[ad_1]

U.S. stock market investors saw 2022 deliver the biggest broad market losses since the Financial Crisis. The S&P 500 finished the year almost -20% lower, while small caps (as represented by the Russell 2000) finished lower by nearly -22%, and the Nasdaq 100 lost nearly 1/3 of its value.

Investors would like to gauge what’s in store for 2023, so we asked our contributors to present their broad market analysis and estimates for the S&P 500 for the coming year.

Will Stocks Rebound In 2023?

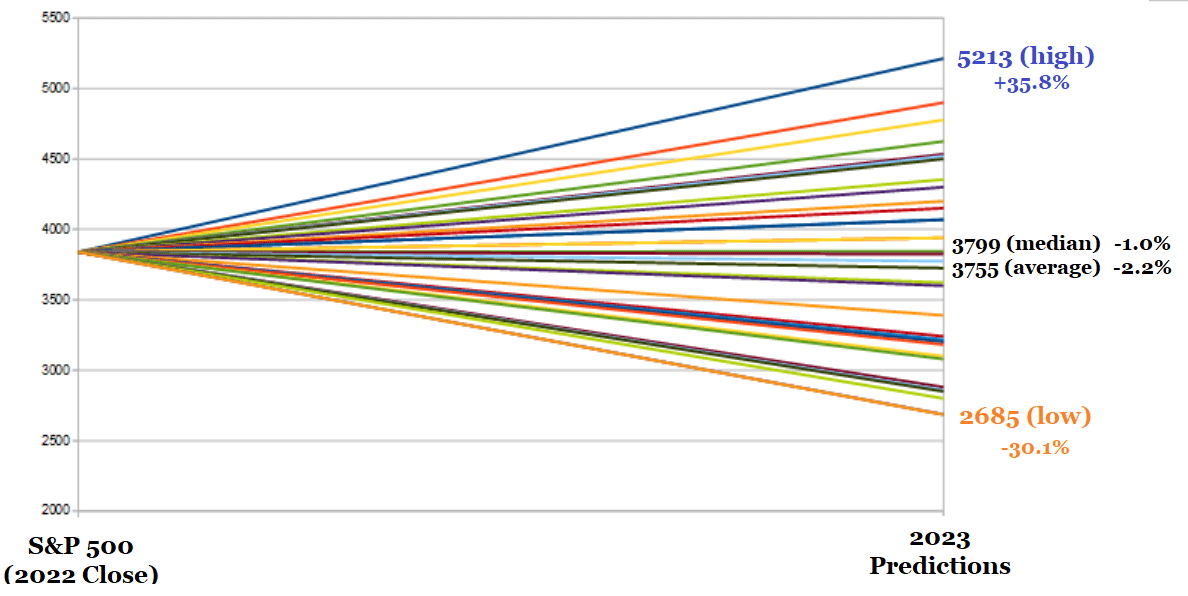

According to our contributors, no, stocks are not likely to rebound in 2023. The below chart summarizes the S&P500 predictions from the 34 contributors who weighed-in with their analysis.

On average, contributors are expecting a small decline in the S&P 500 in 2023.

The most optimistic forecast for the S&P 500 for 2023 is for a rise of +35.8%. The most pessimistic contributor who submitted a prediction for 2023 expects the index to close at 2685, or -30.1% lower, in 2023.

The Seeking Alpha Quant Rating for the SPY (SPDR S&P 500 Trust ETF) is also a Hold. To learn more about Quant Ratings, see here.

Will 2023 Be Another Volatile Year?

Indeed, many contributors predict that the S&P 500 will bottom-out at a much lower level than it is today, sometime mid-2023. Most then expect some sort of rebound.

