[ad_1]

JHVEPhoto/iStock Editorial via Getty Images

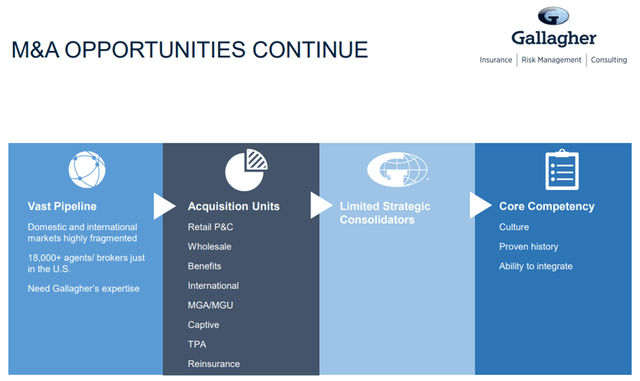

Property and casualty insurance broker Arthur J. Gallagher (NYSE:AJG) has been on an acquisition spree over the last month or so. Its most significant purchase was that of Buck, an employee benefits consulting company, for $660m (~11x trailing post-synergies EBITDA). Given its >$5bn cash position and success in integrating tuck-in acquisitions to drive long-term earnings growth, AJG’s M&A activity will be well-received by investors. Plus, valuations are coming down across the industry, with interest rates on the rise and most competitors (strategic and financial) running low on cash. Synergies will be key to making this acquisition work – assuming a successful integration, AJG should benefit from the added scale in its employee benefits arm, Gallagher Benefit Services (GBS), along with an expanded offering to its P&C-focused client base.

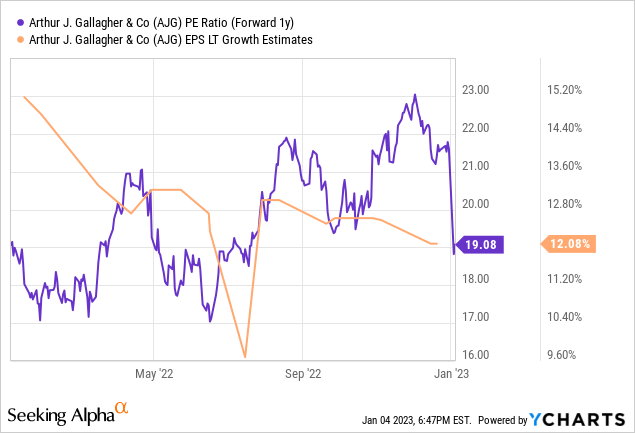

In the meantime, the company remains on track to exceed its >50bps core brokerage margin expansion guidance for 2023 on organic growth from continued wage and medical inflation, as well as cost efficiencies. The stock isn’t cheap at ~19x fwd P/E, but relative to the low-teens EPS growth potential, the risk/reward seems attractive.

A Pricey Acquisition But Ample Synergy Opportunities

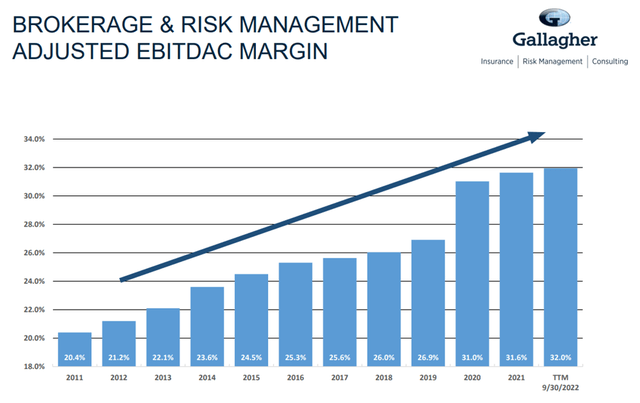

AJG has been actively deploying its dry powder, most notably acquiring employee benefits consulting firm Buck for $660m. The deal amounts to an ~11x EBITDA price tag (based on trailing twelve-month numbers) but includes synergies; the upfront transaction multiple would have been closer to a pricey ~20x. Still, Buck offers a healthy revenue stream of ~$280m with good margins at ~19% EBITDAC on a post-synergies basis (~12% pre-synergies). There are likely ample margin opportunities left, though, as the post-synergies Buck margin profile remains below AHG’s GBS business and the broader brokerage segment (>30%; see chart below). Based on the projected synergy run-rate and funding terms (cash and short-term debt), the deal is projected to be low-single-digit % accretive to EPS and is on track for an H1 2023 close.

