[ad_1]

alexsl

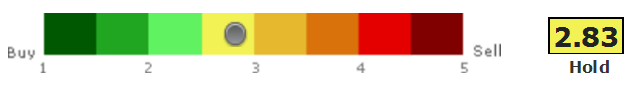

Snapchat (NYSE:SNAP) is currently traded at $8.81, representing 3x TEV/NTM Sales. According to CapitalIQ, SNAP is rated “Hold” based on the blended recommendations from all sell-side contributors. I am aligned with this rating, but I think it’s still worth going deeper into a few things about SNAP.

CapitalIQ

SNAP’s Touch Year

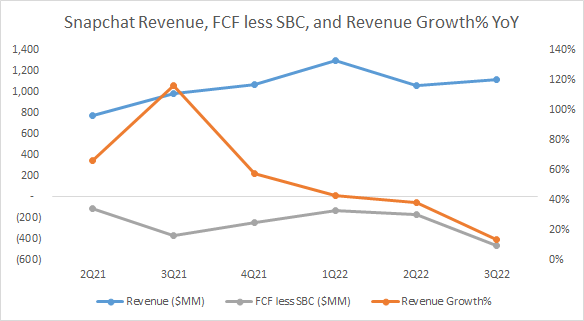

Snapchat had a tough year. Its revenue growth in Q3-22 dropped to 13%, as compared to 42% in Q1-22 and 38% in Q2-22. FCF less SBC was -$466MM in Q3-22, as compared to -$137MM in Q1-22 and -$169MM in Q2-22.

SNAP Financials

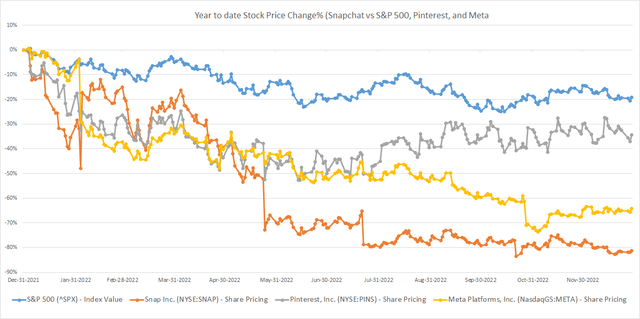

Its share price dropped by 80% year to date, as compared to S&P 500 (-19%), Pinterest (-34%), and Meta (-64%).

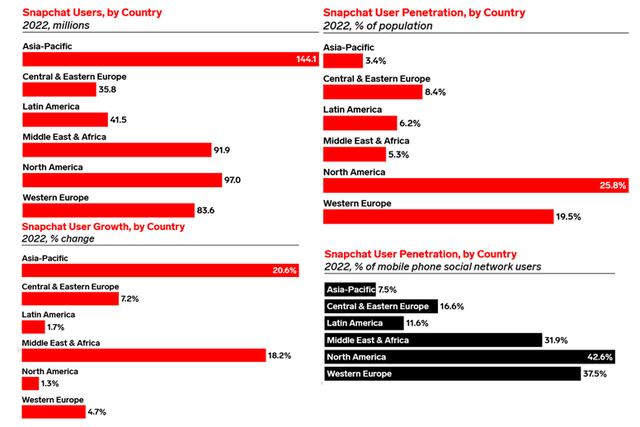

Despite SNAP’s headwinds in revenue, profitability, and stock price, SNAP still has very valuable assets considering its user growth and level of advertising monetization. The following figure shows 1) SNAP is gaining traction globally, and continues to grow their uses in each region; 2) SNAP’s user penetration is material, but still sees plenty of rooms to grow.

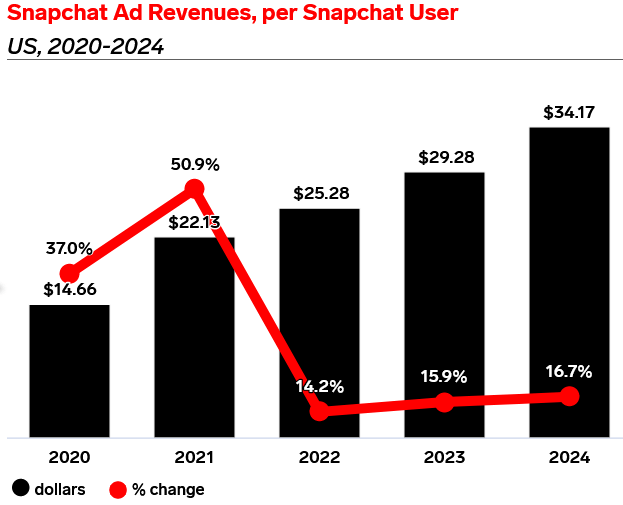

If we look at SNAP’s ARPU in US, $25.28 advertising revenue per Snapchat user is pretty decent, as compared with WhatsApp ($0.28 in US), Pinterest ($24.14 in US), Twitter ($45.83 in US), and WeChat ($7 in China)

eMarketer

SNAP – An Attractive Takeover Target

SNAP is now a $14B company, getting way more attractive than last year when its market cap was $76B high. Let’s take a 360-degree look at SNAP from the lens of takeover.

