[ad_1]

MEDITERRANEAN/E+ via Getty Images

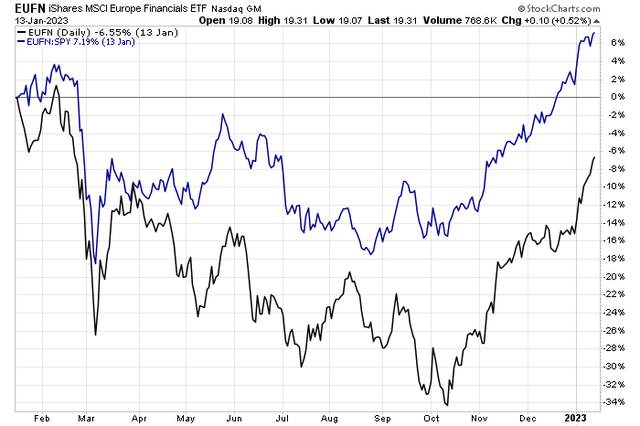

European financials are on an absolute tear. The group, as measured by the iShares MSCI Europe Financials ETF (EUFN), of once-beaten-down equities has surged more than 40% from its double-bottom low back in September and October to the highest weekly settle since February of last year. A stronger euro currency and broad return to favor of ex-US stocks have been major wins for the space along with reduced chances of a protracted recession in the Euro Area.

One bank has enjoyed a monster rally from a few months ago. But is there still value in shares of NatWest Group? And is the chart over-extended? Let’s check it out.

European Financials Fun!

Stockcharts.com

According to Bank of America Global Research, NatWest Group plc (NYSE:NWG) is primarily a UK-focused retail and commercial banking business. It carries out similar activities in the Republic of Ireland and has a relatively small broader international presence. Investment banking activities have been scaled down substantially and are now primarily aimed at servicing the company’s corporate customers.

The Edinburgh, Scotland-based $34.8 billion market cap Banks industry company within the Financials sector trades at a low 11.5 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.0% dividend yield, according to The Wall Street Journal.

NWG’s management team remains focused on cutting costs to improve its balance sheet. It appears poised to benefit from an eventual turnaround in the UK economy, though a recession in the country could be in the works this year. With shareholder accretive activities but a recent troubling earnings report and profit warning, there are mixed signals.

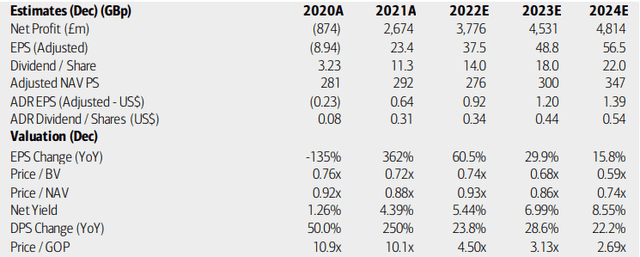

On valuation, analysts at BofA see earnings having risen sharply in 2022. Another year of impressive per-share profit growth is seen in 2023 before EPS growth slows a bit by 2024. In terms of ADR EPS adjusted to USD, earnings are steeply on the rise, and the stock trades at just a 12 forward operating earnings multiple, but that is up a lot from depressed levels in 2022.

Even still, the bank’s price-to-book value remains under 1, and NWG’s trailing 12-month dividend yield is slightly higher than its 5-year historical average, according to Seeking Alpha. I continue to like the valuation, but it is no longer a screaming buy. Readers should be encouraged, however, but NWG’s impressive 3rd ranking in the Financials sector.

NatWest: Earnings, Valuation, Dividend Yield Forecasts

BofA Global Research

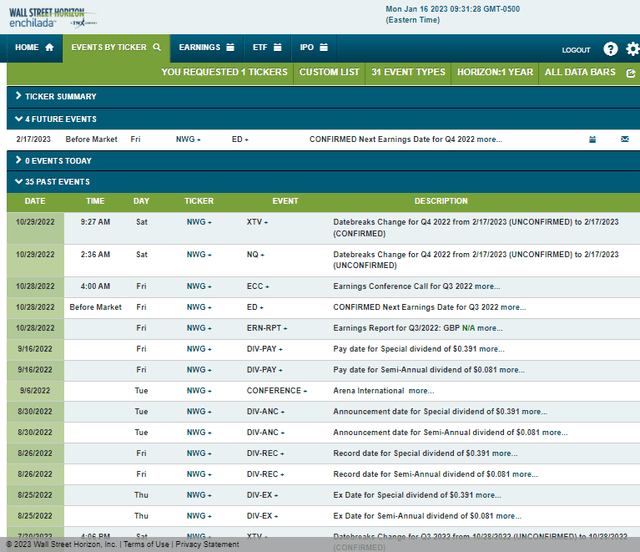

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q4 2022 earnings date of Friday, February 17 BMO. The calendar is light on volatility catalysts aside from next month’s reporting date.

Corporate Event Calendar

Wall Street Horizon

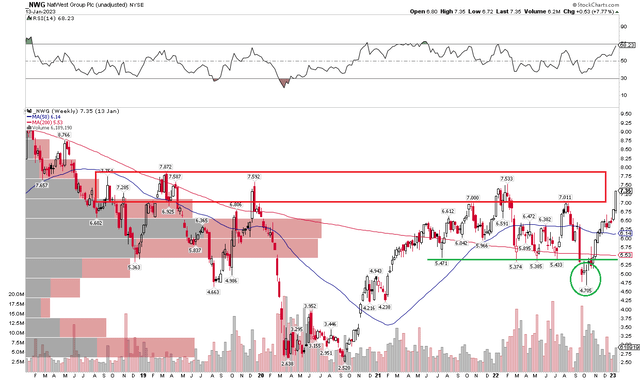

The Technical Take

NWG is coming off a monster week. Shares surged from near $6.80 to nearly $7.50. After a more than 40% run-up since late September, I see the stock has entered a potential resistance point. Notice in the chart below that shares have found some trouble in the $7 to $8 area. I noted that about $7 was first resistance in my September post, so some profit-taking here makes sense.

What’s bullish, though, is that the stock featured a false breakdown in October, under $5. Technicians like to say that from false moves come fast moves in the opposite direction. That played out, but the rally might have run its course. Still, there’s ample volume by price in the $5.50 to $6.50 range, so scooping up shares on a retreat to that zone is a prudent move.

Overall, I would be bullish on a move above $8, but the current area is a spot of historical selling. So, the bulls should be ready for a rest.

NWG: Shares Rise Into Resistance

Stockcharts.com

The Bottom Line

I have a near-term hold on NWG. We could see some back and fill on the stock and shares are not as big of a value today. I continue to like the stock as a European bank turnaround play in the long term though, so it remains categorically a buy.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.