Given most of AJG’s employee benefits revenue comes from non-P&C insurance areas such as medical and dental, the addition of Buck is a complementary fit. Within GBS, for instance, Buck adds capabilities across the full range of retirement solutions, from defined benefit and contribution plans to investment consulting. Thus, the deal fits nicely within AJG’s strategic framework of expanding its product offerings, as well as its emphasis on GBS and HR consulting per the December investor update. Geographically, the deal also expands its international footprint (i.e., UK and Canada), paving the way for incremental cross-selling opportunities over the long term.

On Track For More Beat-and-Raise Quarters

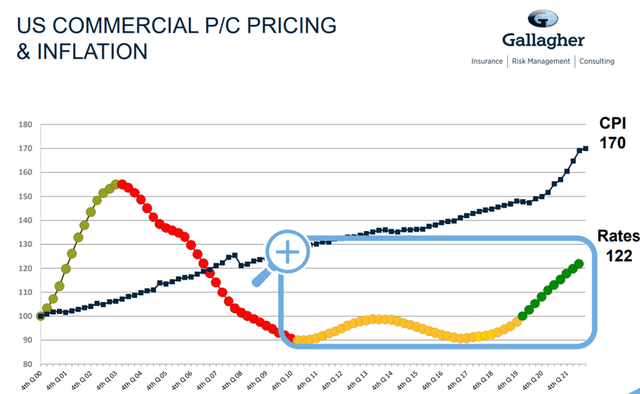

The increased exposure to wage and medical inflation tailwinds post-acquisition will be a nice boost. With this month’s JOLTS data also highlighting a resilient labor market despite the accelerated rate hikes, employee benefits growth should sustain into FY23, supporting strong P&C pricing. Recent management commentary supports this view – AJG has observed audits, endorsements, and cancellations trending better in late 2022 than early 2022, along with limited economic pressure from the labor market. In addition, medical inflation is set to be another key source of upside – at a projected +10-15% on the back of higher renewal premiums and wage increases across the health system, AJG is well-positioned to benefit.

Yet, consensus expectations continue to embed a slowing employment growth scenario. Similarly, management has conservatively pegged the organic growth target at mid-single-digits % for the year, so the bar for upward EPS revisions is low. AJG has also pegged the margin expansion guidance at >50bps in the core brokerage business for this year, based on this organic growth assumption. Given the growth target is well below the >9% for FY22e, though, I suspect management has embedded a wide safety margin here. With strong tailwinds from wage/medical inflation and investment income growth, as well as continued opex efficiencies, I see ample room for more beat-and-raise quarters ahead.

Executing The Inorganic Growth Playbook

Net, I view AJG’s expansion of its employee benefits portfolio via the Buck acquisition as a good move. Backed by a strong cash position and an increasingly M&A-friendly environment, AJG is sticking to a growth playbook that has worked in recent years to drive through-cycle earnings growth. The only difference this time is that it isn’t a P&C deal but an adjacency, which could be an advantage near-term, given the ongoing wage and medical inflation tailwinds. Over the long run, adding Buck highlights AJG’s intent in scaling beyond P&C to adjacent service offerings for its P&C-heavy client base. Depending on execution, this strategy could extend the earnings growth runway significantly.

In the meantime, the guidance bar seems conservative at a >50bps margin expansion and mid-to-high-single-digits organic growth in the core brokerage business for FY23. While some caution is warranted given the potential macro headwinds, stronger wage-driven benefits growth, fiduciary investment income, and more cost efficiencies should drive upside. The stock isn’t optically cheap at ~19x fwd earnings, but the valuation is more than justified by the consistent double-digit growth algorithm.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.