[ad_1]

adventtr

The U.S. economy is at a turning point as the Federal Reserve’s aggressive monetary tightening appears to be working as intended. To be clear, we are not referring to the turning point in inflation because CPI readings have already peaked way back in June 2022. Instead, we are referring to a turning point in hawkish sentiment. And this is crucial in terms of determining how markets are likely to behave in the near future.

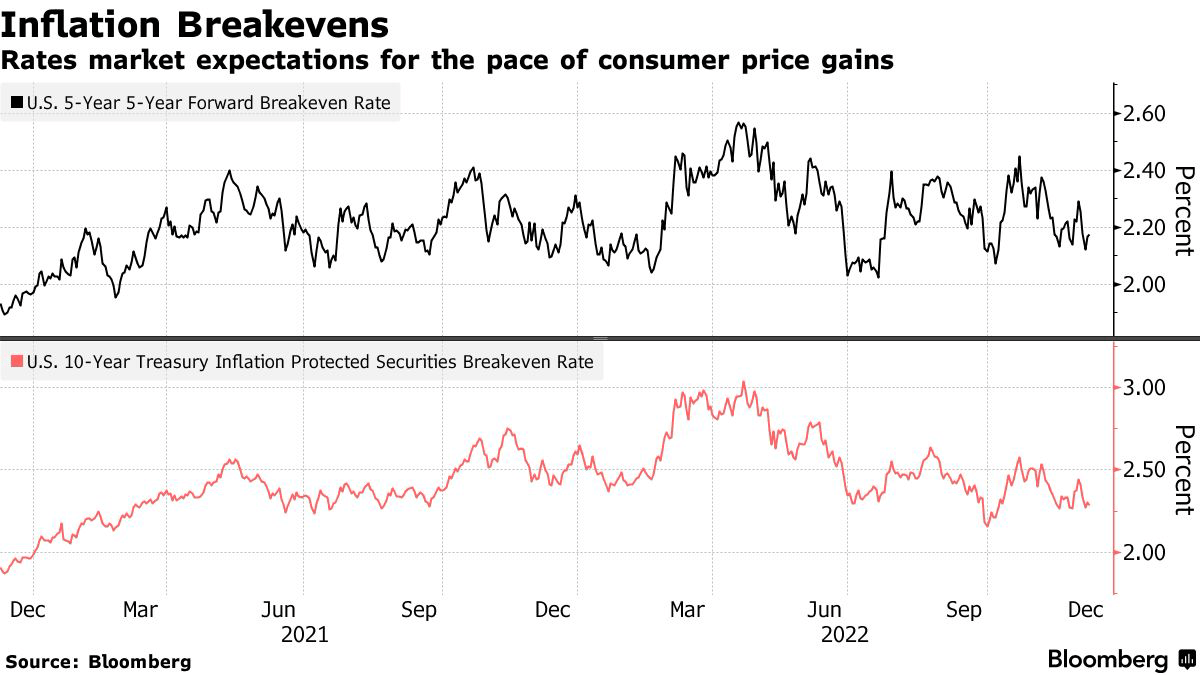

Inflationary expectations have moderated significantly while doomsday scenarios suggesting a potential return to the stagflationary period of the 1970s also seem to have dissipated from the financial media. A recent report from the Federal Reserve Bank of New York showed that November median inflation expectations for both one-year and three-year horizons decreased by 0.7 percentage points to 5.2%, and by 0.1 percentage points to 3.0%, respectively.

