[ad_1]

puhimec

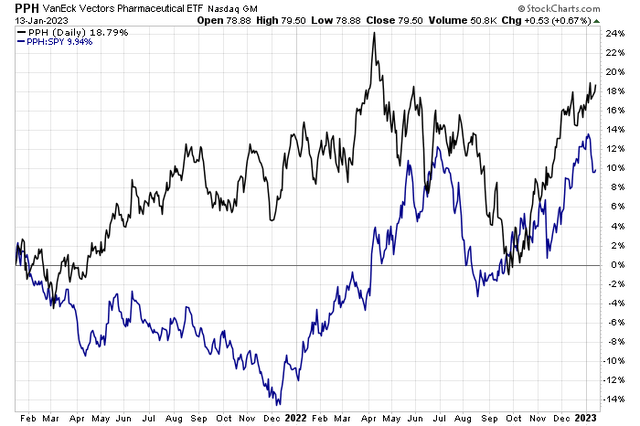

Pharmaceutical stocks have been a nascent space of safety and growth in a volatile market over the last year plus. The group rallied hard on a relative basis during the first half of 2022, but then gave back some of those relative gains while the broad market rose in the summer. Lately, though, there has been a return to favor in the VanEck Vectors Pharmaceutical ETF (PPH).

One stock in the ETF, along with Eli Lilly (LLY), has a big share of the weight-loss drug market. It’s a highly rated stock by both BofA and Goldman Sachs, but is the valuation now stretched? And what does the chart say ahead of earnings next month? Let’s investigate Novo Nordisk (NVO).

Pharma in Focus

Stockcharts.com

According to Bank of America Global Research, Novo Nordisk is a world leader in insulin and diabetes care and manufactures and markets a variety of other pharmaceutical products. Key products include Victoza (GLP-1) and long-acting basal insulins Levemir and Tresiba.

The Denmark-based $307 billion market cap Pharmaceuticals industry company within the Health Care sector trades at a high 40.5 trailing 12-month GAAP price-to-earnings ratio and pays a small 0.8% dividend yield, according to The Wall Street Journal. Earlier this month, Novo said a shortage of its weight loss drug Wegovy had ended. The company continues to have some dominance in the vital weight loss and obesity drug market, which should help sustain positive momentum for the stock.

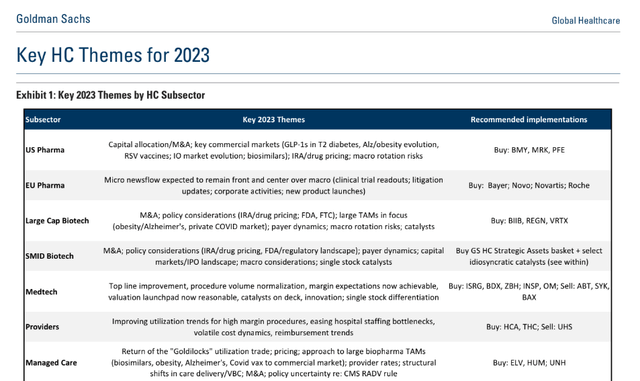

Goldman Sachs: Bullish on Novo

Goldman Sachs Investment Research

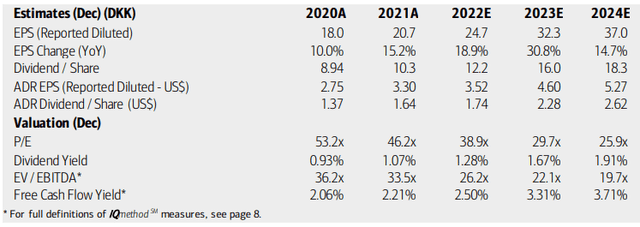

On valuation, analysts at BofA see earnings having risen by nearly 20% in 2022. EPS growth is then forecast to accelerate this year with still-robust earnings advancement in 2024. Dividends, meanwhile, are expected to rise commensurate with per-share profits for international investors and US investors buying the ADR shares. With big growth ahead, it’s reasonable to expect the stock to trade with a valuation premium to both domestic and foreign equities. NVO’s EV/EBITDA is also around three times that of the ex-US market, but the firm is free cash flow positive.

With a high-growth company like Novo, I like to look at the forward PEG ratio. That’s a smidgen above 2, not far from the sector median, and an 18% discount to the stock’s 5-year average. Pricier than when I last covered the stock back in July of 2022, I continue to like the growth outlook but there are risks should Wegovy & Rybelsus sales perform worse than expected along with litigation and currency changes adversely affecting the firm.

Novo Nordisk: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

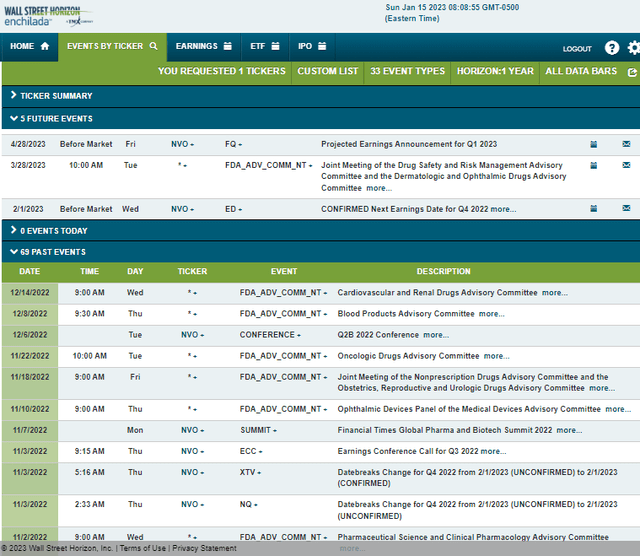

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q4 2022 earnings date of Wednesday, February 1 BMO. The calendar is light on volatility catalysts aside from the reporting date.

Corporate Event Calendar

Wall Street Horizon

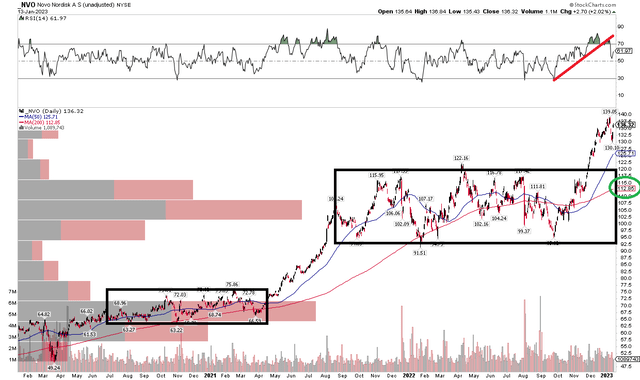

The Technical Take

NVO had another thrust higher from near $95 back in October to nearly $140 to start 2023. I eye support at its prior highs near $120, so a long position here with a stop under, say $110, makes sense. Notice in the chart below that shares have lost some momentum, so I would not be surprised to see a continued retreat into the $120s, but it is also possible that price simply resolves higher.

What I like is an uptrend 200-day moving average near $112, though that line has not been support or resistance in the past. Ultimately, a near-term upside target of around $150 makes sense based on the $30 range from the second half of 2021 through late 2022.

NVO: Shares Bust Higher After Consolidating

Stockcharts.com

The Bottom Line

With a big total addressable diabetes and weight loss market and a reasonable valuation for a high-growth pharma stock, I continue to like NVO here. While not as cheap as last summer, price momentum continues to run high on this international stock.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.