[ad_1]

Leonid Sorokin

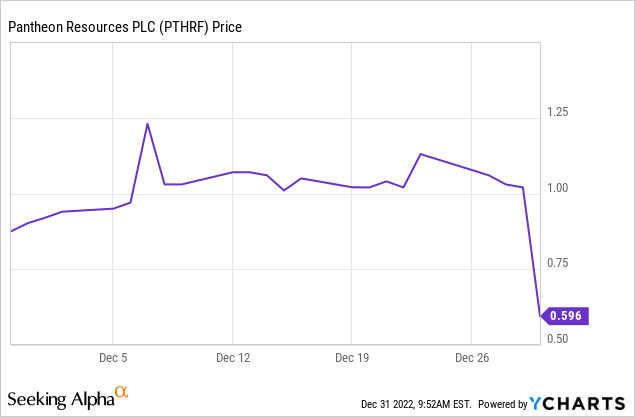

Pantheon Resources (OTCQX:PTHRF) had a disappointing well result and financials, disclosing both on the last day of the year, sending the stock down almost 50%. Pantheon has been a battleground stock, with a number of mostly anonymous promoters pushing the stock on social media and several famous short sellers disclosing short positions.

Pantheon’s well result showed production of approximately 200 barrels of oil a day and 300-350 barrels per day of natural gas liquids. This was below potential production scenarios laid out in the company presentation and by stock promoters and shareholders. While the oil is easily marketable due to the proximity of a pipeline, the NGLs are less marketable and likely receive a fraction of the net price of the oil. The company pointed to “sand blockage of 1,000 lateral feet” and plans to clean out the well using a workover rig in January, but the unobstructed 4,000 feet of lateral are producing below expectations.

This disappointment may have been exacerbated by the proliferation of pictures of a flare on the well site. Flares at well sites are not indicative of well productivity beyond indicating the presence of hydrocarbons. Unfortunately, with images and videos of the flare proliferating on social media and elsewhere, it appears expectations were high, at least partly based on this. The market reaction to the well result seems to bear this out.

The company’s financial disclosure likely did not help. The company showed a cash position of $16.6 million, along with a burn rate of $7.4 million for overhead and interest of $8 million – not a lot of running room! With disclosed estimated well costs of $20 million to $25 million and apparent actual cost on the most recent well of $30 million, Pantheon has insufficient cash to drill additional wells without another financing or asset sale.

With a falling share price, it may be difficult for Pantheon to execute an equity financing without a significant discount and potentially warrants or convertible debt. But there is already a large convertible debt balance outstanding, which may reduce the availability and increase costs of such financing.

On the asset sale side, the recent acquisition of “high graded” land by Pantheon for $28/acre in a public auction implies a private market value of $5.6 million for Pantheon’s total land position. However, this transaction was conducted prior to the disappointing well result. The well result could negatively affect the asset value, which is already 1/70th of Pantheon’s market cap subsequent to the recent share price crash, based on the lease sale metric. This leaves limited value for a potential joint venture or “farm out” without significant dilution from the current market cap of ~$400 million.

With a rapidly depleting cash position and reduced financing prospects, Pantheon’s share price has room to decline precipitously from here. With $39.2 million of convertible debt outstanding, the clock is ticking.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.