Bloomberg

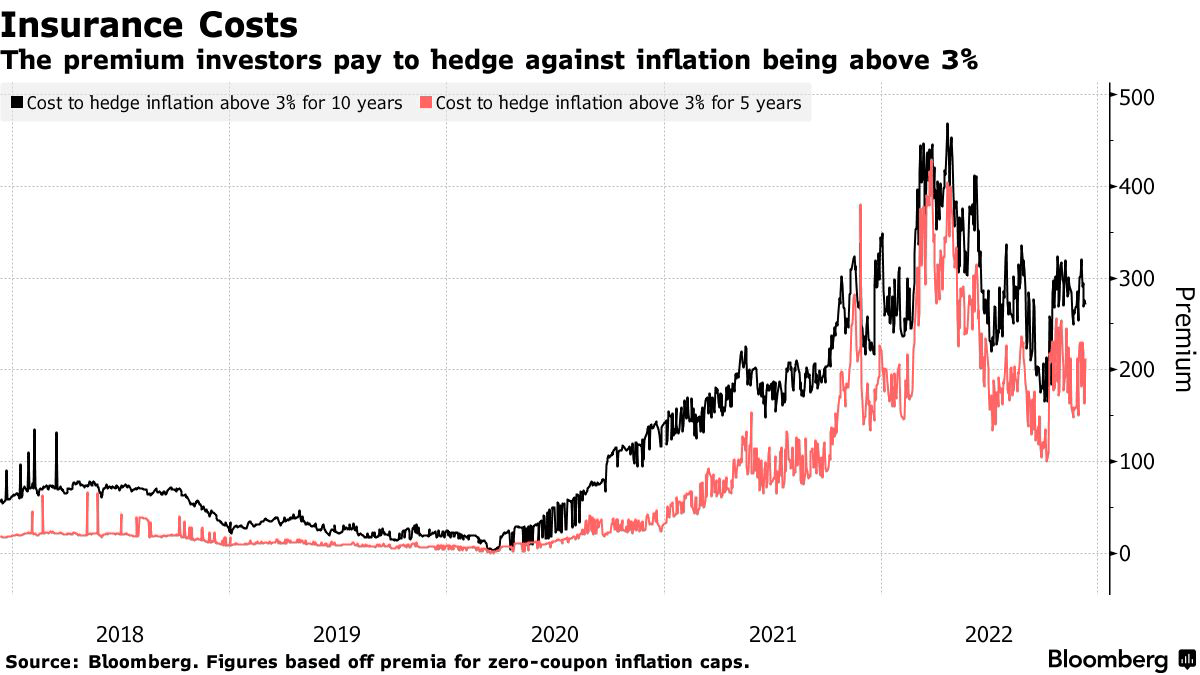

Breakeven rates, which measure market expectations for inflation have moderated substantially since April 2022. Insurance costs to hedge against inflation have also declined. Meanwhile, mentions of a possible soft landing for the U.S. economy have also begun to surface.

Bloomberg

As the picture on inflation becomes clearer, we believe that the U.S. dollar will see further weakness in 2023 as the Federal Reserve pauses on monetary tightening while expectations for a pivot continue to build in the coming months.

Commodities Stand To Benefit From Dollar Weakness

Given that most globally traded commodities are priced in dollars, a weaker dollar means commodities become less expensive relative to other currencies. This to some extent stimulates demand for commodities and also alleviates inflationary pressures for importing countries.

More specifically, we expect copper and crude oil to outperform. China’s reopening of its economy will also play an important role in driving demand for commodities. Although we remain sceptical of a smooth reopening in China due to inadequacies in the country’s vaccination program, we believe that the government’s old playbook of relying on infrastructure investments to boost the economy and efforts to restart unfinished real estate projects will be positive factors driving copper prices higher.

We also hold a constructive view on crude oil prices and have very recently initiated a “Buy” rating on the ProShares Ultra Bloomberg Crude Oil ETF (UCO) on 12 December. We believe that crude prices will be supported by factors including the Biden administration’s plan to replenish the Strategic Petroleum Reserve at US$70/bbl, and growing pressure on OPEC+ to cut production.

iShares S&P GSCI Commodity-Indexed Trust ETF

For investors looking to build exposure to commodities as an asset class, the iShares S&P GSCI Commodity-Indexed Trust ETF (NYSEARCA:GSG) may be a suitable choice.

According to fund information provided by iShares, GSG seeks to track the results of the S&P GSCI Total Return Index, which represents a diversified, fully collateralized investment in futures contracts.

The commodities included in the index are weighted, on a production basis, to reflect the relative significance (in the view of the Index Sponsor) of those commodities to the world economy. The fluctuations in the level of the index are intended generally to correlate with changes in the prices of those physical commodities in global markets.

