[ad_1]

Vertigo3d

Investment Thesis

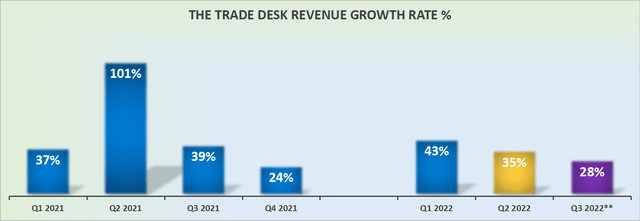

The Trade Desk (NASDAQ:TTD) reported Q2 results which saw its stock jump after hours. The Trade Desk’s guidance points to Q3 2022’s revenues growing by 28% y/y.

However, knowing that The Trade Desk hasn’t missed revenue estimates in at least its prior twelve quarters, management is likely to be lowballing its revenue guidance to allow for an easy beat later on.

Hence, for all intents and purposes, investors are eyeing up a 30% compounding machine.

However, given that the stock is already priced at 47x EBITDA, I question just how much upside is left in this stock. Hence, I’m neutral on the stock.

The Trade Desk’s Guidance Discussed

TTD revenue growth rates

The Trade Desk guides for Q3 revenues to be up 28% y/y. In a time when countless other advertising-related companies are guiding for either poor guidance or no guidance at all, The Trade Desk’s sub-30% CAGR was welcomed by investors.

The Trade Desk just went against its toughest quarterly comparison with last year, Q2 2021, and still posted solid revenue growth.

Hence, this guidance, when taken together with the overall challenging macro environment, plus the fact that The Trade Desk is still a 30% CAGR company, made investors clamor for its stock.

The Trade Desk’s Near-Term Prospects

The Trade Desk continues to take market share in programmatic advertising.

The Trade Desk’s goal of being the go-to advertising platform outside of the infamous walled gardens continues to gain momentum, with co-founder and CEO of The Trade Desk Jeff Green noting that The Trade Desk is well-positioned ”to gain market share in any market environment”.

During the earnings call, Green stated,

And what is often happening is, we are winning because of those secular tailwinds and because programmatic is growing share and because digital is growing share and meanwhile it is possible to have some macroeconomic headwinds in our face and have a secular tailwind of CTV and all the things I just talked about that, that overshadow that. (emphasis added)

Above we can see the premise of this investment and why the stock carries the multiple that it does.

The Trade Desk contends that irrespective of the macroeconomic headwinds, The Trade Desk continues to benefit from strong secular tailwinds in CTV.

Profitability Profile in Focus

Another aspect where The Trade Desk shines is in its strong EBITDA margins. Consider the following EBITDA margins that The Trade Desk reports.

- Q2 2021: 42%

- Q3 2021: 41%

- Q4 2021: 48%

- Q1 2022: 38%

- Q2 2022: 37%

- Q3 2022: 36% (at least)

As you can see above, from an EBITDA margin perspective, there’s no denying that The Trade Desk continues to impress.

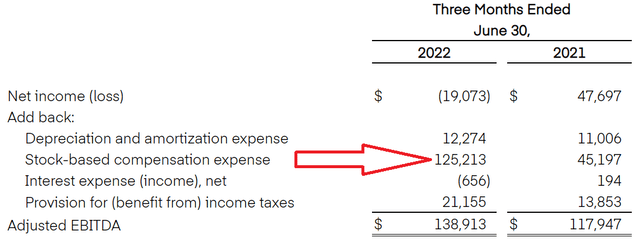

On the other hand, the fact remains that 90% of The Trade Desk’s EBITDA for Q2 2022 is in the form of stock-based compensation.

TTD Q2 2022

What this means in practical terms, is that while shareholders saw their GAAP EPS go from positive $0.10 last year in the Q2 quarter to negative $0.04 this time around, the management team saw their stock-based compensation increase by 178% y/y.

Hence, it makes me ponder who exactly is benefitting more here. Shareholders or management?

That being said, egregious management stock-based packages don’t appear to be something that is troubling this market.

TTD Stock Valuation – 47x EBITDA

We know that Q4 of each year is particularly strong for advertising companies. Thus, I’m inclined to believe that Q4 of this year is more likely than not to see The Trade Desk once again reporting solid EBITDA margins.

Hence, by my estimates, if we presume that the Trade Desk’s Q4 2022 EBITDA comes in line with the prior year, this would see its EBITDA reach approximately $240 million.

Consequently, here’s how the EBITDA for the year breaks down: H1 at $260 million + Q3 at least $140 million + Q4 at approximately $240 million.

Therefore, when taken all together this implies that The Trade Desk will probably see around $640 million of EBITDA this year.

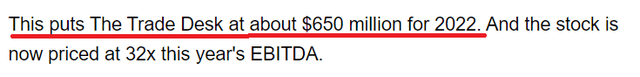

If we look back to my previous article last month to my full year estimate for The Trade Desk, I said at the time:

Author’s EBITDA estimate for 2022

Hence, I continue to believe that The Trade Desk’s EBITDA profile continues to be in this same ballpark of $640 to $650 million. The only difference is that now, given the after-hours reaction, The Trade Desk is now priced at 47x this year’s EBITDA.

Is The Trade Desk priced at 47x EBITDA really a worthwhile investment? I’m not convinced. That being said, I was convinced that The Trade Desk was going to see tough Q3 guidance last month, and I was proven wrong.

The Bottom Line

The Trade Desk has a huge number of fanatic investors. Investors who look to this company as a leading technology platform that is well positioned to embrace the demand for cookie-free, high margin, ad tech.

While there’s little doubt that The Trade Desk continues to show no signs of slowing down, even as its competitors lose steam, The Trade Desk continues to flourish.

However, I’m nevertheless unimpressed to see that for all its strong, resilient, and predictable revenues, shareholders here are failing to see their underlying profits increasing.

Hence, I’m neutral on this stock.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.