

We have seen this show before, and not too long ago. In early March, the state of the world looked pretty bad. Russia had just invaded Ukraine, inflation was showing itself to be anything but transitory, and the Fed was getting ready to raise rates for the first time since 2018 – not by the usual incremental bump of 0.25 percent but by a whopping 0.5 percent. Investors, seemingly, were desperate for anything that could be remotely construed as “good for stocks.” And so, upon the Fed’s rate hike announcement on March 16, a market that had been sputtering along sideways since hitting a year-to-date low on March 8 kicked into high gear. This rally finally petered out on March 29, but not until the S&P 500 had racked up an impressive trough-to-peak gain of 11.1 percent from that March 8 low.

There Must Be a Pony Out Back

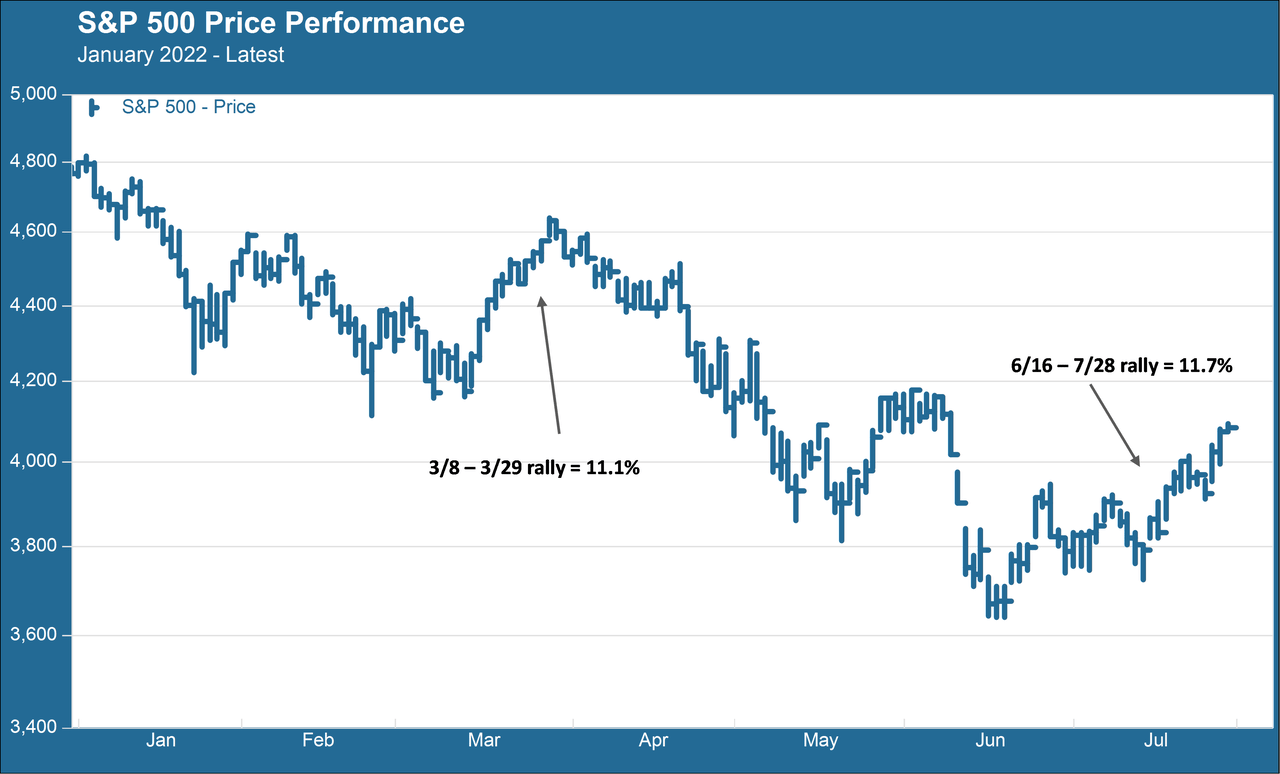

No doubt that old FOMO feeling kicked in for many punters during the latter days of that March rally and they put their chips on the table. Unfortunately for them, the subsequent reversal was a brutal fall of 20.1 percent from that March 29 high to the low point for the year so far on June 16. But never fear – if at first, you fail miserably, try and try again. Since hitting that low on June 16 stocks have rallied impressively once again, generating a price gain of 11.7 percent to the market close on July 28. The chart below shows the S&P 500 price trend year to date with the March and June-July rallies highlighted.

The vibes this time seem entirely familiar. When investors are burned out from losses they will take anything – any little green shoot real or imaginary – as good news. Good news is good news, unclear news is good news, bad news is good news. If there’s manure under the Christmas tree, there must be a pony out back. The Fed met again this week and, as widely expected, raised interest rates by 0.75 percent. Going into the Fed meeting, there had been a great deal of chatter in the market about a supposed “Fed pivot.” This is the idea that inflation will come more or less under control sometime between now and the end of the year, thus the Fed will start to slow down the pace of its rate hikes. Then, with growing signs of the economy slowing, the Fed will stop raising rates entirely next year and pivot back to a dovish sequence of rate cuts to encourage growth. The stock market lives and breathes for low interest rates, so this imagined pivot was enough to sustain the post-6/16 rally heading into the meeting this week.

Tune Out the Negative

During the press conference that followed the conclusion of the Fed’s policy meeting on Wednesday, Chair Jay Powell said absolutely nothing about a pivot. In fact, he was very clear that the best way to view Fed policy in 2023 would be to stick with the most recent set of Summary Economic Projections that came out a month earlier, after the June meeting. Those projections point to a continuation of rate hikes into 2023 on the assumption that the central bank will still be in the process of bringing down inflation. Powell was also crystal clear about the bank’s not wavering from this singular focus on inflation, regardless of the potential impact on growth. He noted – consistent with the opinion of pretty much every mainstream economist everywhere – that the current unemployment rate of 3.6 percent is highly likely to rise as the economy slows down. But things will be far worse, for far longer, if we can’t get prices under control.

Investors tuned out all of those points. What they focused on, practically to the exclusion of everything else, was Powell saying that at some point, as policy tightens, it would be appropriate to “slow the pace of increases” while they assess how the policy is affecting inflation and the economy. That single comment by itself, and irrespective of everything else Powell said, was enough to power the Nasdaq Composite to a four percent intraday gain.

Less than 24 hours later the report for second quarter GDP came out, and it showed a second straight month of negative real GDP growth (bear in mind that this is only a preliminary estimate and will be revised two more times). That inevitably sparked much chatter about inflation, since two consecutive negative quarters is often used as a thumbnail explanation for a recession (it is not an accurate explanation, however, and neither Powell himself nor most economists nor ourselves think we are actually in one right now). The GDP report, if anything, seemed to add fuel to the bulls. There must be a Fed pivot in there somewhere!

Beware the Greed Trap

Look, we are as pleased as anyone that equities have done as well as they have this month, after such a dismal start to the year. What you heard many times from us during that first half of the year was to beware the “fear trap” – don’t panic and dive for cover, because getting the timing right is diabolically hard and the risk of missing out on growth is significant. Now comes the other side of that warning – don’t fall into the “greed trap.” This is every bit as pernicious as the fear trap – as anyone who tried to play market timer during that eleven percent March rally learned. We believe there are likely to be many more bumps in the road ahead as we work through all the many risks and global uncertainties at play. We’ll take whatever gains we can get from the animal spirits currently at play, but we do not think this is the time to double down on hope and a prayer. Keep positioned for growth, but don’t lose sight of the further downside potential.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.