[ad_1]

Justin Sullivan

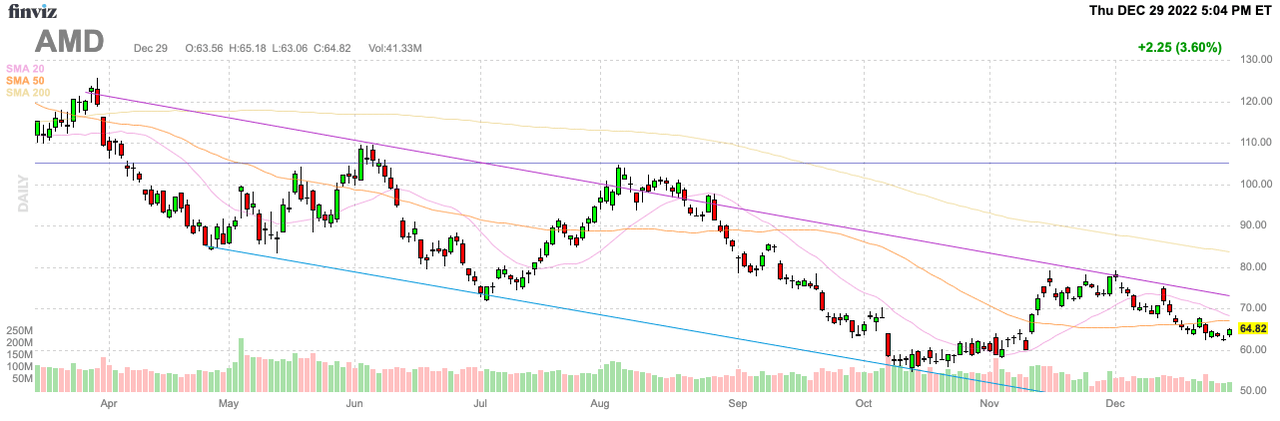

Despite the negativity on Advanced Micro Devices, Inc. (NASDAQ:AMD) in 2022, the stock hasn’t hit new lows in December with the market meltdown. The headlines like to focus on the PC demand issue, but AMD stock remains a data center growth story. My investment thesis remains Bullish on AMD over the long term, with a focus on the constant progress made with the business.

Source: FinViz

Focus On The Progress

The story with a lot of semiconductor stocks is that the peak expectations entering 2022 will return in the next few years. Some of the covid demand boost wasn’t sustainable, but the shift into AI and automobile technology will only grow chip demand long into the future after a digestion period.

The AI data demands will be the prime area of growth for AMD in the future. OpenAI’s ChatGPT was the hit product of the month, but a top focus of the CEO was the high cost to operate a conversational AI chatbot due to the massive processing power needed.

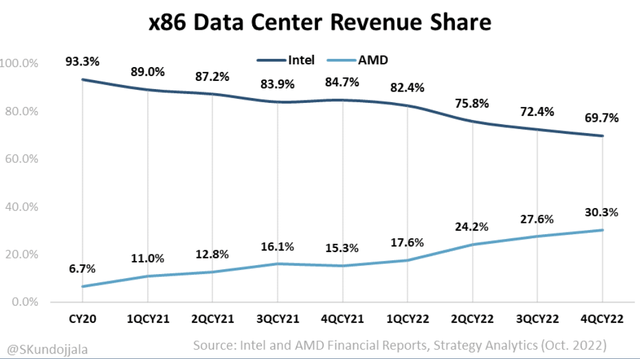

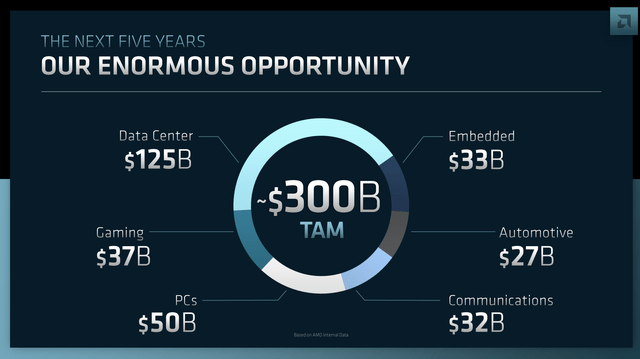

AMD is already set to take substantial market share in the data center space from Intel (INTC). The growth opportunity in the chip space remains massive, with AMD estimating a $300 billion TAM (total addressable market) in 2027 (5 years after the Xilinx deal closed).

Source: AMD Analyst Day ’22 presentation

The areas with the most impressive forecast growth are data center and gaming. The data center market is forecast to surge from $50 billion to $125 billion in 5 years due to the demand from AI, machine learning, and the metaverse.

The one area not expected to grow much is the PC segment. Those revenues are only forecast to grow from $40 billion currently to $50 billion, in a prime example of why AMD is focused on taking market share in the server CPU market and less so on low-end PC chips.

AMD is forecast becoming a $40 billion company by 2025, and revenues from the data center sector would still be a fraction of the total data center market. The company only had an estimated 30% of the revenue share in Q3’22.

Whether or not 2023 is a tough year for CPU server demand will impact AMD stock next year, but all signs point to substantial growth in the years ahead. AMD is not a stock to sell down $100 from the highs due to short-term trading, especially not now after a dismal year.

The investment story hasn’t changed one bit over the last year. As pointed out above, a PC inventory correction isn’t a reason to sell AMD. The only main reason to sell AMD is losing data center leadership back to Intel, and this isn’t anywhere close to occurring.

Higher Profit Targets Will Return

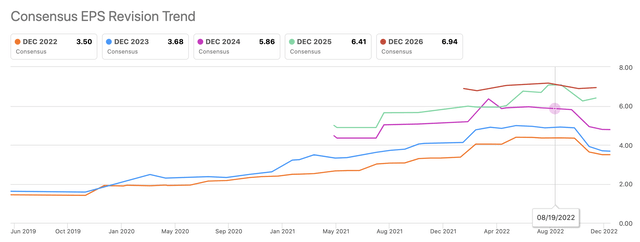

Just back in August, analysts had the below EPS targets for AMD. The prime target was for a 2023 EPS of $4, jumping towards $6 in 2024.

These EPS targets are very crucial to understand, because the numbers AMD reports in the 2H of this year and into the start of next year aren’t normal market numbers. Investors shouldn’t value the chip stock based on trough market dynamics where PC sales are slashed by $1 billion due to the PC correction.

Our view on AMD earnings power hasn’t changed one bit, though the timeline could be extended. Investing in the chip company has never been about the timeline, progress has always been the focus.

The company had a target to hit of $32 billion in revenues for 2023 entering the year, producing a $5.75 EPS. Whether this is pushed out to 2024 isn’t too relevant when understanding that AMD will move on next to hit their target for $40 billion in revenues in 2025 – and that could become a 2026 target.

The stock trades in the low-$60s now, and an EPS target in a few years approaching $6 will lead to a stock much closer to the all-time highs than $60.

Takeaway

The key investor takeaway is that Advanced Micro Devices, Inc. is far too cheap for the opportunity ahead. The market is too focused on the trough financial targets in 2022 and not the long-term upside for AMD in a few years.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.