[ad_1]

imaginima

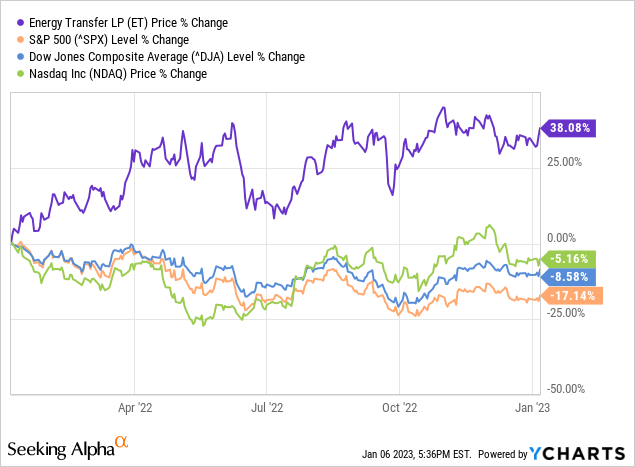

Energy Transfer (NYSE:ET) has been a long-standing investment for me. In the face of significant market turmoil, including material drops in the S&P, Dow Jones, and Nasdaq indices, ET has proved to be a reliable source of stability. Over the past year or so, ET has generated a return of around 40%, while the Nasdaq, Dow Jones, and S&P 500 indices have declined by 5.2%, 8.6%, and 17.1%, respectively.

What a massive outperformance, especially in the face of various economic challenges including inflation, rising interest rates, uncertainty about an economic recession, as well as ongoing concerns about energy security due to the conflict between Russia and Ukraine.

The partnership offers an attractive distribution yield of nearly 9%, supported by a strong distribution coverage ratio. In fact, the distribution yield is nearly 6 times the S&P dividend yield of around 1.5%. All of this is supported by strong fundamentals, with the company consistently setting new records. Specifically, ET achieved record intrastate natural gas transportation volumes in Q3 2022, Midstream gathered volumes reached a new record in Q3 2022, Nederland and Marcus Hook Terminals set new records for ethane exports in Q3 2022 and NGL fractionation volumes reached a new record in Q3 2022. What’s more, ET recently completed the construction of the Gulf Run Pipeline with compression modifications expected to be completed by the end of 2022 and has signed new LNG offtake agreements for the Lake Charles LNG project. In other words, ET is firing on all cylinders. This is reflected in the partnership’s financials. As a result, Energy Transfer has increased its 2022 guidance for the 3rd time. The expected adjusted EBITDA is now in the range of $12.8-$13.0 billion, up from the previous range of $12.6-$12.8 billion, and growth capital remains between $1.8 and $2.1 billion.

It is anticipated that distributable cash flow will reach $1.6 billion, an increase of about 20% from the same period in the previous year. Additionally, excess cash flow after distribution payments is expected to be around $760 million. This means that on an annualized basis, Energy Transfer is setting aside over $3 billion after distribution payments. This is particularly impressive considering the partnership’s market capitalization remains below $40 billion.

What’s more, Energy Transfer is making progress on a number of strategic initiatives. For example:

- In August 2022, ET completed the previously announced sale of ET Canada for cash proceeds of ~$302 million. The sale reduced ET’s consolidated debt by ~$850 million.

- On December 5, 2022, ET priced $1 billion of 5.55% senior notes due 2028, and $1.5 billion of 5.75% senior notes due 2033. The partnership intends to use net proceeds to repay outstanding indebtedness and for general purposes.

- In September 2022, ET completed the Woodford Express bolt-on acquisition for $485 million.

- In 2022, ET executed six long-term LNG SPAs to supply 7.9 million tonnes of LNG per annum. This will boost ET’s contracted cash flow.

At this point it is important to highlight that the vast majority (nearly 90%) of Energy Transfer’s earnings are derived from fee-based contracts, which means that fluctuations in commodity prices have little effect on the partnership’s earnings. Despite this, energy demand is booming. Domestic natural gas demand is at all-time high, having increased by nearly 65% over the last two decades and the Lake Charles LNG Export Terminal is receiving increasing interest as global LNG demand grows (ET is now targeting FID by end of Q1 2023).

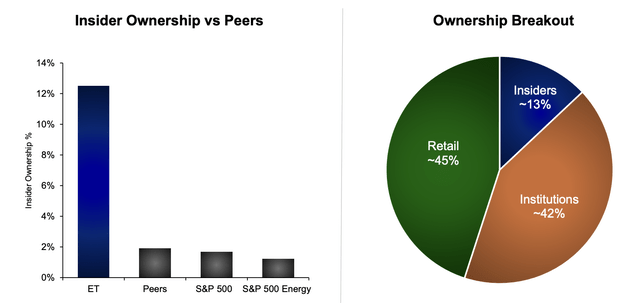

It is evident that ET is heading the right direction on all fronts. This is supported by insider activity. Since January 2021, ET insiders as well as independent board members have purchased approximately 29.4 million units, totaling approximately $265 million. This includes purchases of approximately $37 million by Kelcy Warren, the company’s Executive Chairman in November 2022.

Energy Transfer December 2022 Investor Presentation

It is fair to say that Management and Insiders are significantly aligned with common unitholders. All this is extremely positive.

In my view, what matters the most to ET investors is the attractive and stable income. After all, ET is an MLP (master limited partnership), which is predominantly an income vehicle. As mentioned above, ET is a promising investment opportunity due to its attractive distribution yield of around 9%, and the distribution is well covered, leaving ample cash on hand for corporate priorities such as M&A, debt repayment, as well as distribution increases.

For Q3 2022, ET paid a quarterly cash distribution of $0.265 per common unit, which is equivalent to $1.06 on an annualized basis. This represents an increase of more than 70% compared to Q3 2021 and a 15% increase over Q2 2022. The distribution increase is in line with the partnership’s plan to return value to unitholders while maintaining its target leverage ratio of 4.0x-4.5x debt-to-EBITDA. The ultimate goal is to return to the previous pre-COVID level of $0.305 per quarter, or $1.22 on an annual basis, while considering the partnership’s leverage target, growth opportunities, and unit buy-backs.

In short, an investor in ET today can lock in a distribution yield of almost 9% and a pro-forma yield exceeding 10%. It is my belief that the partnership will eventually surpass its pre-COVID distribution level of $1.22 per unit on an annual basis by a wide margin. Along with its strong distributions, ET is investing in high growth areas such as LNG export terminals and has a dedicated Alternative Energy Group working on renewable initiatives like solar and carbon capture. In other words, ET is much more than a traditional oil and gas pipeline company and there are exciting times ahead for its investors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.