[ad_1]

imaginima

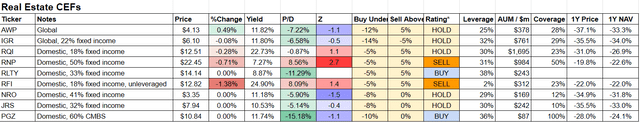

There are nearly 500 closed-end funds that investors can choose from. We help try to cut through those to find out what is worth buying and when. Our CEF Watchlist allows snapshots into many different closed-end funds while also providing Buy, Sell or Hold ratings.

The CEF Watchlist is also a great resource for looking at CEF swap opportunities. At the CEF/ETF Income Laboratory, we’ve refined the strategy of CEF rotation in order to gain “free shares” of our favorite funds.

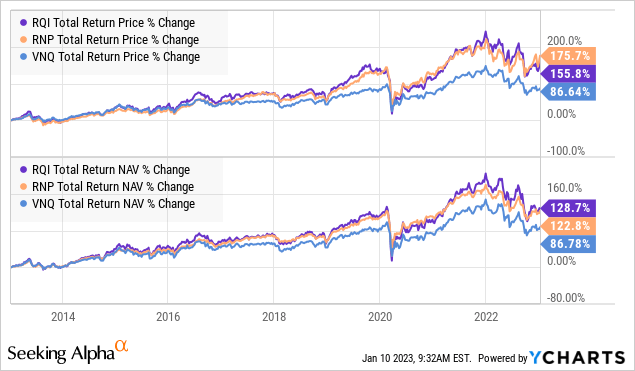

One such opportunity that presents itself today is among the stable of Cohen & Steers REIT CEFs. I consider these the “gold standard” of REIT CEFs, with two of the more well-known funds, Cohen & Steers Quality Income Realty Fund (RQI) and Cohen & Steers REIT and Preferred and Income Fund (RNP), solidly outperforming the Vanguard Real Estate ETF (VNQ) over the past 10 years. (While it is true that RQI and RNP are leveraged, it should also be noted that the unleveraged Cohen & Steers Total Return Realty Fund (RFI) also outperformed VNQ over this time frame).

The swap opportunity

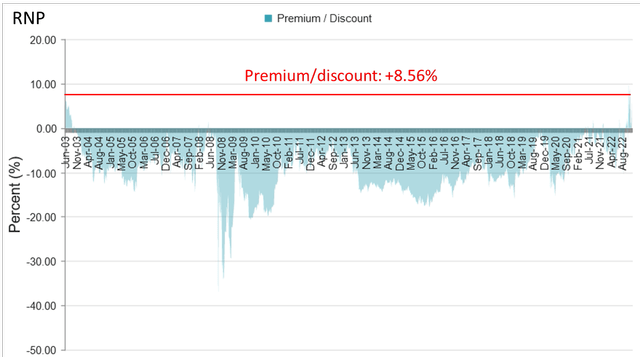

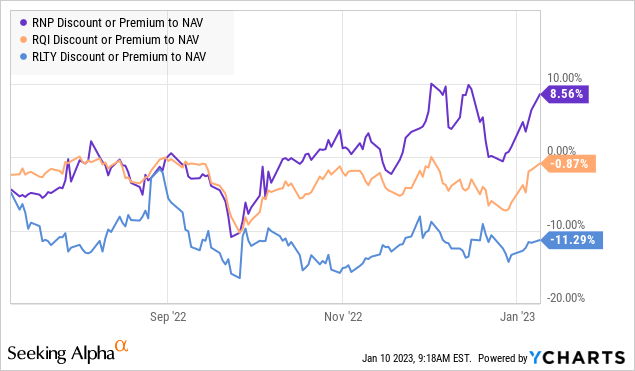

A large divergence has recently opened up between the valuations of RNP with RQI and a third Cohen & Steers fund, the Cohen & Steers Real Estate Opportunities and Income Fund (NYSE:RLTY). As can be seen from our handy CEF Watchlist tool, RNP trades at a +8.56% premium with a 1-year z-score of +2.7, putting into “sell” territory based on our premium/discount targets.

