[ad_1]

zorazhuang

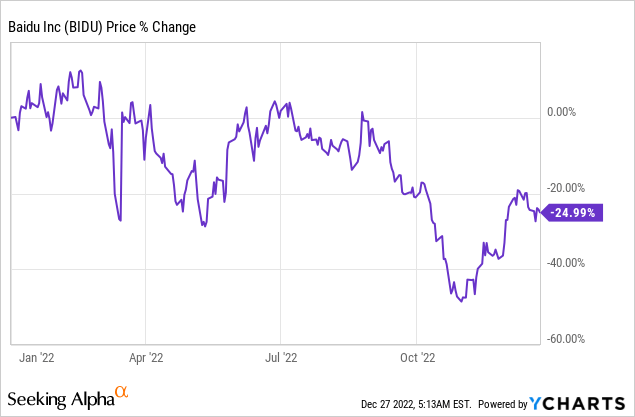

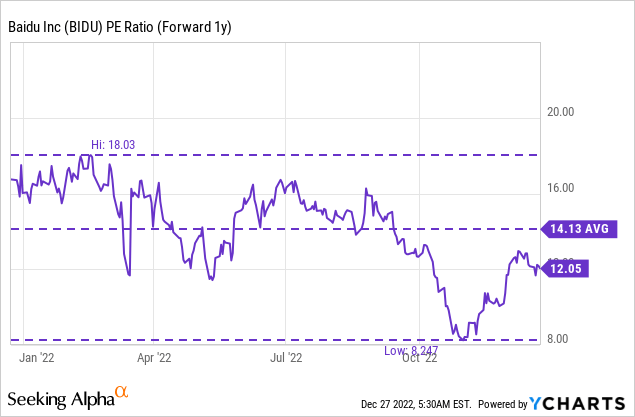

Shares of Baidu, Inc. (NASDAQ:BIDU) dipped back to $111 lately, which I believe is an opportunity for investors to start a position in the Chinese technology company. Baidu posted strong results for its third-quarter and the expected reopening of the Chinese economy could be a powerful catalyst for Baidu’s revenue growth, especially in the advertising segment. I believe that the risk profile for Chinese technology companies is very attractive right now, and considering that Baidu trades at a forward P/E ratio of just 12 X, Baidu has continued recovery and revaluation potential in 2023!

Baidu’s business is showing signs of a recovery

Like most Chinese technology companies, Baidu has seen top line headwinds throughout FY 2022, in part because of COVID-19 related lockdowns and because of increasingly assertive regulators that are looking to reign in the excesses of the corporate sector. Additionally, a slowdown in the advertising market has hurt Baidu’s revenue prospects in FY 2022.

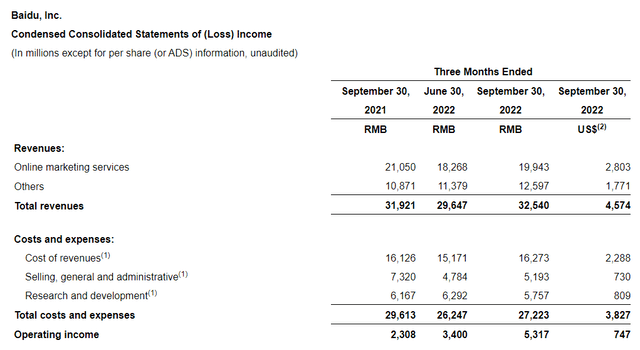

However, Baidu posted surprisingly good Q3’22 results that included a 10% quarter-over-quarter increase in revenues to 32.5B Chinese Yuan ($4.57B) due to a rebound in online marketing services which essentially relate to the sale of search engine ads.

Online marketing services are Baidu’s core business and accounted for 61% of all revenues in the third-quarter. The firm’s core online advertising platform is search engine Baidu which enjoys a leading position in the search market with a share of 65%. The rebound in online advertising services in the third-quarter is encouraging especially because Chinese companies have suffered greatly in 2022 and, I believe, could be set for a major rebound in 2023.

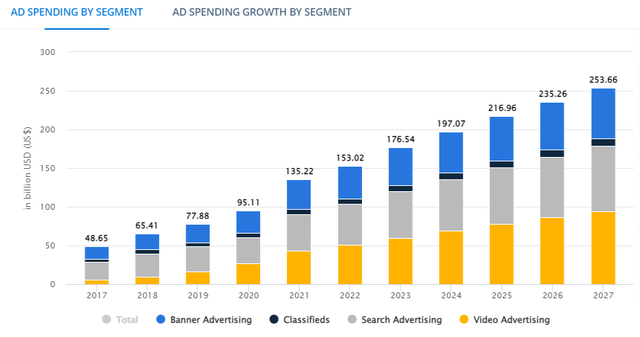

Since the Chinese economy is now reopening, pent-up demand for products and services could be unleashed and further bolster Baidu’s core advertising business. The online advertising business is big business in China, and projections call for an 11% growth in ad-spending between FY 2022 and FY 2027.

One key advantage Baidu has over its rivals is its large reach. As a leading online search engine, an ad placed on Baidu is sure to attract the most eyeballs which makes the platform a key element in companies’ advertising strategies. A rebound in the digital advertising market, therefore, could support Baidu’s growth significantly.

Baidu is also solidly profitable on an operating income basis which could help reignite interest in Baidu’s shares if the Chinese economy opens broadly and fully in 2023. Baidu reported strong operating income for the third-quarter, totaling 5.32B Chinese Yuan ($747M), showing a 56% quarter over quarter jump.

Baidu’s valuation

Baidu is expected to see a recovery in top line growth in FY 2023, although I believe estimates still undervalue Baidu’s potential in the online marketing services segment if we were to see a full reopening of the Chinese economy next year. Baidu is expected to see $19.8B in revenues in FY 2023, implying top line growth of 11%. The top line trend for FY 2022 is negative given the COVID-related challenges in China and it implies a 10% decrease in revenues.

Like most large-cap Chinese technology companies — including Alibaba (BABA) and Tencent (OTCPK:TCEHY) — Baidu’s share price has suffered from negative sentiment overhang, but a reopening of China’s economy potentially provides a much-needed catalyst for an upwards revaluation.

Based off of earnings, shares of Baidu are valued at a forward P/E ratio of 12.1 X… which is very cheap considering that Baidu owns the most popular online search engine in the market. Shares are currently trading 15% below the 1-year average P/E ratio.

Other Chinese large-caps are also trading at low P/E ratios, potentially indicating that the market broadly undervalues the potential of Chinese enterprises. Alibaba, for example, currently has a P/E ratio of less than 10 X and could also be a big winner if the e-Commerce business gets reinvigorated by a Chinese economic reopening.

Risks with Baidu

Baidu is a Chinese technology firm and Beijing has made clear in the last three years that it will more strictly enforce regulations to prevent anti-competitive practices. This means heavy fines could come down on Baidu at any moment for practically any reason. Slowing top-line growth, a resurgence of COVID-19 and a delayed reopening of the Chinese economy are key risk factors for Baidu as well. More specifically, a moderation of revenue growth in Baidu’s online marketing services and a decline in Baidu’s search engine market share would likely be two reasons that would get me to change my opinion on the technology company.

Final thoughts

With a general reopening of the Chinese economy likely to occur in 2023, Baidu is an attractive investment for investors that believe in the long term potential of the Chinese economy as well as the digital advertising market. Since the stock is also currently in a “buy the dip” situation and has a very attractive valuation based off of earnings, I believe the risk profile for Baidu, Inc. is very attractive for investors that want to bet on a recovery of the Chinese economy!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.