[ad_1]

PIKSEL/iStock via Getty Images

There are not too many ETFs that we are harshly critical of. Sure, most may not be designed to generate alpha, but they all seem to have a good target audience. ProShares Ultra VIX Short-Term Futures ETF (BATS:UVXY), on the other hand, takes a bad idea and makes it worse. According to UVXY’s website, the ETF takes on a leveraged position on volatility futures (also known as the VIX).

ProShares Ultra VIX Short-Term Futures ETF seeks daily investment results, before fees and expenses, that correspond to one and one-half times (1.5x) the daily performance of the S&P 500 VIX Short-Term Futures Index.

ProShares Ultra VIX Short-Term Futures ETF provides leveraged exposure to the S&P 500 VIX Short-Term Futures Index, which measures the returns of a portfolio of monthly VIX futures contracts with a weighted average of one month to expiration.

Source: ProShares

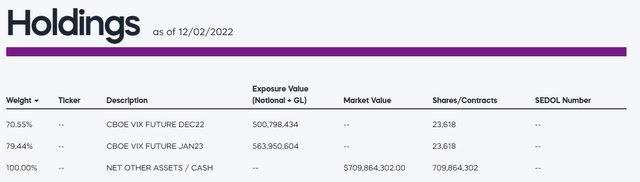

The fund holds the front month (nearest expiration) futures and then rolls them over time to the next expiring month. Hence at any point, it lands up holding two sets of futures contracts in different proportions. As we write this, the fund is about evenly balanced between December 2022 and January 2023. Note that the today weight is about 150% which corresponds to the 1.5X mentioned above.

ProShares

The setup is about as bad as it can get for chronic decay of NAV. Volatility futures trade in a state of extreme contango for most of the time and that creates a very huge negative roll for 80-90% of its existence. We can see that in the performance section next.

Performance

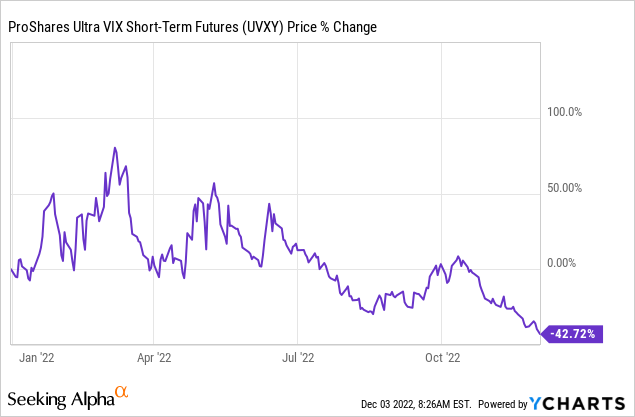

Coming into 2022, one could have assumed it was VIX’s and UVXY’s moment to shine. After all, we have had unprecedented volatility. Surely the returns would have been spectacular. While the ETF did have its moments, it is now down 42.72% year to date.

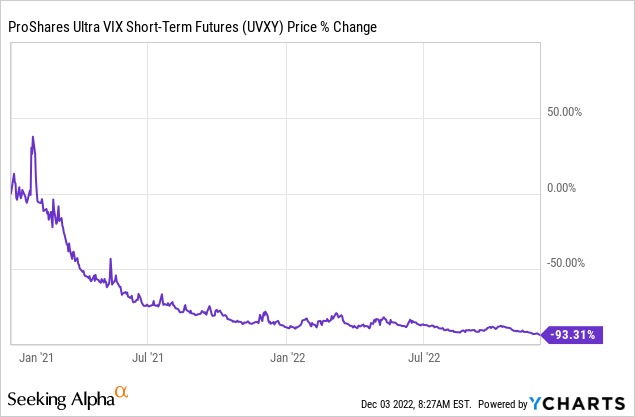

This goes to show you just how poor the return setup is on this one. Even when things go right you lose money. In a year where markets go up, like 2021, you routinely take a 90% plus loss.

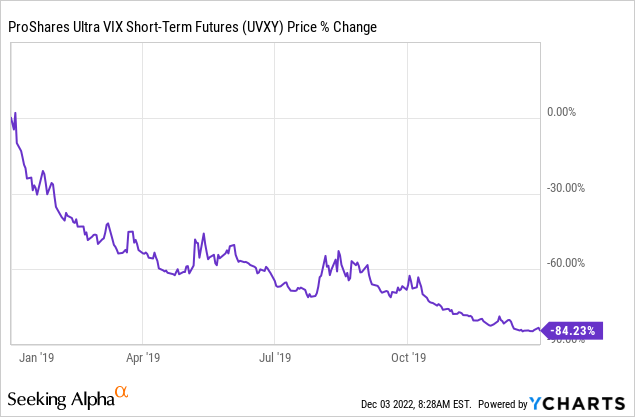

In 2019, The ETF dropped 84.23%.

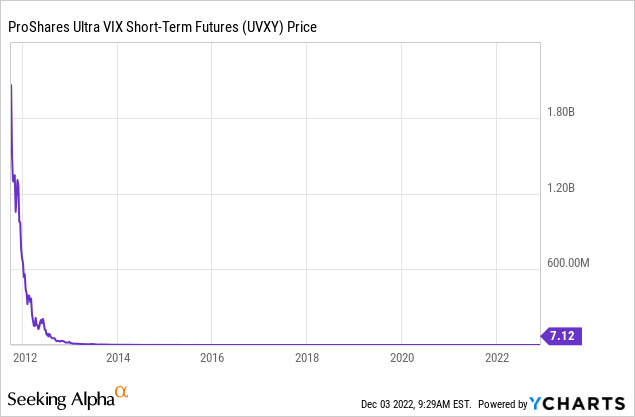

At inception, UVXY NAV was over $1.8 billion per share (split adjusted).