In contrast, RLTY trades at a -11.29% discount, making it nearly 20 percentage points cheaper than RNP! RLTY is marked as a “buy” on the sheet.

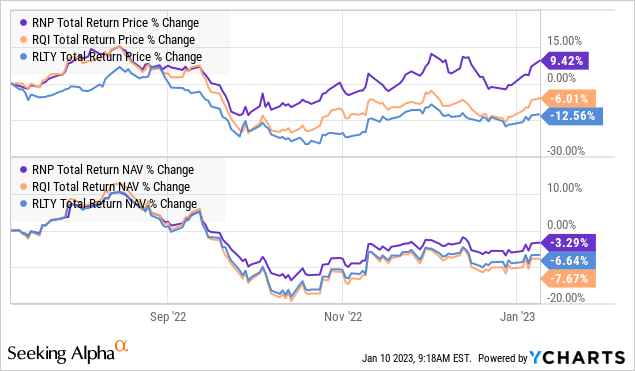

We can see the effect of this divergence in the price and NAV charts below. RNP has outperformed RLTY by “only” +3.35% at the NAV level over the last 6 months, but its price return is a whopping +21.80% better.

YCharts

Experienced CEF investors will know that the above is caused by a divergence in premium/discount valuations. About 6 months ago, RNP, RQI and RLTY were trading at about the same discount level. However, RNP’s premium has rocketed higher while RLTY’s valuation has become depressed.

YCharts

It is also worth noting that the premium of RNP is at its highest levels since inception of the fund in 2003.

What explains this 20 point valuation discrepancy between RNP and RQI? There could be a number of reasons.

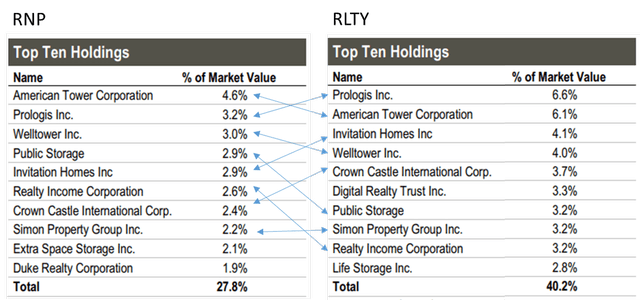

First, RNP has a higher fixed income component (about 50%) compared to RLTY (around 33%). This has helped buffer RNP’s downside, as rising rates hit REITs hard. This can be seen in the chart above where RNP outperformed RLTY slightly at the NAV level over the last 6 months.

Second, RNP (but not RQI or RLTY) had a large year-end special distribution of $1.0714 that was paid out last month (ex-date December 7, 2022). This could have attracted dividend hunters into the stock in order to get the fat dividend, pushing up the price.

Third, RLTY is a relatively new fund being only incepted in February 24, 2022, meaning that it hasn’t passed its first year anniversary yet. Newer funds can often trade at discounts vs. their similar peers, due to lack of investor participation.

It is our expectation that the discount differential between RNP and RLTY will close over time. This is mainly because the allure of RNP’s special distribution will fade, while RLTY should attract more interest from investors as it becomes more well-known. RNP and RLTY run very similar equity portfolios, which explains why their returns have tracked each other relatively closely despite differences in the size of their fixed income allocations.

A final point to note is that RLTY is a term fund that is due to liquidate on February 23, 2034. While that is still some years away, this structure should provide an additional tailwind to RLTY as the discount is expected to gradually approach zero as the liquidation date nears.

Nick (a member of the CEF/ETF Income Laboratory team) last covered RLTY for our members here: RLTY: Large Discount In The Beaten Down REIT Space (public link)

Summary

Owners of RNP (+8.56% premium) are recommended to switch to RLTY (-11.29% discount) to take advantage of the premium/discount differential between the two funds. When the valuation difference reverts, one can then swap back from RLTY to RNP to gain “free shares” of RNP. For those reluctant to invest in such a new fund as RLTY, then the more established RQI (-0.87% discount) is also an excellent alternative to RNP.

We own RLTY in our Tactical Income-100 portfolio and RNP in our Income Generator portfolio.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.