[ad_1]

courtneyk

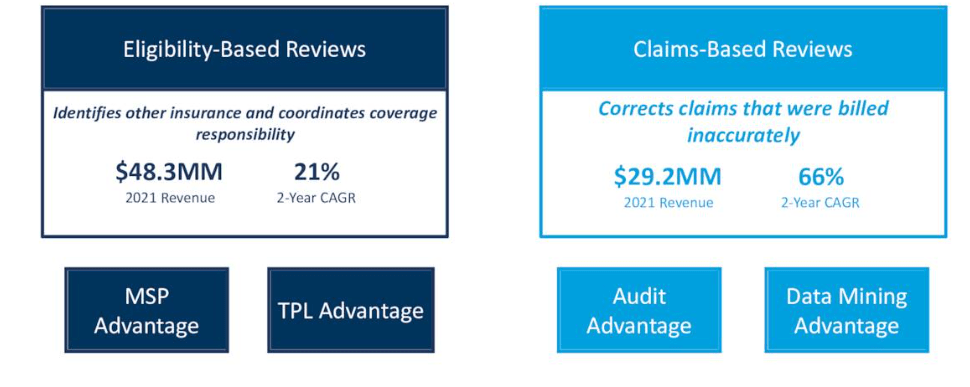

Almost two years ago, I praised Performant Financial Corporation (NASDAQ:PFMT) for its decision to abandon its legacy student loan recovery business and focus on the rapidly growing healthcare segment:

Company Presentation

That said, the performance of the new core business has also been impacted by the pandemic, as hospital utilization rates have remained below pre-COVID levels for the first half of 2022.

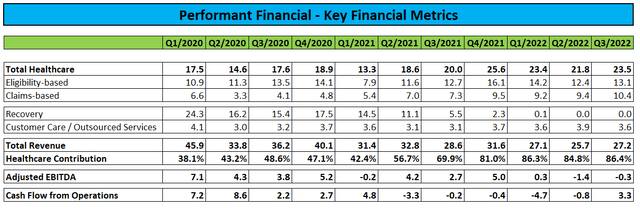

In November, Performant Financial reported sequentially improved third quarter results with decent cash flow from operations:

In combination with approximately $4.3 million in cash proceeds from asset disposals, unrestricted cash increased by 60% sequentially to $25.6 million while the company’s $15 million revolving credit facility remained undrawn.

On the flip side, management warned of lower-than-expected profitability for the year (emphasis added by author):

Our third quarter results were largely inline with our expectations and our long-term plan and strategy remains intact. Our healthcare offerings demonstrated continued year-over-year growth, which we expect will continue into 2023 based on our robust sales and implementation pipelines,” stated Rohit Ramchandani, Senior Vice President of Finance and Strategy at Performant. “Our cash position remains strong and we are pleased to reiterate our healthcare revenue guidance of $92-$96 million for 2022.

Following the recent re-affirmation of the contract award for RAC Region 2 from CMS, we expect to start spending on the implementation work in the current month. This RAC related spend in tandem with additional costs incurred during the protest process, as well as increases in operating expenses related to our transformation from legacy markets served to today, leads us to a revised EBITDA range for the year of negative $1MM to a positive $1MM.

Compared to previous projections, 2022 EBITDA expectations have been reduced by $3 million at the mid-point.

Moreover, as the company has started implementation work for the CMS RAC Region 2 contract in Q4, I would expect cash flow to turn negative again for the quarter.

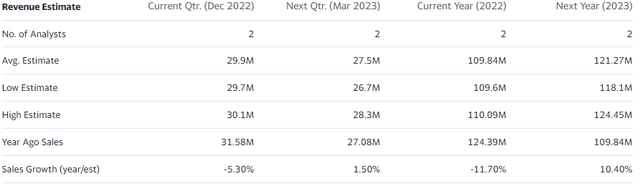

While Performant Financial has yet to provide guidance for 2023, expectations are rather muted, with the two-analyst consensus calling for just 10% growth:

With management expecting healthcare revenue growth to be driven by a robust sales and implementation pipeline, strong eligibility inventory developments, and a sustained rebound in hospital utilization rates, top-line results might surprise to the upside, but this will require the company implementing and ramping recent contract wins as soon as possible.

Assuming strong execution, I would expect profitability metrics to improve considerably and EBITDA to increase to a range of $5 to $10 million this year.

Bottom Line

While Performant Financial Corporation remains on track to achieve its previously communicated 2022 healthcare revenue projections, full year profitability targets have been reduced due to higher operating expenses and costs incurred to successfully defend a recent contract win.

Despite Performant Financial Corporation’s less-than-stellar 2022 operating performance, shares have rallied in recent months and are up by more than 100% from their October lows as investors are apparently looking forward to the improvements expected for this year.

While risk appetite has improved considerably since the beginning of the year, I would advise investors to hold off from opening or adding to existing Performant Financial Corporation positions at these levels and rather wait for management to provide full-year guidance on the Q4/2022 conference call in March.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.