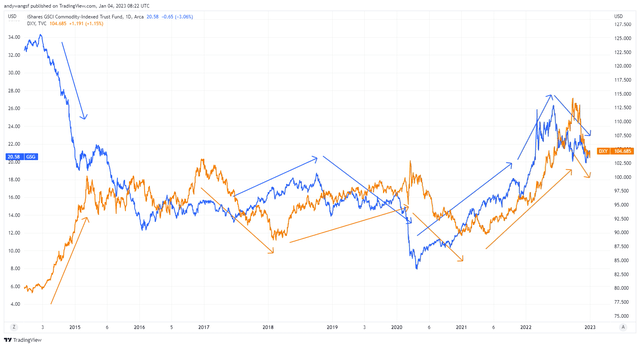

As the accompanying chart shows, GSG (orange line) generally trades inversely to the dollar index (DXY), which tracks the performance of the U.S. Dollar against a basket of currencies. Of course, other factors specific to the U.S. dollar or specific commodities may cause this relationship to fail from time to time.

Indeed, beginning sometime in late 2021, elevated inflation and the prospect of aggressive monetary tightening sent both commodities and the U.S. dollar surging. But as monetary policy normalisation comes to the fore in 2023 and inflation continues on its downward trend, we expect the negative correlation between the two to resume.

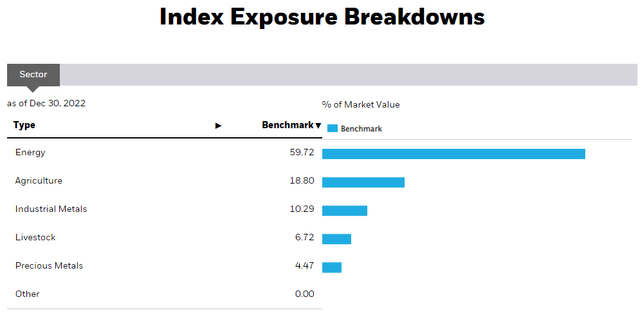

A Concentrated Bet On Energy

In terms of the breakdown of GSG’s holdings, however, investors should take note that it is quite heavily weighted towards the energy markets. Therefore, GSG may not provide adequate diversification for investors seeking to build a more balanced exposure across a broader basket of commodities. As the accompanying table shows, energy markets make up 59.7% of the index’s exposure.

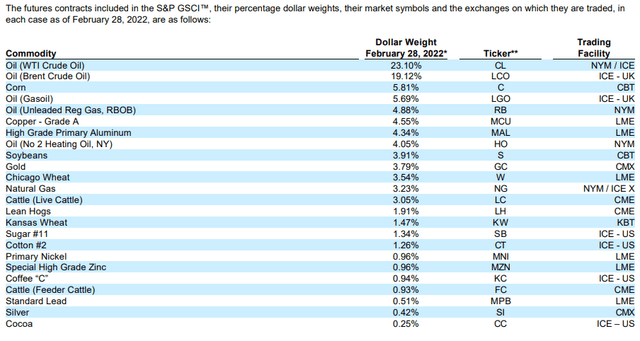

Below is a more detailed but slightly outdated breakdown of the index’s exposure by futures contracts as of February 2022. Crude oil futures alone, make up around 42% of GSG’s portfolio. Unfortunately, copper only makes up a fraction of GSG’s portfolio at around 4.6%.

Due to commodity ETFs having to constantly switch out nearer futures contracts for contracts that are further away from expiry in order to maintain positions over extended periods of time, the cost of switching contracts adds up over time. Furthermore, diversified commodity ETFs typically hold positions in more than 10 commodity markets at any point in time. Maintaining these futures positions inevitably requires a large number of transactions that further add to the cost of running the fund. Consequently, GSG’s expense ratio is high at 0.86%, similar to peer commodity ETFs.

In Conclusion

Overall, for investors looking to quickly build exposure to commodities with the intention to overweight crude oil, GSG would be an excellent choice.

While we expect GSG to do well in 2023 due to its heavy crude oil exposure, we prefer to take a more selective approach to the commodity markets by taking a more concentrated position on crude oil and copper. Thus, we are sticking with our existing positions on UCO and COPX.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.