Playing The Long Side

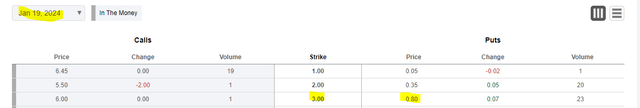

UVXY is best designed as a day-trading ETF. You cannot invest in it. You certainly cannot buy and hold unless you are in need of some massive tax losses the following year. If, and we think this is wrong to start with, you wish to do a slightly longer term holding, you have to neutralize the decay by finding some other patsies. What we mean by that is that you have to use options. For example, if you think this is a bear market rally and the next drop in stocks is overdue, you could do a covered call on UVXY. The implied volatility is pretty insane on UVXY due to its levered structure.

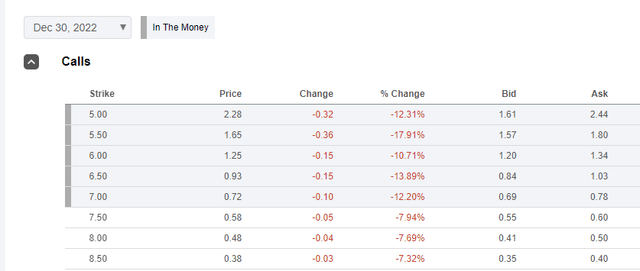

Seeking Alpha UVXY Options

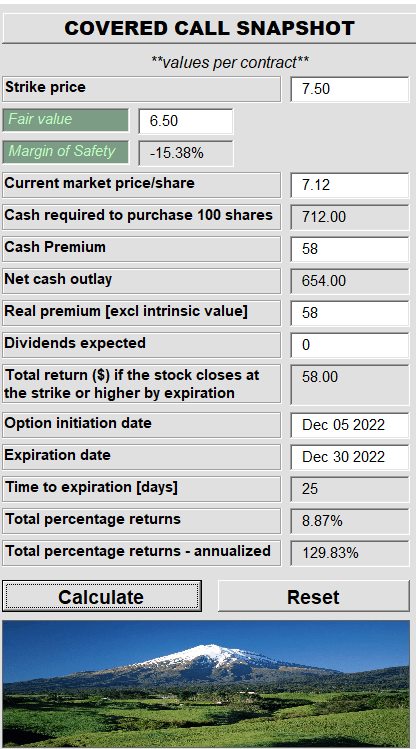

You could theoretically buy UVXY and sell the $7.50 calls for December 30, 2022 for 58 cents. You are essentially getting paid 9% in 25 days if the ETF remains flat.

Author’s App

That 130% annualized rate is the minimum you need to even venture into these waters of holding UVXY for any period of time. In other words, fight decay by selling decaying options.

Playing The Short Side

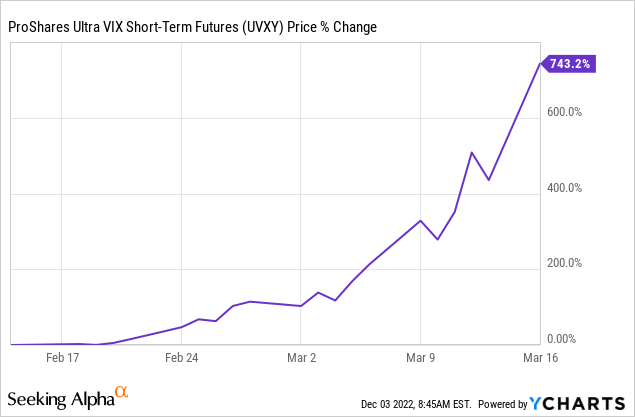

Seeing the difficulties of making money on the long side, you must be asking whether you should just join the short bandwagon. After all there is no better case of “the odds forever being in your favor” then this setup. There is a problem though. That problem is that you can get carted off the field very quickly in a volatility spike. Here is the 2020 result.

Very few people would be able to hold a short position through a 750% upswing. Hence a direct short while feasible has to be done in a more tactical way. A good way is to short after a huge spike. A better way is to sell naked calls on UVXY after a huge spike. The two steps create a big buffer and allow you to enter in an opportune setting. Even after these two measures, your notional exposure should be kept extremely small relative to your portfolio size. In an ideal world, your starting notional exposure should be around 1%. That is, if your naked calls were assigned your short position on UVXY should get you to 1% of total portfolio.

What About Buying Puts?

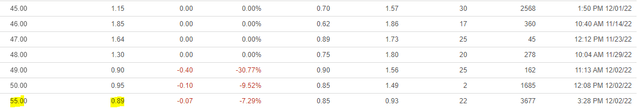

This can work in a standard year, despite the very high premiums. Keep in mind that UVXY drops about 90% in a regular year but you can improve your entry by starting off after it spikes. Longer dated options can still give you solid returns. Below we show the January 2024 options which would return about 180% if UVXY did its routine 90% drop in 2023.

Seeking Alpha UVXY Options

In theory, you could finance this by selling the naked calls for UVXY $55 strikes, which shockingly sell for 89 cents.

Seeking Alpha UVXY Options

But remember the rule about 1% total portfolio exposure.

Verdict

While UVXY has dropped sharply, we don’t think the stock bear market is over. Hence, tactically, it is a bad time to short UVXY. Of course, it is almost always a bad time to go long UVXY and hence we suggest that anyone playing that game, do so using covered calls. We rate this at neutral here and look forward to deploying our short side tactics on the next spike up.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.