[ad_1]

sankai

That is a tried and true trader’s saw, which, unfortunately, like all saws, is not 100% accurate. The shorter version of the same saw – due to the ways of instant gratification brought on by high-speed internet – is “as goes the first week of January so goes the year”. So how did the first week go in 2023?

Up!

The past shortened holiday week saw dramatic selling into a strength that marked the low of the week for the S&P 500 on the first trading day of the new year, while on Friday we saw dramatic buying of the dip due to cooling wage gains and ISM price indicators that marked the high of the week.

Don’t get me wrong, I do think the year will be as volatile, even if not more volatile than 2022, simply because I do not believe that the fastest rate hiking cycle in Federal Reserve history (relative to the base interest rate when it started) has not sunk into the economic numbers yet. Monetary policy works with long and variable lags and to make matters worse those lags can be more profoundly variable at times. Simply put, we have not seen all the results of Powell’s belated monetary tightening yet.

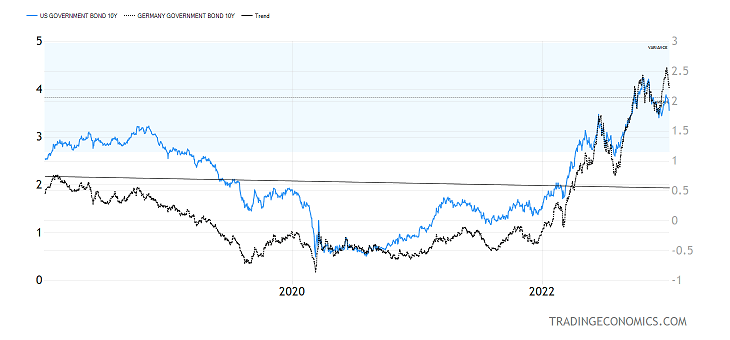

Trading Economics

Graphs are for illustrative and discussion purposes only. Please read the important disclosures at the end of this commentary.

What bothered me in 2022 is that the volatility in Treasury prices was far bigger than the volatility in stock prices. The 10-year Treasury yield tripled, which is in and of itself a crash in bond prices. But what do we say about the German 10-year bund? That one went from negative to 2.56% in 2022, which cannot be even called a triple. Try infinity maybe?

I think in 2023 bonds and stocks will trade places and the volatility in stock prices will be bigger than the volatility in bond prices. What also bothered me in 2022 is how mechanical the selling in stocks was at times with volatility indexes like the VIX, VXN, and RVX literally failing to respond to the selling pressure on the tape. That may change in 2023.

How to Be, or Not to Be, A Central Banker

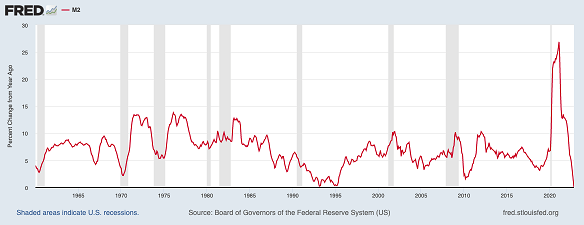

Board of Governors of the Federal Reserve System

Graphs are for illustrative and discussion purposes only. Please read the important disclosures at the end of this commentary.

Right now, the Fed funds futures market is betting that the Fed will pivot and reverse course despite the “higher for longer” narrative coming from the FOMC and that no rate cuts are coming later in the year. Powell is afraid of another Arthur Burns moment when the Fed in the 1970s backed off too early and inflation came back. But as discussed last week, due to the collapse in M2 growth which just hit “0” (as in zero), which has never happened before in all the data I have managed to find going back to 1960, I think inflation wild declined precipitously in 2023 possibly towards 2% by the end of the year.

Plus, Jerome Powell seems hell-bent on saving his reputation after messing it up pretty good in the latter part of 2021 and early 2022 with his belated monetary tightening, so it will be interesting to see how he reacts to somewhat rising unemployment and rapidly falling inflation. In the end, if we do get a soft landing, and I do think that is possible due to structural issues in the labor market where there simply are not enough workers, which may prevent massive layoffs, it would be difficult for the Fed to keep rates high if inflation is rapidly falling.

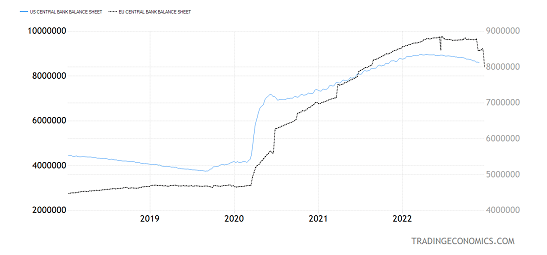

Trading Economics

Graphs are for illustrative and discussion purposes only. Please read the important disclosures at the end of this commentary.

The great unknown remains quantitative tightening (QT), which is ongoing at a rate of $95 billion per month at present in the US and lately at a bit sharper rate in Europe. That is the same exact thing as sucking electronic dollars out of the financial system and shrinking the monetary base, or M0, the narrowest form of the money supply. I remember well what happened in December 2018 when the Fed over-tightened and pressed too hard on QT. Nobody knows what the critical level of excess reserves in the system is so sparks may fly again.

The thing about this central bank’s quantitative business is that it can distort the stock market dramatically. Stocks can go down a lot even if the economy is doing well and earnings are rising (as QT did in 2018), or stocks can go up a lot even if earnings are shrinking and the economy is under stress (as QE did in 2020).

What will QT do in 2023? Stay tuned.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.