[ad_1]

RiverNorthPhotography

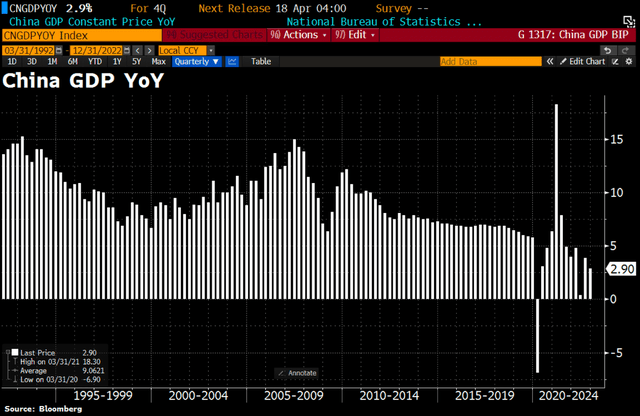

China reported much better-than-expected economic data earlier this week. GDP verified at 2.9% for Q4 annualized from a year ago. While that’s down from the prior year, it was much better than the sub-2% expectation.

As the nation reopens following draconian zero-COVID measures, consumer areas stand to benefit. But is too much optimism now priced in following a surge in China equities? Let’s focus on one restaurant name that is not far from its 2021 peak.

China Growth Better Than Forecast

According to Bank of America Global Research, As the first major global restaurant brand entering China, in 1987, Yum China (NYSE:YUMC) is the largest restaurant company in China. YUMC completed the spin-off from Yum Brands and became a separately listed company in October 2016. It has the exclusive right to operate and sublicense the KFC, Pizza Hut, and, subject to achieving certain agreed-upon milestones, Taco Bell brands in China, excluding HK, Taiwan, and Macau. It also owns the East Dawning and Little Sheep marks.

The Shanghai-based $25.2 billion market cap Hotels, Restaurants & Leisure industry company within the Consumer Discretionary sector trades at a high 29.9 trailing 12-month GAAP price-to-earnings ratio and pays a small 0.8% dividend yield, according to The Wall Street Journal.

Back in November, Yum China reported an impressive 5.1% year-on-year climb in sales with operating per-share profits of $0.49. What was particularly encouraging was that margins jumped from the same quarter last year. With new stores to be opened this year and significant capex seen, there’s certainly a growth story intact. But the stock looks expensive. Read on.

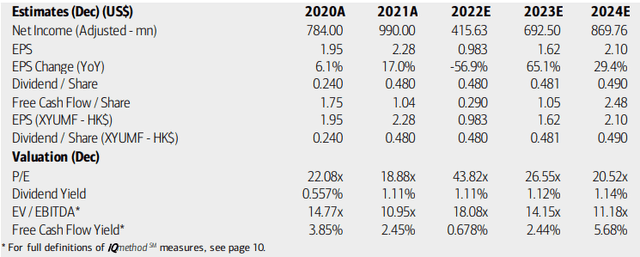

On valuation, analysts at BofA see earnings having fallen massively in 2022 given strict COVID-related lockdowns in China, but earnings are seen as rebounding big this year and even through 2024, eventually sending EPS back to 2021 levels. Dividends should be somewhat stable over the coming quarters, though.

What’s solid from a business and operating point of view is that free cash flow per share should remain positive throughout its volatile EPS period. The valuation is pricey, though, even considering an earnings bounce back. Much of the optimism may be priced in.

Yum China: Earnings, Valuation, Free Cash Flow Forecasts

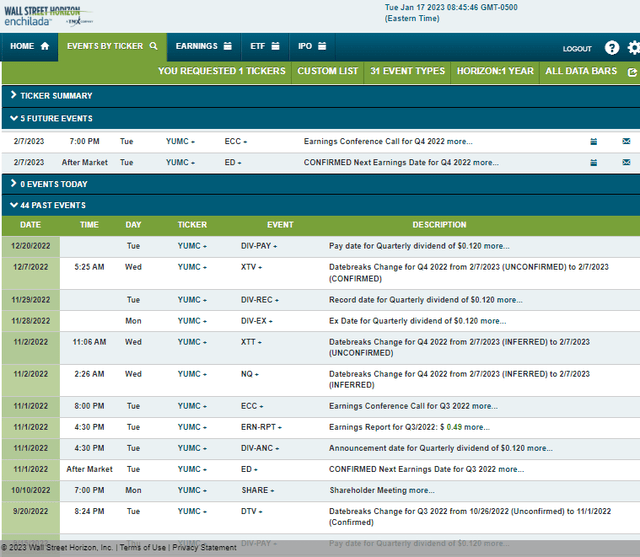

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q4 2022 earnings date of Tuesday, February 7 after market close with a conference call later that evening. You can listen live here. The calendar is light on volatility catalysts aside from the reporting date.

Corporate Event Calendar

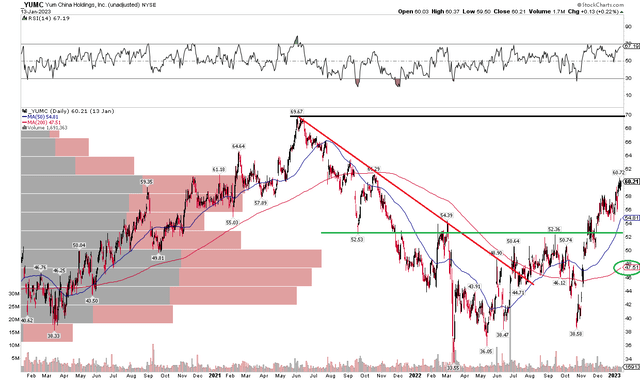

The Technical Take

YUMC, and China writ large, has rallied sharply in the last several months. Shares have nearly doubled after their March 2022 low just above $33. With a series of shaky higher lows, the trend is in favor of the bulls right now, but the stock looks stretched when comparing the latest price to its 200-day moving average.

While the long-term trend indicator has turned upward sloping, a positive feature, the stock could be due for some mean reversion to the low to mid-$50s. I’d be a buyer technically on that dip. What’s encouraging is that YUMC’s RSI at the top of the chart is holding onto the bullish 40 to 90 zone. Overall, it’s a mixed technical picture – while momentum is high, shares look extended while still trading below the mid-2021 peak.

YUMC: Best to Wait For a Pullback

The Bottom Line

I’d harvest gains in YUMC after its big move off the 2022 lows. The stock now looks expensive even when considering growth prospects. Buying on a move into the low $50s would be a viable strategy.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.