[ad_1]

Michael Vi

Thesis

Coupang, Inc. (NYSE:CPNG) reported results for the June quarter of 2022 on August 10th after hours and delivered a solid performance. The company beat analyst consensus with regard to both revenues and net loss, despite what has arguably been a very challenging macro-economic backdrop. Given a record gross profit for Q2 2022, I am confident to reiterate my claim that Coupang could be net-profitable by as early as 2023. However, I would like to point out that CPNG shares have rallied by almost 30% since I have assigned my Buy recommendation for the stock, and this has neutralized the risk/reward for investors. As a function of valuation, I now downgrade my recommendation to Hold. The target price of $19.37/share remains unchanged.

Coupang’s June Quarter

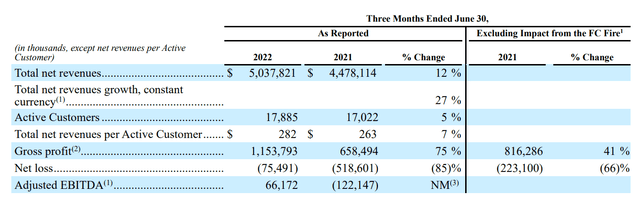

During the period from April to end of June, Coupang generated total revenues of $5 billion, which reflects a proud 12% year over year and 3% quarter-over-quarter growth. Higher revenues and a 250 basis point margin improvement supported a record gross profit of $1.2 billion. Notably, Coupang’s gross profit for Q2 is 75% higher than the company’s gross profit for the same period one year prior. Investors will appreciate that the company has met the major milestone of the company’s first-ever positive operating result: Adjusted EBITDA for the period was $66 million in Q2, which is a $350 million improvement as compared to Q2 2021. However, Coupang is still not net profitable. For the Q2 quarter, the company generated a net loss of $75 million.

On a segment basis, Product Commerce generated revenues of $4.9 billion, which represents an increase of 13% year over year and, according to the company, x4 the growth rate of the Korean product e-commerce market. The segment’s adjusted EBITDA margin jumped by 450 basis points, up to 2%. Developing Offerings generated sales of $160 and an adjusted EBITDA loss of $32 million.

Coupang’s balance sheet remains solid and strong enough for supporting both growth investments and an economic downturn: The company closed the quarter with $3.12 billion of cash and short-term investments and total debt of about $601.5 million.

Guidance and Profitability Targets

Coupang announced that the company is on track to achieve operating profitability in 2022. This is a considerable guidance upgrade as compared to six months earlier, when the company estimated negative EBITDA of about $400 million for the year. And when asked about long-term profitability going forward, CEO Kim Bom commented during the analyst earnings call:

We do expect benefits to continue to come from greater economies of scale, improved operational excellence and the growth of higher margin categories and services

But he also added that the economies of scale improvement is likely not linear:

But as we’ve stressed, the rate of improvement will not be consistent. As a result, the efforts will materialize unevenly

I would also like to highlight that Kim Bom noted the challenges posed by higher inflation and expects that this will materially contribute to short-term profitability deviation as compared to the company’s long-term target. Accordingly, I believe that, like Amazon (AMZN), Coupang is not a business that investors should judge and trade by a single quarter. In my opinion, investors are advised well if they anchor on a 12-month (or longer) price target and then trade against this target.

Implication and Recommendation

Personally, after Coupang’s strong Q2 quarter, I am confident to reiterate my claim that the company is likely to achieve positive net profitability by 2023. Moreover, I still see no challenges to my thesis that Coupang will grow to become an e-commerce monopoly in South Korea.

When Coupang stock was trading at about $14.5/share, I pointed out that the risk/reward is very attractive, and I assigned a Buy recommendation. Since then, CPNG shares have rallied by more than 30% and my thesis has neutralized. As a function of valuation, I downgrade CPNG to Hold, as I continue to believe that $19.37/share is the stock’s fair implied price and CPNG shares today are trading very close to that level.

My initiation article on Coupang: Coupang: The Risk/Reward Has Now Become Attractive

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.