[ad_1]

delihayat

Investment Thesis

The Direxion Daily Semiconductor 3x Bull Shares ETF (NYSEARCA:SOXL) is a way for bullish investors to play a rebound in the semiconductor industry. There is a high amount of risk involved in these types of exchange traded products and they are intended for holding periods of only one day. SOXL is a trading vehicle and not a long-term investment, but if traders are looking for short-term bullish leveraged exposure to the semiconductor industry it suits that purpose well.

Investment Objective

SOXL is a short term trading vehicle that provides leveraged bullish exposure to the semiconductor industry.

Direxion states on their website:

These leveraged ETFs seek a return that is 300% or -300% of the return of their benchmark index for a single day. The funds should not be expected to provide three times or negative three times the return of the benchmark’s cumulative return for periods greater than a day.

The SOXL fact sheet states:

Target Index: ICE Semiconductor Index (ICESEMI) is a rules-based, modified float-adjusted market capitalization-weighted index that tracks the performance of the thirty largest U.S. listed semiconductor companies. One cannot directly invest in an index.

The SOXL ETF is meant only for trading purposes. The objective is to give traders the opportunity to increase their bullish exposure to short-term moves in the semiconductor industry. The target index of the ETF is the ICE Semiconductor Index.

ICE Semiconductor Index

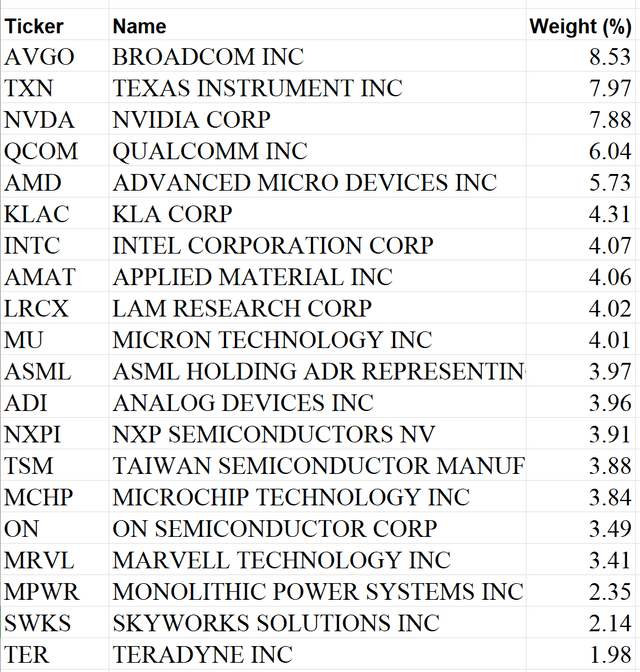

These are the top 20 holdings of the ICE Semiconductor Index:

ICE Semiconductor Index Components (ICE)

As we can see the holdings of the index give investors broad exposure to the semiconductor industry. All of these holdings are large and mature companies. This makes the SOXL ETF more of a macro-focused one than it may appear on the surface due to the nature of the industry. For the index to do well the cyclical semiconductor industry as a whole needs to be thriving. Many investors do not expect the industry to have a strong 2023, but there are many factors that could cause a sharp rebound in semis and leave holders of SOXL with substantial gains.

Macroeconomic Outlook

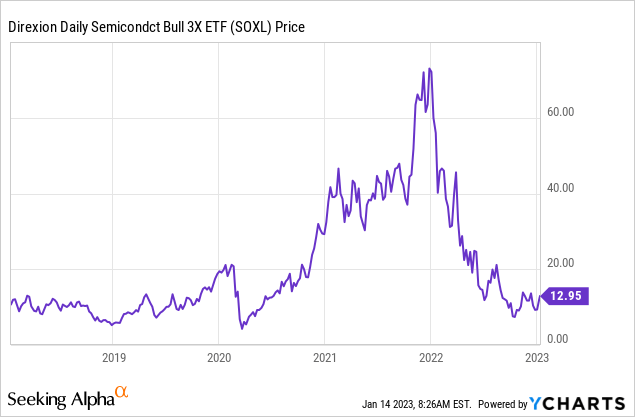

The semiconductor industry has sold off hard in 2022, and investors expect 2023 to be more of the same. Traders can capitalize on this bearish sentiment through the SOXL ETF. A similar phenomenon happened during the market selloff in 2020, which was followed by a nearly two year bull run in SOXL.

Some near-term catalysts that could fuel a sharp rebound in semis:

China reopening causing an increase in global economic activity and an increase in demand for semis.

Supply chain reshoring and government assistance to semiconductor companies could spur a sharp increase in demand for WFE.

EVs rapidly gaining market share and other instances of chip-dense products overtaking products with a lower chip content, thus increasing the long-term demand for automotive semiconductors.

A decrease in political tensions, especially those regarding Taiwan would significantly de-risk the sector and likely lead to sharp gains.

The Federal Reserve could stop increasing rates or even cut rates, causing a rebound in the hardest hit areas of the market such as the semiconductor industry.

A risk-on mentality returning to markets would benefit the stocks of semiconductor companies which traditionally do well in such environments.

Any of these catalysts could spark sharp short-term moves to the upside such as those SOXL experienced in 2020 and 2021. If investors are bullish on semiconductor stocks in 2023 purchasing SOXL is a way to take a leveraged contrarian position that could pay off big if catalysts materialize in the short-term.

Before investors use these products it is important to understand the risks involved.

Mechanics of Leveraged ETFs

Let’s say that you make a $100 purchase of a 3x leveraged ETF such as SOXL. The next day the index the ETF tracks increases by 1%, the leveraged ETF should increase by 3%. Instead of making $1 you made $3. Sounds easy enough right?

Of course, the position could move against you. If the index instead declined by 1% the ETF would decline by 3%, leaving you with $97 instead of $99.

The main issue with leveraged ETFs is that volatility can cause the ETF to decline over time even if the index itself remains flat. This is why these types of ETFs are meant to have a holding period of only one day, the math does not favor holding over a longer period of time.

Here’s an example of this:

Say an index drops from $100 per share to $97 per share, a loss of 3%. In that case a 3x leveraged ETF will drop by 9%, from $100 per share to $91 per share.

The next day the index instead gains 2%, bringing it up to $98.94 for a net loss of 1.06%. However, the corresponding 6% gain in the 3x leveraged ETF only brings the price up to $96.46 leaving it with a net loss of 3.54%.

3 x 1.06% = 3.18%, but the leveraged ETF lost 3.54% over that two day period.

Because of this math, leveraged ETFs lose more money when volatility is high.

Risks

If the underlying index decreases by 33.33% or more in a day the ETF would go to zero. This is a total loss with no possibility of recovery.

For those who hold this ETF for more than a day they could be harmed by volatility, and even if they are correct about the direction of the index they could still lose money by holding the leveraged ETF that tracks the index.

Key Takeaway

For traders who are bullish on the semiconductor industry SOXL is a way to increase leverage to short-term moves. Traders should be very aware of the risks before taking a position in SOXL or any other leveraged ETF.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.