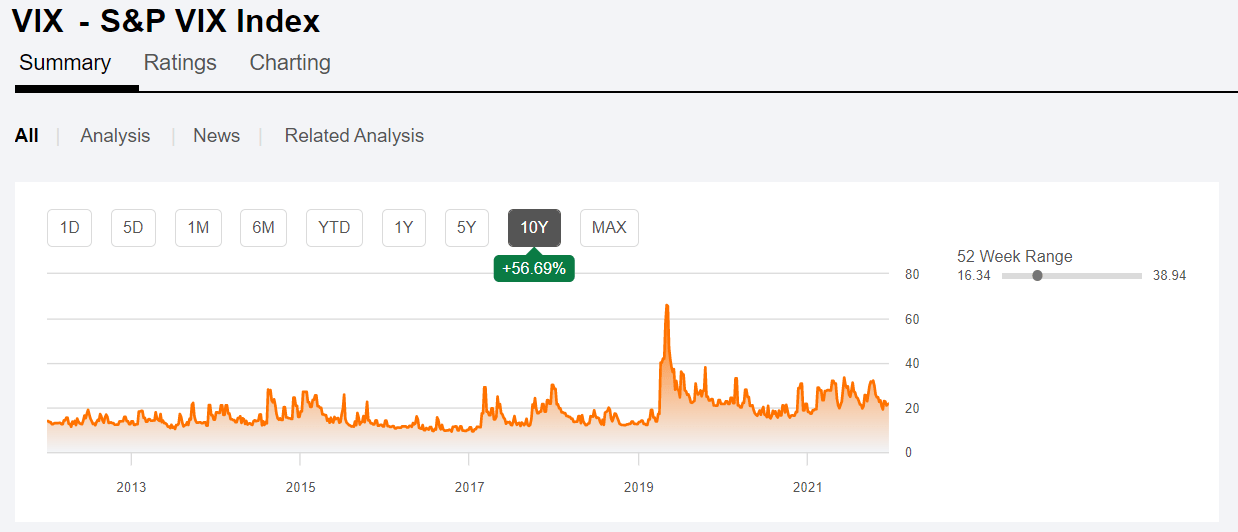

The VIX, the measure of volatility expectations for the S&P 500, experienced several spikes to the ~35 level during the past year. The indicator has settled down in recent months but remains significantly above the 2021 low and pre-pandemic levels.

What Are Some Of The Primary Bearish Arguments For Stock Markets in 2023?

- The Federal Reserve continues to hike short-term interest rates, although has slowed the pace of the increases.

- Higher Interest Rates not only make stocks less attractive, but pressure the earnings of companies who carry a substantial amount of debt. Many corporations took on large amounts of debt when it was essentially ‘free money’ when interest rates were extremely low.

- The average bear market decline for the S&P 500 is more than -30%. The index is only down about -20% from its all-time high set in 2021.

- The Price/Earnings multiple for the S&P 500 remains relatively high, and furthermore earnings estimates remain too high.

- The Federal Reserve will get it wrong and cause a ‘hard landing‘.

- Technical Analysis suggests pressure will remain to the downside.

What Are Some Of The Primary Bullish Arguments For Stock Markets in 2023?

- Consecutive years of negative performance is extremely rare.

- Inflation will moderate, and drive GDP growth, while also allowing the Federal Reserve to loosen policy.

- A recession will be averted.

- Markets will ‘climb a wall of worry‘ as they often do, despite grim fundamentals.

- Geopolitical tensions will subside.

- Corporate earnings will be assisted, more than investors think, by interest earned on large cash balances.

Examples of In-Depth Market Analysis

Seeking Alpha has received lots of thoughtful stock market analysis for 2023, stemming from our competition to predict the S&P 500 for 2023. Here are a few highlight articles with very detailed analysis for the consideration of our valued subscribers.

- S&P 500 In 2023: Brace For A Fed Pivot, by Atlas Equity Research

- S&P 500 2023: A Mixture Of The Early 2000s and 1980s, by Wright’s Research

- The S&P 500 Index In 2023 May Disappoint Investors, by Anna Sokolidou

- Forecasting The S&P 500 For 2023: Year Of The Fed-Pivot And More Record Volatility, by JD Henning

- The Fortune Teller’s Predictions For 2023 by, of course, The Fortune Teller

- S&P 500: Recession Is Not Bullish, by Garrett Duyck

- A New Bull Market Is Likely To Start In 2023, by ANG Traders

- S&P Forecasts For Year-End 2023, by John Overstreet

- 2023 S&P 500 Prediction: CAPE Vs. Yield Spread, by Sensor Unlimited

Seeking Alpha would like to thank not only the contributors who participated in sharing their market analysis for 2023, but all of our contributors and valued subscribers.

We wish you the best of luck for 2023.

As for the S&P 500 prediction contest, we will post the occasional update throughout the year.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.