[ad_1]

Disclaimer: Nothing in this article should ever be considered advice, research or an invitation to buy or sell securities. I am not a financial advisor.

When it comes to retirement, one of the largest decisions that we’ll have to make is deciding on whether or not we are going to relocate to another area.

Aside from the obvious emotional costs (distance from family, etc.), relocating can also have a domino effect on our finances in retirement that can result in significant increases/decreases in expenses such as:

- Housing

- Food

- Transportation

- Medical Care

- Taxes

As a result, it’s imperative to understand how much our unique lifestyle will cost us in another state.

In today’s article, we will be examining how to effectively use the cost of living index method in order to evaluate whether or not relocating in retirement is financially prudent.

Let’s dive in.

What is the Cost of Living Index Method?

Cost of living refers to the amount of money required in order to cover our expenses.

Our individual cost of living is influenced by a variety of factors including:

- Our Lifestyle Choices

- Our Family Size

- Our Age/Health

- Where We Live

From a retirement perspective, we can think of cost of living as being synonymous with the annual budget that is required in order to support our lifestyle. However, due to a variety of economic factors, the annual budget for our lifestyle can fluctuate significantly from state to state.

Fortunately, we can rely on data from the Council for Community and Economic Research (C2ER) in order to better understand what these price fluctuations are. “Using over 60 goods and services collected at the local level from over 300 independent researchers,” the C2ER has one of the most comprehensive cost of living datasets available.

The result is a price index that accurately and reliably compares prices amongst different states as well as cities. Here is how we would read and interpret the index:

- A cost of living index = 100 indicates that an area’s costs are in line with the national average

- A cost of living index < 100 indicates that an area’s costs are lower than the national average

- A cost of living index > 100 indicates that an area’s costs are higher than the national average

Using this data, we can compare two area’s cost of living indices in order to get an idea on whether or not our lifestyle costs would either increase or decrease with a potential move. This is very important to understand before we move because:

- An increased cost of living can potentially result in not having enough money to support the type of lifestyle that we want for our retirement

- A decreased cost of living can potentially give us more discretionary funds that we can spend in retirement

With that being said, let’s take a look on how we can use the cost of living index method.

Applying the Cost of Living Index Method

Let’s take a look at a hypothetical scenario using C2ER data published by the Missouri Economic Research and Information Center.

Imagine that an individual from New York was considering relocating to Florida to retire.

In Q3 2022, the cost of living index for New York was 135.7. In other words, living in New York was 35.7% more expensive than the national average. During the same time period, the cost of living index in Florida was 104.5. While living in Florida is 4.5% greater than the national average, a move from New York to Florida would represent an average cost of living decrease by 31.2%.

While this is a good ballpark approximation, it’s important to remember that these are state level averages and can vary widely based on individual cities. As a result, in order to get the most accurate representation of an area’s cost of living, one should use a city/county specific calculator that leverages C2ER’s data such as NerdWallet’s cost of living calculator.

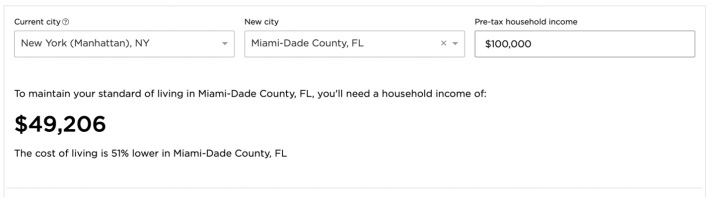

Continuing with our example, using NerdWallet’s calculator, let’s take a look at what a $100,000 annual retirement budget looks like when moving from Manhattan NY to two different cities in Florida.

Manhattan NY to Orlando FL:

Manhattan NY to Miami-Dade County FL:

In this example, moving to Miami-Dade County would be 51% cheaper than Manhattan whereas Orlando would be 58% cheaper than Manhattan (and 7% cheaper than Miami-Dade County)

From a retirement portfolio perspective, we can really notice a sizeable difference. In this particular case, if the individual were to stay in Manhattan, their estimated retirement portfolio (assuming a 4% safe withdrawal rate) would be equivalent to $2.5M.

With that being said (assuming the same 4% safe withdrawal rate) moving to Orlando would only require an estimated retirement portfolio of $1,050,925. This translates to a -58% decrease in the portfolio required to support a similar lifestyle! This can melt years off our path to financial independence.

By using this publicly available and city-specific cost of living data, we are able to make a better judgement call when it comes to exploring potential relocation options.

Final Thoughts

Where we decide to live is a foundational pillar in deciding what our retirement will look like.

While relocating in retirement can be a fun daydream, we should pragmatically understand what is involved in order to ensure that we are setting ourselves up for success and making the most out of our hard-earned retirement.

Finally, money is only one part of the retirement equation. We also need to be sure that we are emotionally ready to retire in the right location.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.