[ad_1]

Melpomenem

By Rob Isbitts

Strategy

iShares 3-7 Year Treasury Bond ETF (NASDAQ:IEI) is part of a series of bond index funds from ETF giant BlackRock (BLK). It invests in a set of Treasury securities with maturities from 3 to 7 years from now. That puts it in between short-term T-Bills and Treasury Notes, and the benchmark 10-year Treasury Bond.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Bonds

-

Sub-Segment: US Treasury

- Risk (vs. S&P 500): Low

Proprietary Technical Ratings

-

Short-Term (next 3 months): Sell

-

Long-Term (next 12 months): Hold

Holding Analysis

IEI owns about 60 different bond issues. Just over half of the fund allocation is currently invested in bonds with 3 to 5 years to maturity, and nearly all the remaining exposure is to bonds set to mature between 5 and 7 years from now. The ETF turns over at about a 60% rate, which implies that it is rebalancing the portfolio to keep that 3-7 year range intact. IEI does not let bonds get all the way to maturity, instead selling them off around the 3-year mark.

Strengths

IEI is part of a set of US Treasury ETFs that have set the bar for Treasury ETF investing for over 15 years. iShares, the ETF behemoth, has an ETF for each of several segments of the US Treasury Yield Curve, from T-Bills to 30-year bonds. IEI does its job by covering one of the shorter-term ends of the curve, the 3-7 year segment. This is a nice tradeoff for investors, as it tends to be less-volatile than long-term bonds, but often yields more than shorter-term bonds.

Weaknesses

IEI’s strength is also its long-term weakness. Should we re-enter a years-long era of declining US Treasury rates, IEI will not have the “juice” of long-term bonds and likely won’t yield as much.

Opportunities

This is a most intriguing time for this segment of the yield curve. T-Bills are getting a lot of headlines (including from us!) for their competitive yields versus long-term bonds. And, long-term bonds are being hyped for their potential to reverse lower in yield, which could represent a generational opportunity to lock in the highest yields in a while, and generate massive profits from those falling rates. Then, quietly in the corner, between those two hotly-debated ends of the yield curve, sits the less-popular 3-7 year segment. It doesn’t have the panache of the 7-10 or 10-20 yield segments, since those both include 10-year US Treasuries, the benchmark for bond investments.

But the market is not acting like it used to. And there is currently no strong trend in rates. It appears to us to be more of a back-and-forth, looking for direction situation. In such an environment, the 3-7 year segment may offer a nice niche for those who want to avoid “credit bonds” (corporate, high yield, municipals, etc.), while not taking on too much price risk of longer-term maturities.

Many investors I have interacted with recently seem to think that buying and holding bonds is the only way to invest in bonds today. A decade ago, I was right there with them. But not today. The bond market has moved too close to the stock market in terms of stability and predictability. In other words, it is less stable and predictable than in the past! And, I believe we have not reached the “late innings” in this bond cycle. That all means it really helps to add to your toolbox of potential ETFs to consider those that target niche areas. That is what IEI represents.

Furthermore, I think the next couple of years will reward investors who are flexible enough in their portfolio construction to consider using niche ETFs like IEI, versus locking in 3-5% yields that might look terrible in a 6-10% yield environment (which is at least still on the table).

Threats

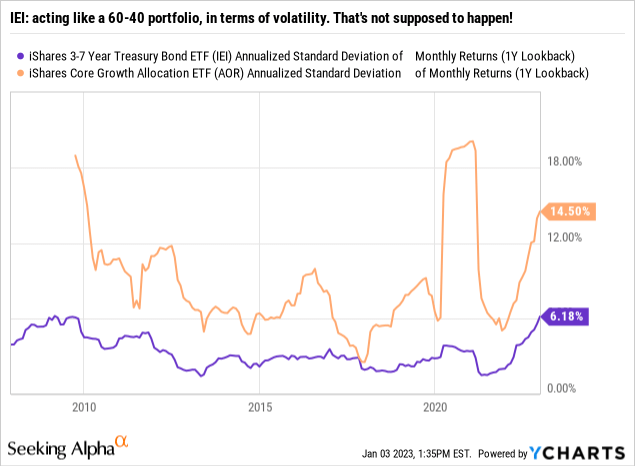

Ah, but timing matters here. It used to not matter, but look at that chart above. Even the sheepish 3-7 year range that IEI covers has seen its Standard Deviation (how variable its returns are) just about triple in recent years. What’s going on? That’s the subject of another, more macro-focused article, but I wrote this one as a starter piece 3 months ago, shortly after I started writing for Seeking Alpha: Rob’s Bond Market Primer Article.

Conclusions

ETF Quality Opinion

IEI is solid, time-tested, and does what it is supposed to do. The question for investors is whether they want what IEI offers. I suspect that in time, more will. Why? Because it occupies that sweet spot on the curve. So, for reasons that investors may be more comfortable owning 5-year bonds versus speculating on the future of interest rates and credit market conditions with 10-30 year bonds and non-Treasury bonds, this ETF could be a relatively calm role player.

ETF Investment Opinion

However, we have to limit our forward-looking enthusiasm for IEI to a Hold rating, for now. That’s because there is still too much “wiggling” (technical term, there!), in the price of nearly all parts of the yield curve, even for Treasuries. The market’s obsession with the Fed has to settle down before we can be more confident in stepping in here. After all, even IEI, that quiet little ETF in the corner, has seen price drops of over 10% in the recent past. Given what we expect from IEI when we own it, that’s too much, given how low the yield is.

What would change us to a Buy rating? We can’t ever say with certainty. But a flushing of bond prices across the board (which we think is on the table during 2023), a technical breakout (a few percent away, at least) or both will go a long way toward that. In the meantime, IEI is a Hold, not a Sell, simply because downside risk is there, but not nearly at the level that exists for credit bonds and longer-term US Treasuries.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.