SNAP’s profile:

1) 363 million users worldwide, penetrating 3-26% of regional population;

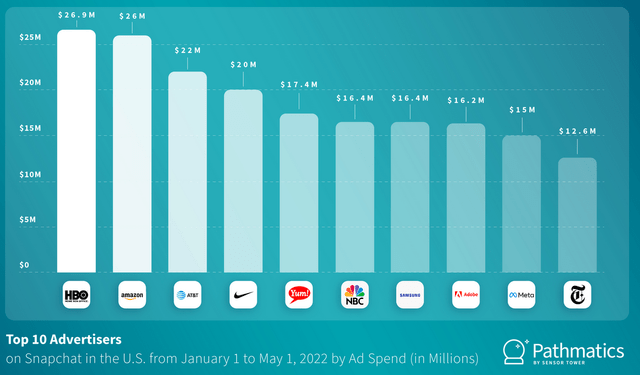

2) $5B revenue (+13% YoY) by serving thousands of advertisers (top10 advertisers estimated annual spend was over $600 million based on Jan-May 2022 data from Pathmatics (see details in the following figure);

3) SNAP is a social network App with rich media, especially well positioned for brand advertising;

4) Half of SNAP’s Top10 advertisers are going after digital advertising dollars, and three of the remainder are major ad publishers.

Who might be interested in SNAP?

Leading social Ads player: Although Meta’s two previous attempts were turned down, I think Meta is still eager to have it considering its Super-App vision (Meta Bets on WhatsApp to Replicate WeChat Success) and Metaverse vision. SNAP’s $25 ARPU is tremendously more attractive relative to WhatsApp’s 28 cents.

Full-funnel Ads player that lacks Social assets: There are big Ads players that have been doing very well in gaining full-funnel advertising budget leveraging their existing assets, but they just lack social assets and have been holding off for a while.

Retail Media Network player who is willing to double down in digital advertising: Snapchat is partnering with Walmart, Kroger, and BigCommerce to connect their 363 million users to various brands. A Retail Media Network player such as Walmart might have found SNAP interesting. See my recent article, Walmart: Doubling Down in Retail Media Network.

CTV Players who are new entrants but very ambitious to win a big chunk of the digital advertising market shares: Netflix and Disney, along with a few others, are currently heavily investing in CTV. SNAP video and Connected TV video could complement with each other, and also drive massive cross-sell given SNAP’s already strong connections with advertisers. See my recent article, CTV Stocks to Invest In.

What is SNAP Worth?

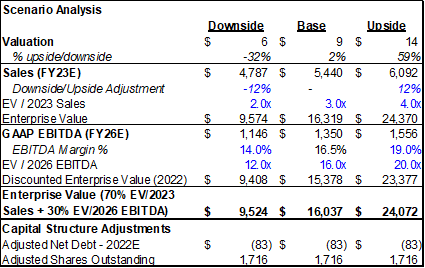

My valuation shows $9 for the base case, a range of $6-$14 considering downside and upside potentials. The valuation is based on two approaches: 2023 Sales (70% weight) and 2026 EBITDA (30% weight).

This calculation has assumed 1) SNAP is able to continue to grow its users as well as its ARPU (a ’22-26 revenue CAGR of 15%); 2) SNAP is able to meaningfully improve its GAAP EBITDA Margin (-25% in 2022E to +16% in 2026E).

SNAP’s market cap is $14B if we consider its fair price $9 per share. As a reminder, Meta acquired WhatsApp for $22B in 2014. WeChat’s valuation is $68B according to Telemedia Online in 2021. TikTok’s valuation is $50B according to GoBankingRates in 2022.

my own valuation

Conclusion

In my opinion, it would take several years for SNAP to meaningfully improve its profitability, and it would be hard for SNAP to significantly accelerate its revenue growth considering the current competitive landscape. However, as a $14B company, SNAP is becoming a very attractive takeover target, and that may warrant some material premium.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.