[ad_1]

bymuratdeniz

Callon Petroleum’s (NYSE:CPE) 2023 results may be not be as strong as I had previously modeled as strip prices have fallen somewhat further, while cost inflation pressure is also cutting into margins.

I am now projecting Callon’s 2023 free cash flow at $457 million at strip ($74 WTI oil), which would be enough to reduce its net debt to around $1.75 billion (1.15x leverage) by the end of 2023.

Weaker near-term cash flow expectations have reduced my estimate of Callon’s value to $58 per share at long-term $70 WTI oil and $4 NYMEX gas. I’d expect the cost inflation pressure to ease up a bit due to the deterioration in forward year strip prices, though.

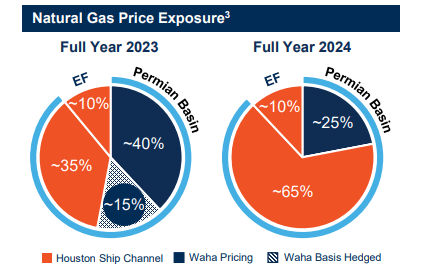

Natural Gas Price Exposure

Callon expects to have 40% of its 2023 natural gas production exposed to Waha pricing (without hedges) and another 15% protected by Waha basis hedges at negative $0.75. The remaining 45% is exposed to Houston Ship Channel pricing.

Callon’s Natural Gas Pricing Exposure (callon.com)

This is expected to shift to 75% Houston Ship Channel pricing and 25% Waha pricing in 2024, which should improve Callon’s overall unhedged natural gas differentials. Houston Ship Channel prices typically average close to NYMEX over the full year, while the Waha differential can sometimes get quite wide. Waha basis futures were averaging around negative $2 for 2023 and negative $1 for 2024.

Potential 2023 Outlook

I am now modeling Callon’s 2023 production at 106,500 BOEPD (63% oil). This is similar to its expected Q4 2022 production levels and slightly (2% to 3%) higher than its guidance for full-year 2022 average production.

At the current strip of approximately $74 WTI oil and $4 NYMEX gas, Callon is projected to generate $2.123 billion in revenues after hedges.

| Type | Barrels/Mcf | $ Per Barrel/Mcf (Realized) | $ Million |

| Oil | 24,489,675 | $73.00 | $1,788 |

| NGLs | 7,385,775 | $27.00 | $199 |

| Natural Gas | 41,982,300 | $2.85 | $120 |

| Hedge Value | $21 | ||

| Total Revenue | $2,128 |

I am now using $900 million for Callon’s operational capex budget for 2023, although a scenario with continued low-to-mid $70s WTI oil may lead to an easing up of some of the cost inflation issues. Thus, I think Callon has the capability of maintaining production at 106,500 BOEPD with less than a $900 million budget if oil prices remain at current levels.

| $ Million | |

| Lease Operating Expense | $300 |

| Gathering, Processing, and Transportation | $100 |

| Production and Ad Valorem Taxes | $126 |

| Cash G&A | $90 |

| Cash Interest | $155 |

| Operational Capital Expenditures | $900 |

| Total Expenses | $1,671 |

Callon is now projected to generate $457 million in positive cash flow in 2023 at $74 WTI oil with the above expenses.

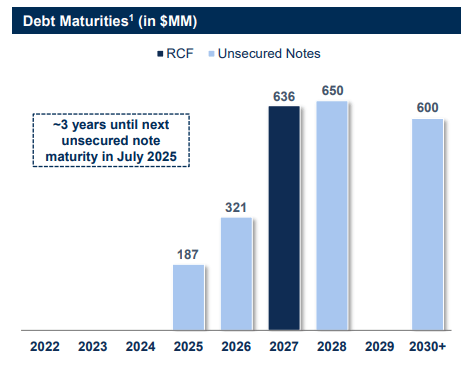

Debt Maturities

Callon’s credit facility maturity date was extended from December 2024 to October 2027. The credit facility borrowing base was increased from $1.6 billion to $2.0 billion, while the elected commitment amount was reduced from $1.6 billion to $1.5 billion.

As well, Callon’s credit facility has been adjusted to use SOFR rather than LIBOR while the maximum leverage ratio has been decreased from 4.00 to 1.00 to 3.50 to 1.00.

Callon does have $508 million in unsecured notes maturing in 2025 and 2026, but it should be able to deal with those notes effectively now that its credit facility maturity date has been extended.

Callon’s Debt Maturities (callon.com)

Callon is aiming for a longer-term target of around $2 billion in debt and leverage of 1.0x. It is currently projected to end 2022 with approximately $2.21 billion in net debt.

Based on current strip prices (and the scenario I mentioned above), Callon may be able to reduce its net debt to around $1.75 billion by the end of 2023. This would be approximately 1.15x Callon’s projected 2023 EBITDAX with $74 WTI oil.

Notes On Valuation

Callon’s estimated value has been reduced to around $58 per share in a long-term (after 2023) $70 WTI oil and $4 NYMEX gas scenario. This would be a total enterprise value of approximately $5.3 billion based on Callon’s projected year-end 2023 net debt.

Another way to look at it would be that this would value Callon’s production at around $40,000 per flowing BOE and its remaining inventory (at the end of 2023) at $1.06 billion.

Conclusion

Callon’s projected free cash flow for 2023 is now at $457 million at $74 WTI oil. It has been negatively affected by the combination of weaker commodity prices and cost inflation pressure. Despite that, it should still be able to reduce its net debt to around $1.75 billion by the end of 2023, which would be approximately 1.15x its 2023 EBITDAX.

I still believe there is considerable upside to Callon in a long-term $70 WTI oil scenario, and would value it at $58 per share in that scenario. Inflationary pressures should ease up at $70 WTI oil as well.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.